- Australia

- /

- Hospitality

- /

- ASX:AGI

Ainsworth Game Technology Limited (ASX:AGI) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

To the annoyance of some shareholders, Ainsworth Game Technology Limited (ASX:AGI) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 18% share price drop.

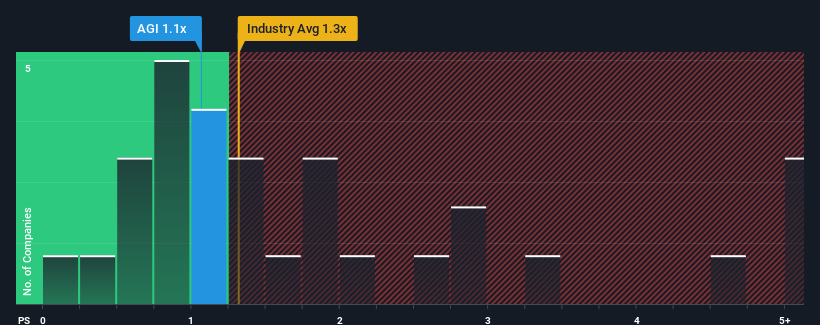

In spite of the heavy fall in price, it's still not a stretch to say that Ainsworth Game Technology's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Australia, where the median P/S ratio is around 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Ainsworth Game Technology

What Does Ainsworth Game Technology's P/S Mean For Shareholders?

There hasn't been much to differentiate Ainsworth Game Technology's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ainsworth Game Technology.How Is Ainsworth Game Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Ainsworth Game Technology would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 150% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 3.2% each year as estimated by the two analysts watching the company. With the industry predicted to deliver 7.4% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Ainsworth Game Technology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Ainsworth Game Technology looks to be in line with the rest of the Hospitality industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Ainsworth Game Technology's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Ainsworth Game Technology with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AGI

Ainsworth Game Technology

Designs, develops, manufactures, sells, distributes, and services electronic gaming machines, and other related equipment and services in Australia, North America, Latin America, Europe, New Zealand, South Africa, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives