- Australia

- /

- Hospitality

- /

- ASX:TAH

Benign Growth For Tabcorp Holdings Limited (ASX:TAH) Underpins Its Share Price

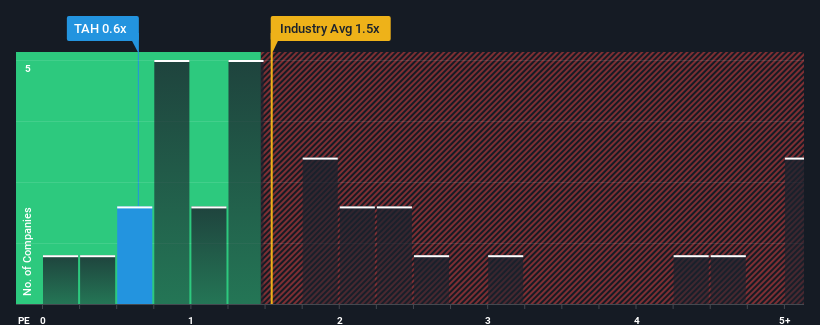

When you see that almost half of the companies in the Hospitality industry in Australia have price-to-sales ratios (or "P/S") above 1.5x, Tabcorp Holdings Limited (ASX:TAH) looks to be giving off some buy signals with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Tabcorp Holdings

How Tabcorp Holdings Has Been Performing

With revenue growth that's inferior to most other companies of late, Tabcorp Holdings has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Tabcorp Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Tabcorp Holdings?

In order to justify its P/S ratio, Tabcorp Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.8% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 53% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.4% each year during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 9.3% per annum growth forecast for the broader industry.

With this information, we can see why Tabcorp Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Tabcorp Holdings' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Tabcorp Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Tabcorp Holdings has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tabcorp Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TAH

Tabcorp Holdings

Provides gambling, and entertainment and integrity services in Australia.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives