- Australia

- /

- Hospitality

- /

- ASX:BBT

Investors Continue Waiting On Sidelines For BlueBet Holdings Ltd (ASX:BBT)

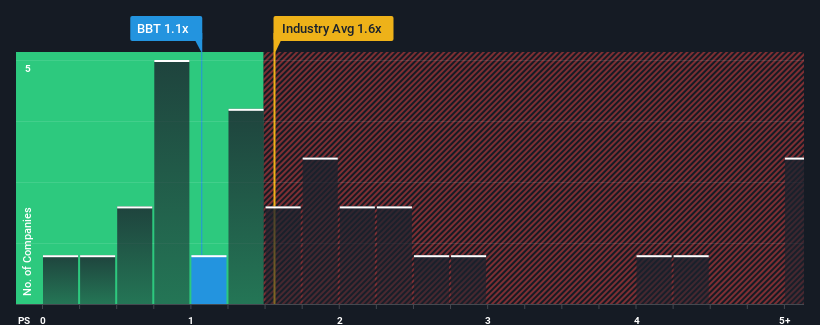

There wouldn't be many who think BlueBet Holdings Ltd's (ASX:BBT) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Hospitality industry in Australia is similar at about 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for BlueBet Holdings

How Has BlueBet Holdings Performed Recently?

While the industry has experienced revenue growth lately, BlueBet Holdings' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on BlueBet Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, BlueBet Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's top line. Even so, admirably revenue has lifted 192% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 18% per annum during the coming three years according to the dual analysts following the company. With the industry only predicted to deliver 9.2% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that BlueBet Holdings' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does BlueBet Holdings' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, BlueBet Holdings' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 4 warning signs for BlueBet Holdings that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Betr Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BBT

Betr Entertainment

Provides sports and racing betting products and services to online and telephone clients, via its innovative online wagering platform, and mobile applications in Australia and North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives