- Australia

- /

- Specialty Stores

- /

- ASX:AX1

3 ASX Stocks That Might Be Trading Below Intrinsic Value By Up To 49.6%

Reviewed by Simply Wall St

The ASX200 closed up a fifth of a percent at 8,209 points as the Index finished the week just below an all-time high of 8,246 set in intra-day trade. Australian markets continue to track Wall Street’s positive sentiment and a growing belief amongst investors that the US Fed Rate cut will secure a goldilocks scenario for the American economy. In this context, identifying stocks that might be trading below their intrinsic value becomes crucial for investors looking to capitalize on potential market inefficiencies. Here are three ASX-listed stocks that could be undervalued by up to 49.6%, making them worth considering in today's mixed market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hansen Technologies (ASX:HSN) | A$4.40 | A$8.19 | 46.3% |

| Accent Group (ASX:AX1) | A$2.42 | A$4.80 | 49.6% |

| Duratec (ASX:DUR) | A$1.40 | A$2.59 | 46% |

| Genesis Minerals (ASX:GMD) | A$2.11 | A$3.98 | 47% |

| Megaport (ASX:MP1) | A$7.28 | A$13.51 | 46.1% |

| Charter Hall Group (ASX:CHC) | A$15.89 | A$29.24 | 45.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.36 | A$0.72 | 49.7% |

| Ai-Media Technologies (ASX:AIM) | A$0.75 | A$1.42 | 47.1% |

| Superloop (ASX:SLC) | A$1.78 | A$3.31 | 46.3% |

Let's review some notable picks from our screened stocks.

Accent Group (ASX:AX1)

Overview: Accent Group Limited (ASX:AX1) operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$1.37 billion.

Operations: Accent Group's revenue segments include A$1.27 billion from retail and A$463.20 million from wholesale operations in Australia and New Zealand.

