- Australia

- /

- Hospitality

- /

- ASX:HLO

AU$2.55 - That's What Analysts Think Helloworld Travel Limited (ASX:HLO) Is Worth After These Results

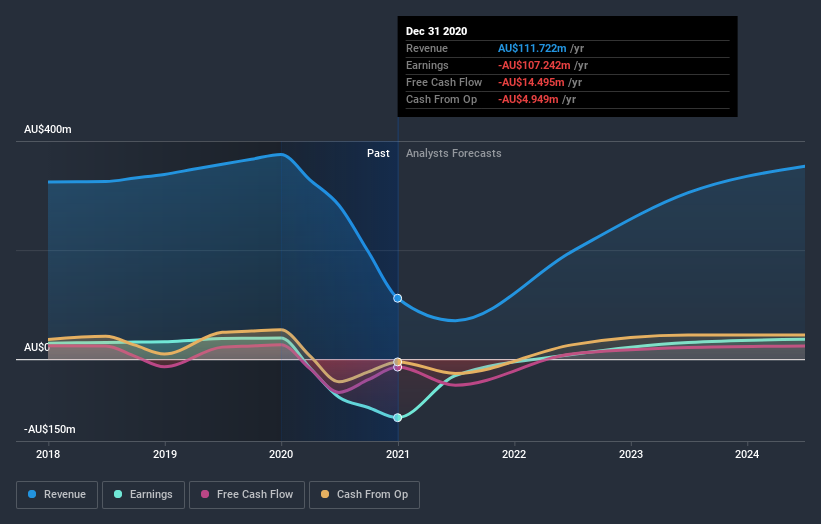

Helloworld Travel Limited (ASX:HLO) just released its latest half-year results and things are looking bullish. Results overall were credible, with revenues arriving 4.5% better than analyst forecasts at AU$30m. Higher revenues also resulted in lower statutory losses, which were AU$0.098 per share, some 4.5% smaller than the analysts expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for Helloworld Travel

After the latest results, the consensus from Helloworld Travel's five analysts is for revenues of AU$70.5m in 2021, which would reflect a stressful 37% decline in sales compared to the last year of performance. The loss per share is expected to greatly reduce in the near future, narrowing 76% to AU$0.18. Before this earnings announcement, the analysts had been modelling revenues of AU$71.0m and losses of AU$0.19 per share in 2021. So there seems to have been a moderate uplift in analyst sentiment with the latest consensus release, given the upgrade to loss per share forecasts for this year.

These new estimates led to the consensus price target rising 14% to AU$2.55, with lower forecast losses suggesting things could be looking up for Helloworld Travel. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Helloworld Travel analyst has a price target of AU$3.10 per share, while the most pessimistic values it at AU$1.95. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Helloworld Travel's past performance and to peers in the same industry. One more thing stood out to us about these estimates, and it's the idea that Helloworld Travel'sdecline is expected to accelerate, with revenues forecast to fall 37% next year, topping off a historical decline of 3.2% a year over the past five years. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 15% next year. So while a broad number of companies are forecast to decline, unfortunately Helloworld Travel is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Helloworld Travel going out to 2024, and you can see them free on our platform here.

Even so, be aware that Helloworld Travel is showing 1 warning sign in our investment analysis , you should know about...

If you’re looking to trade Helloworld Travel, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Helloworld Travel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:HLO

Helloworld Travel

Operates as a travel distribution company in Australia, New Zealand, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion