- Australia

- /

- Consumer Durables

- /

- ASX:TWD

Does The Market Have A Low Tolerance For Tamawood Limited's (ASX:TWD) Mixed Fundamentals?

With its stock down 12% over the past week, it is easy to disregard Tamawood (ASX:TWD). It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Particularly, we will be paying attention to Tamawood's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Tamawood

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Tamawood is:

17% = AU$5.5m ÷ AU$33m (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. So, this means that for every A$1 of its shareholder's investments, the company generates a profit of A$0.17.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Tamawood's Earnings Growth And 17% ROE

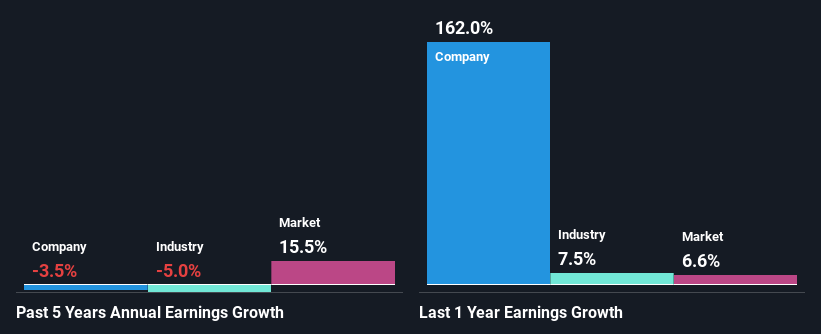

To begin with, Tamawood seems to have a respectable ROE. Further, the company's ROE is similar to the industry average of 14%. As you might expect, the 3.5% net income decline reported by Tamawood is a bit of a surprise. So, there might be some other aspects that could explain this. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

As a next step, we compared Tamawood's performance with the industry and discovered the industry has shrunk at a rate of 5.0% in the same period meaning that the company has been shrinking its earnings at a rate lower than the industry. This does offer shareholders some relief

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for TWD? You can find out in our latest intrinsic value infographic research report

Is Tamawood Efficiently Re-investing Its Profits?

With a three-year median payout ratio as high as 214%,Tamawood's shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Paying a dividend higher than reported profits is not a sustainable move. You can see the 4 risks we have identified for Tamawood by visiting our risks dashboard for free on our platform here.

Moreover, Tamawood has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

Overall, we have mixed feelings about Tamawood. In spite of the high ROE, the company has failed to see growth in its earnings due to it paying out most of its profits as dividend, with almost nothing left to invest into its own business. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Tamawood's past profit growth, check out this visualization of past earnings, revenue and cash flows.

Valuation is complex, but we're here to simplify it.

Discover if Tamawood might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TWD

Tamawood

Provides contract home construction, home design, and other associated activities in Australia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives