3 Promising Penny Stocks On The ASX With Market Caps Up To A$200M

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 1.23% at 8,520 points, nearing record highs as commodity markets rally and financials lead sector gains. Amidst this backdrop, penny stocks continue to capture investor interest by offering exposure to smaller or less-established companies that may present significant value opportunities. Although the term 'penny stock' might seem outdated, these stocks can still provide substantial potential when supported by strong financials and a clear growth path; we explore three such promising options on the ASX.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$313.17M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$105.1M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$106.53M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.995 | A$328.89M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$248.73M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.21 | A$337.66M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.885 | A$102.93M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$243.19M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Fleetwood (ASX:FWD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fleetwood Limited operates in the design, manufacture, sale, and installation of modular accommodation and buildings across Australia and New Zealand with a market cap of A$182.06 million.

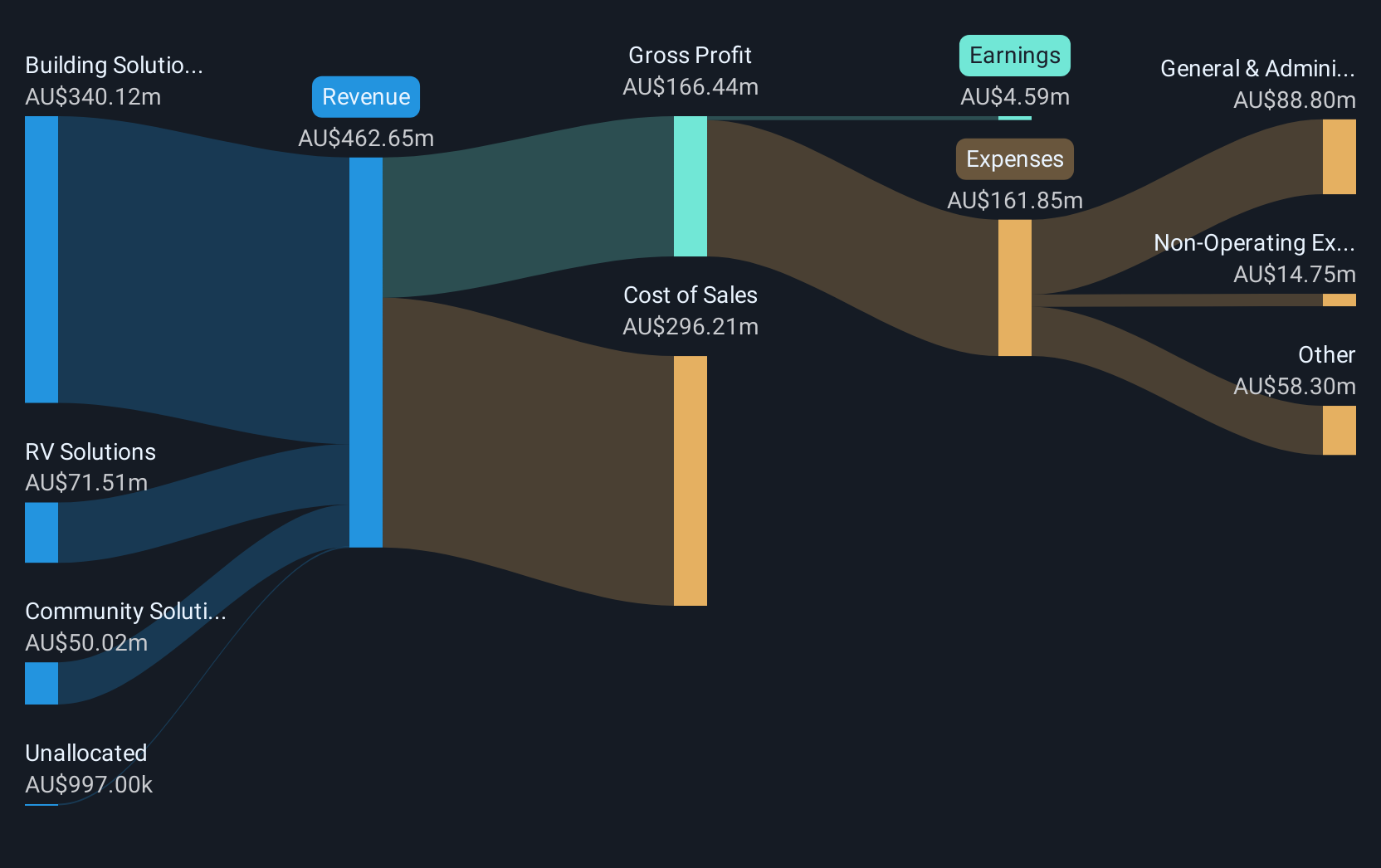

Operations: Fleetwood's revenue segments include RV Solutions generating A$75.50 million, Building Solutions contributing A$309.61 million, and Community Solutions with A$33.70 million in revenue.