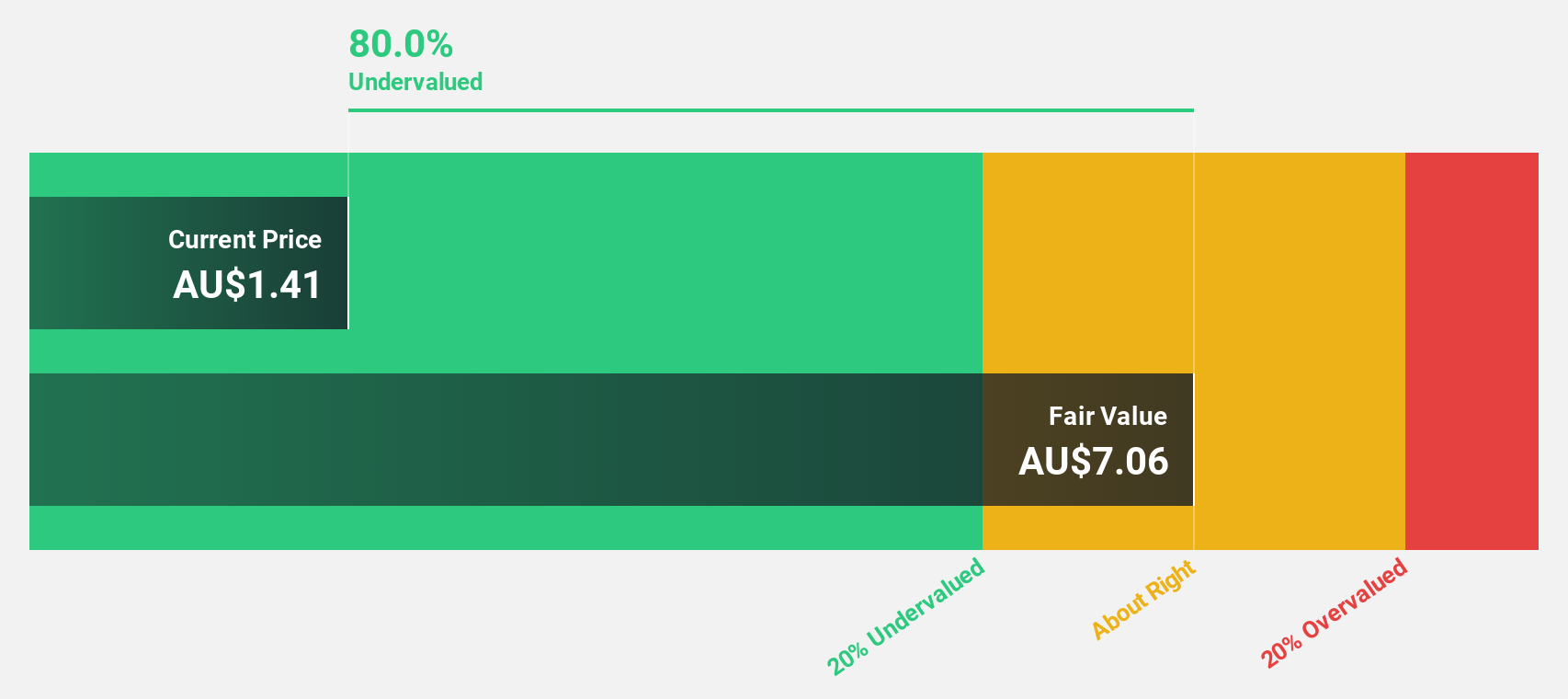

Estimated Discount To Fair Value: 49.6%

Accent Group, trading at A$2.42, is significantly undervalued with a fair value estimate of A$4.8. Despite recent insider selling and a decline in profit margins from 6.2% to 4.1%, earnings are forecast to grow at 15.2% annually, outpacing the market's 12.3%. Recent events include Brett Blundy's resignation and a private placement involving Frasers Group Plc., which could impact future cash flows positively or negatively depending on execution and market conditions.

- Our comprehensive growth report raises the possibility that Accent Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Accent Group stock in this financial health report.

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited, with a market cap of A$4.83 billion, provides travel retailing services for both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia and internationally.

Operations: The company's revenue segments include A$1.35 billion from leisure travel services and A$1.11 billion from corporate travel services.

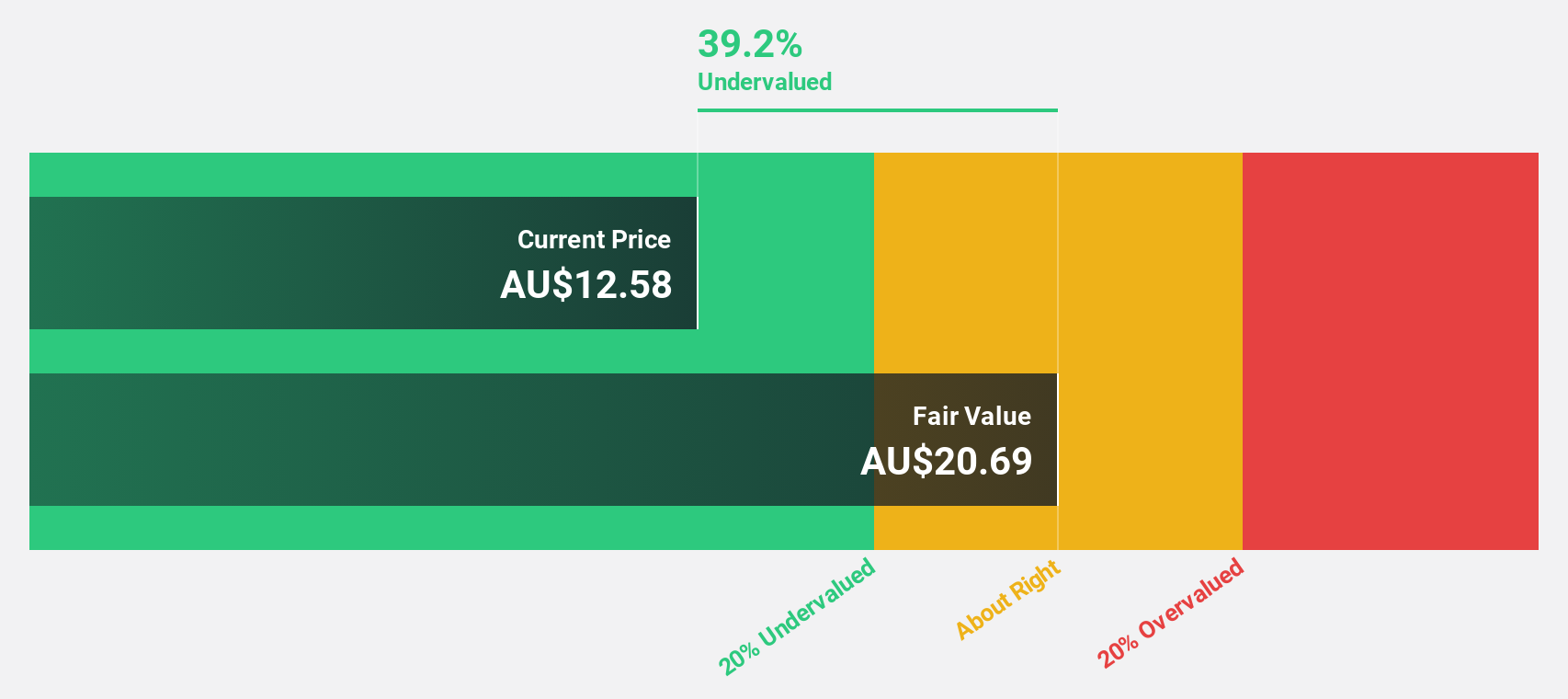

Estimated Discount To Fair Value: 14.4%

Flight Centre Travel Group (A$21.91) is trading at 14.4% below its estimated fair value of A$25.61, indicating it may be undervalued based on discounted cash flow analysis. Earnings are forecast to grow at 19.7% annually, outpacing the Australian market's 12.3%. Recent earnings results showed a significant increase in net income from A$47 million to A$139 million year-over-year, and the company declared a fully franked dividend of A$0.30 per share for FY2024, reflecting strong cash flows and potential for reinvestment in growth opportunities such as acquisitions and expanding Cruise & Touring sales.

