- Australia

- /

- Consumer Services

- /

- ASX:8VI

8VI Holdings Limited's (ASX:8VI) 42% Jump Shows Its Popularity With Investors

8VI Holdings Limited (ASX:8VI) shares have continued their recent momentum with a 42% gain in the last month alone. The last 30 days were the cherry on top of the stock's 886% gain in the last year, which is nothing short of spectacular.

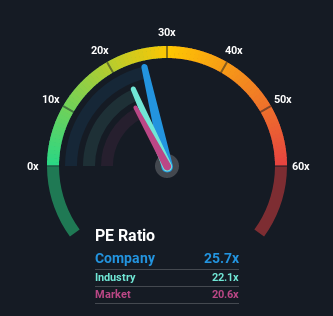

Since its price has surged higher, given close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 20x, you may consider 8VI Holdings as a stock to potentially avoid with its 25.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

Recent times have been quite advantageous for 8VI Holdings as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for 8VI Holdings

How Is 8VI Holdings' Growth Trending?

In order to justify its P/E ratio, 8VI Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 442% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 619% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that 8VI Holdings' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

The large bounce in 8VI Holdings' shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of 8VI Holdings revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - 8VI Holdings has 3 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than 8VI Holdings. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade 8VI Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:8VI

8VI Holdings

An investment holding company, operates as a financial education technology company under the VI brand name in Singapore and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.