- Australia

- /

- Consumer Services

- /

- ASX:MFD

We Think Shareholders May Consider Being More Generous With Mayfield Childcare Limited's (ASX:MFD) CEO Compensation Package

Shareholders will probably not be disappointed by the robust results at Mayfield Childcare Limited (ASX:MFD) recently and they will be keeping this in mind as they go into the AGM on 30 March 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

View our latest analysis for Mayfield Childcare

How Does Total Compensation For Dean Clarke Compare With Other Companies In The Industry?

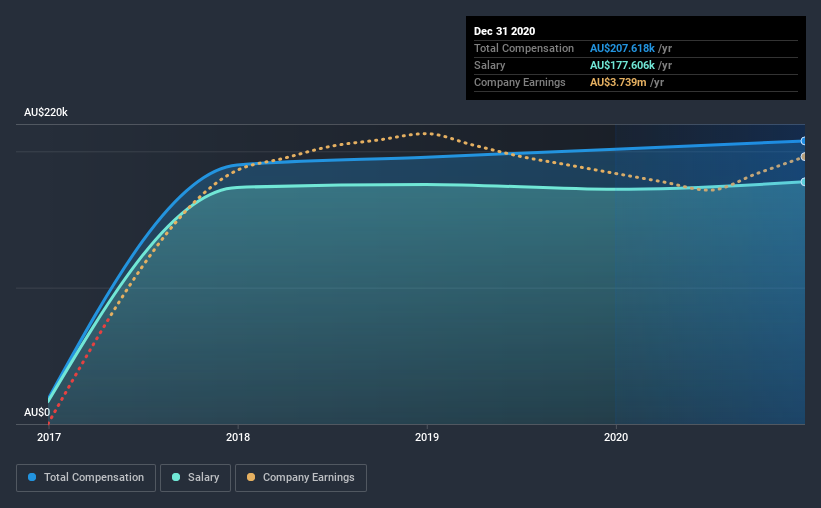

Our data indicates that Mayfield Childcare Limited has a market capitalization of AU$30m, and total annual CEO compensation was reported as AU$208k for the year to December 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of AU$177.6k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under AU$261m, the reported median total CEO compensation was AU$460k. This suggests that Dean Clarke is paid below the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$178k | AU$172k | 86% |

| Other | AU$30k | AU$29k | 14% |

| Total Compensation | AU$208k | AU$202k | 100% |

On an industry level, roughly 80% of total compensation represents salary and 20% is other remuneration. Our data reveals that Mayfield Childcare allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Mayfield Childcare Limited's Growth

Over the last three years, Mayfield Childcare Limited has not seen its earnings per share change much, though there is a slight positive movement. In the last year, its revenue is up 4.6%.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Mayfield Childcare Limited Been A Good Investment?

With a total shareholder return of 7.3% over three years, Mayfield Childcare Limited has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

The company's overall performance, while not bad, could be better. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Mayfield Childcare that investors should be aware of in a dynamic business environment.

Important note: Mayfield Childcare is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Mayfield Childcare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MFD

Mayfield Childcare

Owns and operates long day care centers in Victoria, Queensland, and South Australia.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.