- Insights from our recent growth report point to a promising forecast for Flight Centre Travel Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Flight Centre Travel Group.

Red 5 (ASX:RED)

Overview: Red 5 Limited engages in the exploration, production, and mining of gold and gold/copper concentrates in Canada and Australia, with a market cap of A$2.21 billion.

Operations: Red 5 generates revenue primarily from its production, development, and exploration assets, amounting to A$546.40 million.

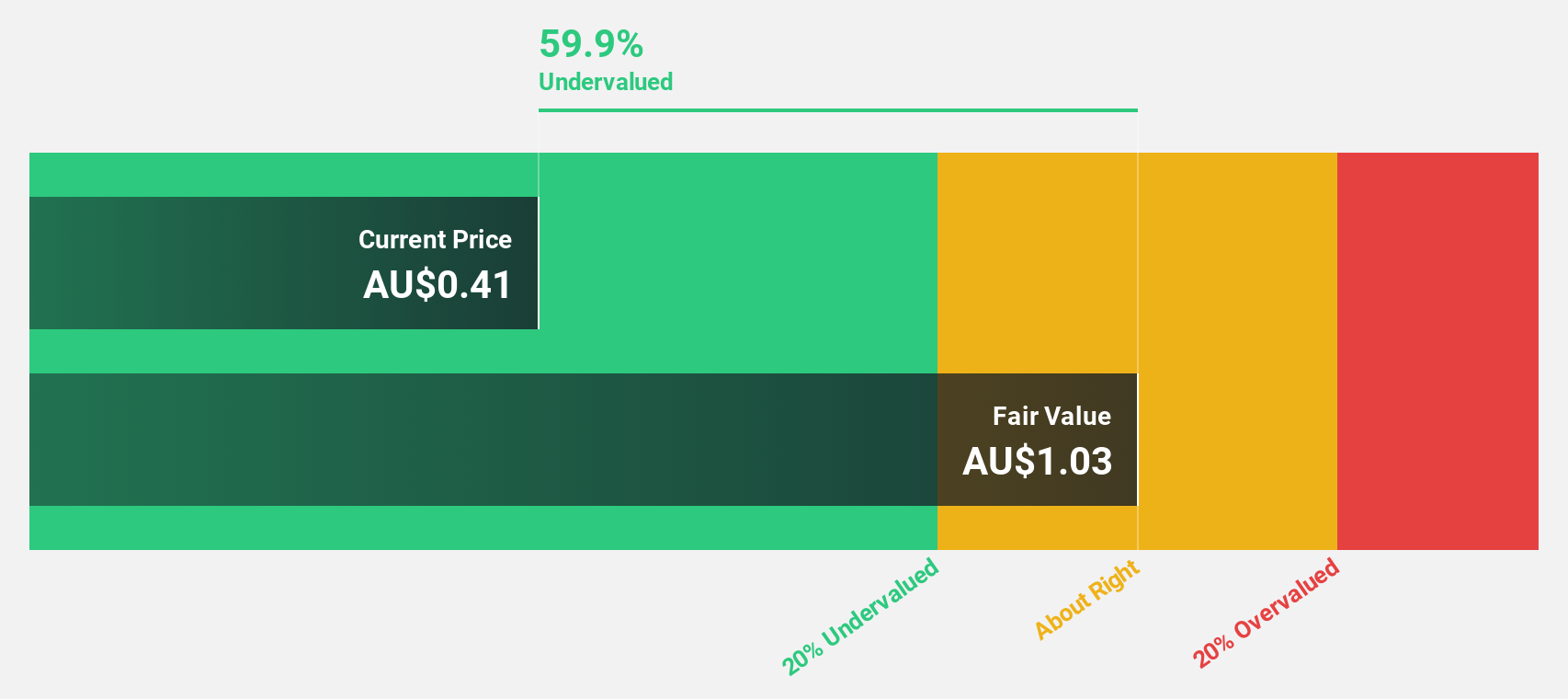

Estimated Discount To Fair Value: 38.7%

Red 5 Limited (A$0.33) is trading at 38.7% below its estimated fair value of A$0.53, making it highly undervalued based on discounted cash flow analysis. The company recently became profitable and its earnings are forecast to grow significantly at 21.5% annually, outpacing both its revenue growth of 17.7% per year and the broader Australian market's growth rates. However, shareholders have faced substantial dilution over the past year and return on equity is expected to be low at 8.3% in three years' time.

- Our growth report here indicates Red 5 may be poised for an improving outlook.

- Navigate through the intricacies of Red 5 with our comprehensive financial health report here.

Key Takeaways

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 35 more companies for you to explore.Click here to unveil our expertly curated list of 38 Undervalued ASX Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Reasonable growth potential with adequate balance sheet.