- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Woolworths Group (ASX:WOW) Has Compensated Shareholders With A Respectable 94% Return On Their Investment

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Woolworths Group Limited (ASX:WOW) shareholders have enjoyed a 65% share price rise over the last half decade, well in excess of the market return of around 37% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 3.7% in the last year , including dividends .

View our latest analysis for Woolworths Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Woolworths Group's earnings per share are down 13% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We are not particularly impressed by the annual compound revenue growth of 2.5% over five years. So why is the share price up? It's not immediately obvious to us, but a closer look at the company's progress over time might yield answers.

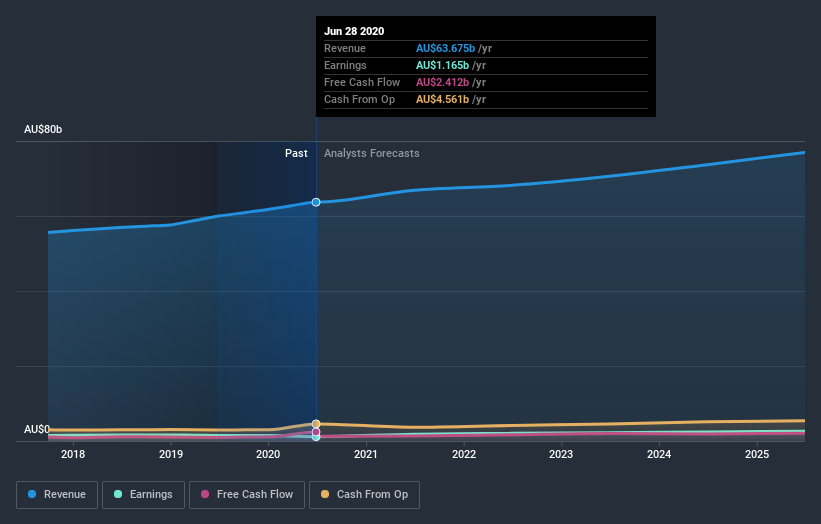

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Woolworths Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Woolworths Group stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Woolworths Group the TSR over the last 5 years was 94%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Woolworths Group has rewarded shareholders with a total shareholder return of 3.7% in the last twelve months. That's including the dividend. Having said that, the five-year TSR of 14% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Woolworths Group is showing 4 warning signs in our investment analysis , you should know about...

But note: Woolworths Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Woolworths Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:WOW

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives