- Australia

- /

- Hospitality

- /

- ASX:CKF

The Market Lifts Collins Foods Limited (ASX:CKF) Shares 26% But It Can Do More

Collins Foods Limited (ASX:CKF) shares have had a really impressive month, gaining 26% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

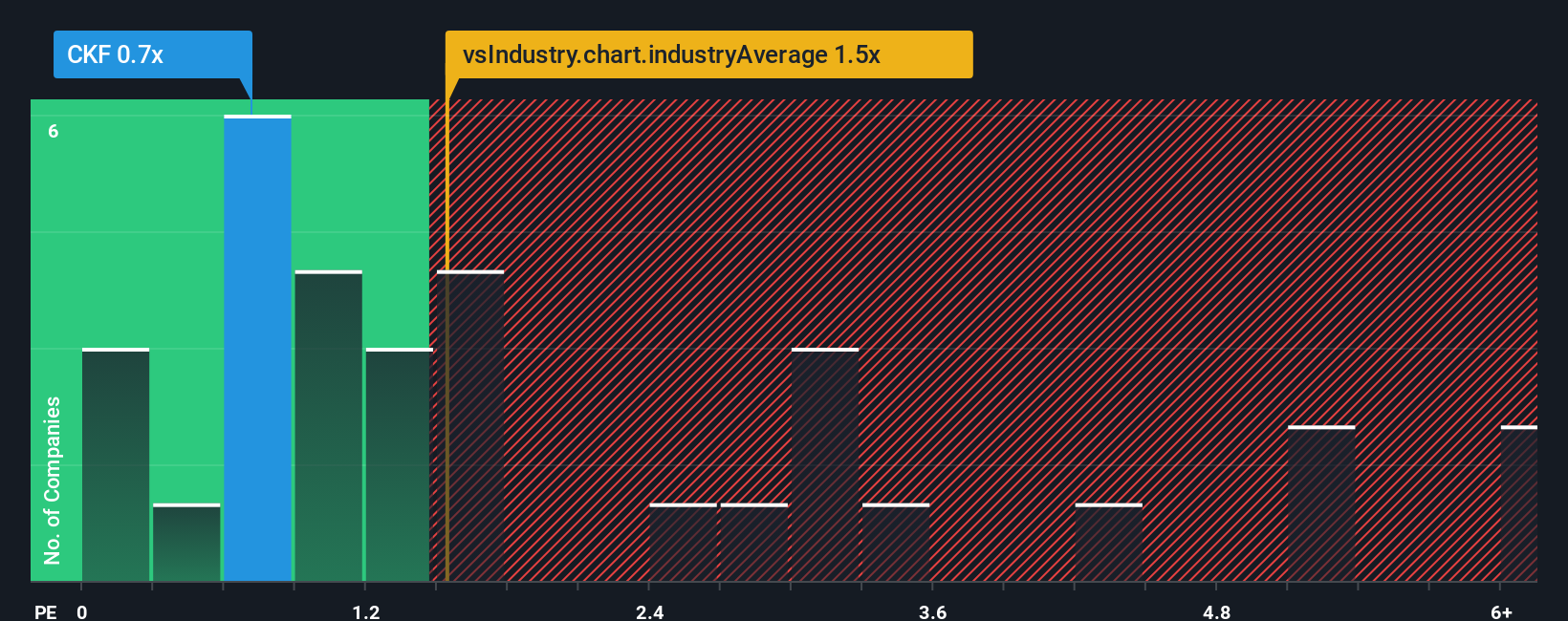

Although its price has surged higher, Collins Foods may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Hospitality industry in Australia have P/S ratios greater than 1.5x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Collins Foods

How Collins Foods Has Been Performing

With revenue growth that's inferior to most other companies of late, Collins Foods has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Collins Foods will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Collins Foods would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 29% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.5% per year over the next three years. With the industry predicted to deliver 4.3% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it odd that Collins Foods is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Collins Foods' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Collins Foods currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Collins Foods that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CKF

Collins Foods

Engages in the operation, management, and administration of restaurants in Australia and Europe.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives