Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Gale Pacific Limited (ASX:GAP) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Gale Pacific

How Much Debt Does Gale Pacific Carry?

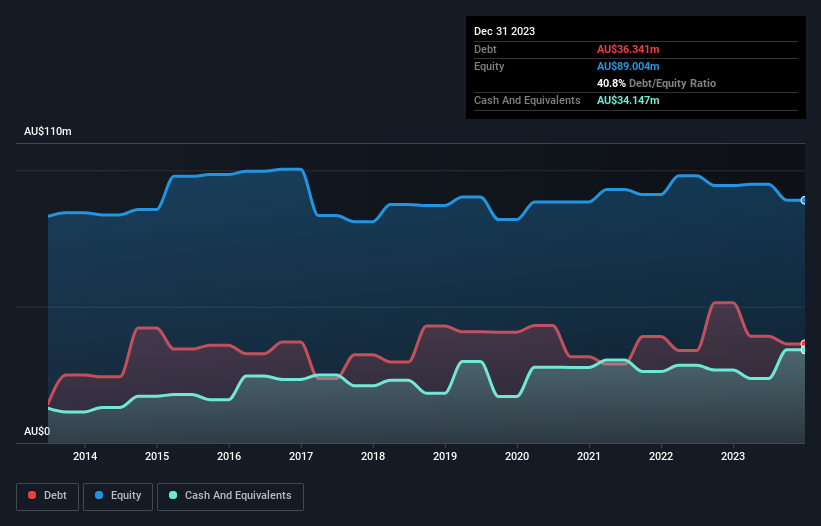

You can click the graphic below for the historical numbers, but it shows that Gale Pacific had AU$36.3m of debt in December 2023, down from AU$51.4m, one year before. However, because it has a cash reserve of AU$34.1m, its net debt is less, at about AU$2.19m.

How Healthy Is Gale Pacific's Balance Sheet?

The latest balance sheet data shows that Gale Pacific had liabilities of AU$75.1m due within a year, and liabilities of AU$23.4m falling due after that. Offsetting this, it had AU$34.1m in cash and AU$30.2m in receivables that were due within 12 months. So it has liabilities totalling AU$34.1m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of AU$41.2m, so it does suggest shareholders should keep an eye on Gale Pacific's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Given net debt is only 0.25 times EBITDA, it is initially surprising to see that Gale Pacific's EBIT has low interest coverage of 0.68 times. So one way or the other, it's clear the debt levels are not trivial. Importantly, Gale Pacific's EBIT fell a jaw-dropping 80% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Gale Pacific will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Gale Pacific actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

While Gale Pacific's EBIT growth rate has us nervous. For example, its conversion of EBIT to free cash flow and net debt to EBITDA give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Gale Pacific is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Gale Pacific (including 1 which makes us a bit uncomfortable) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:GAP

Gale Pacific

Manufactures, markets, distributes, and sells branded screening, architectural shading, and commercial agricultural/horticultural fabric products.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026