Market Cap: A$182.06M

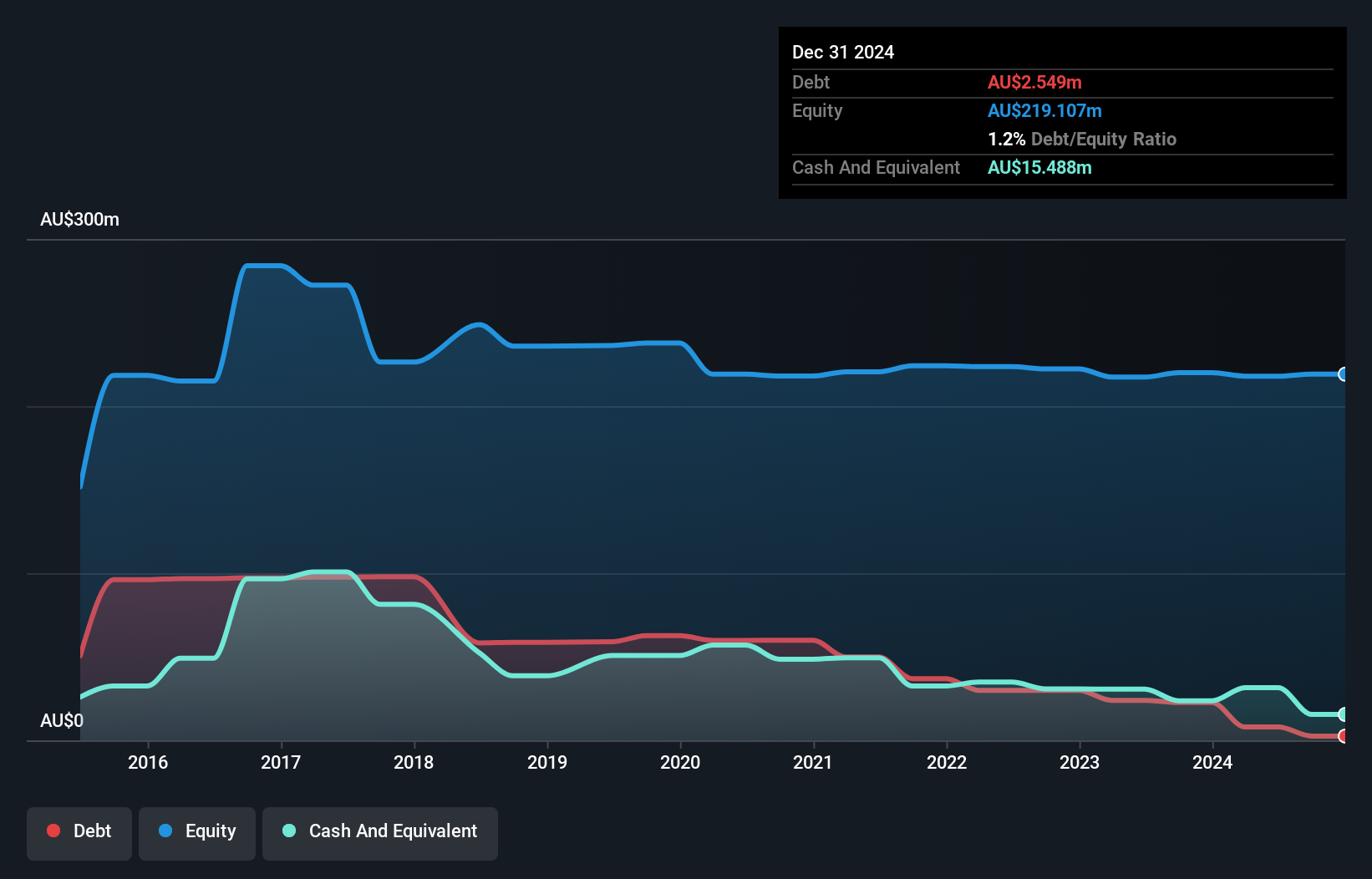

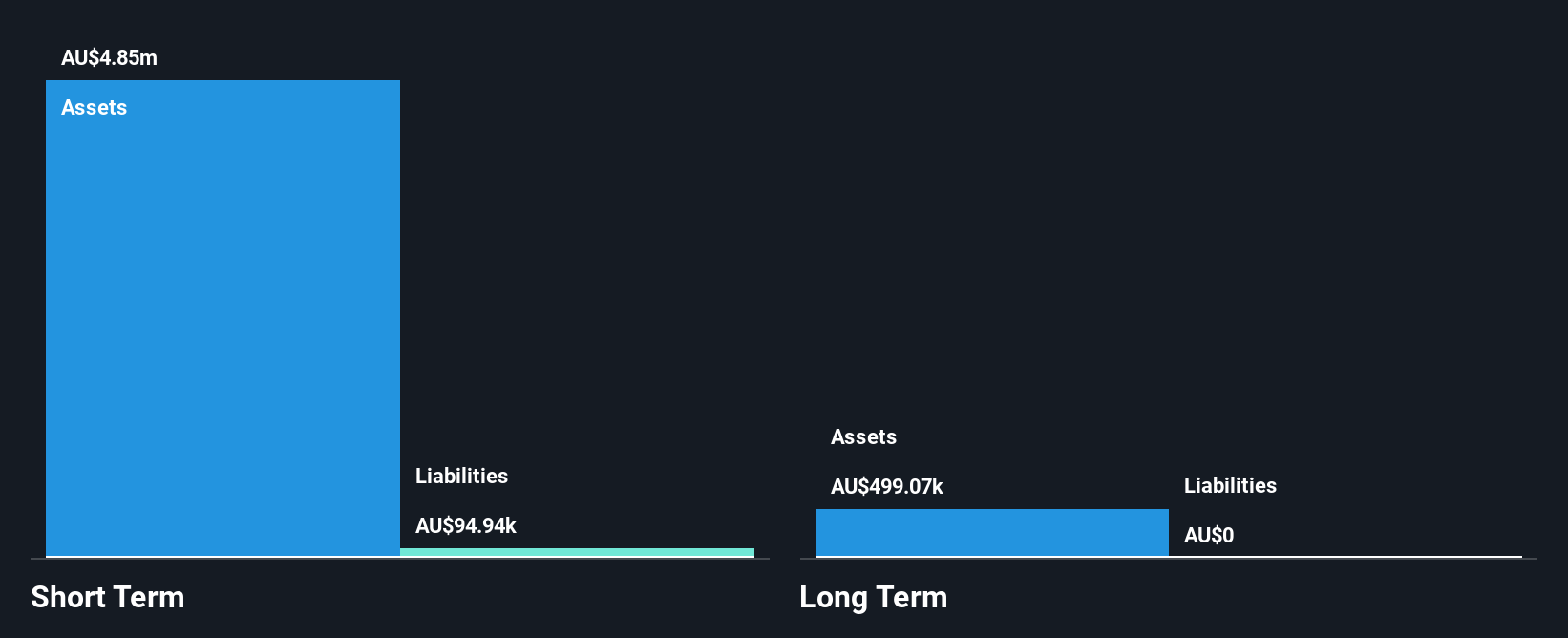

Fleetwood Limited, with a market cap of A$182.06 million, shows potential as a penny stock due to its debt-free status and high-quality earnings. Its revenue streams include RV Solutions (A$75.50 million), Building Solutions (A$309.61 million), and Community Solutions (A$33.70 million). Fleetwood's earnings growth of 85.2% over the past year surpasses industry averages, though its Return on Equity remains low at 2.3%. The company trades significantly below estimated fair value, with stable weekly volatility and no meaningful shareholder dilution in the past year, indicating financial stability despite modest profit margins of 0.9%.

- Dive into the specifics of Fleetwood here with our thorough balance sheet health report.

- Gain insights into Fleetwood's outlook and expected performance with our report on the company's earnings estimates.

GTN (ASX:GTN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GTN Limited operates broadcast media advertising platforms providing traffic and news information reports to radio stations in Australia, Canada, the United Kingdom, and Brazil, with a market cap of A$106.53 million.

Operations: The company's revenue segment is derived from advertising, totaling A$184.23 million.

Market Cap: A$106.53M

GTN Limited, with a market cap of A$106.53 million, presents a mixed picture as a penny stock. While its earnings have grown significantly by 114.9% over the past year, surpassing industry averages and indicating high-quality earnings, the company has faced challenges with declining profits over the last five years at an average rate of -17.8%. The recent board changes suggest strategic shifts within the company. Despite low Return on Equity at 2.6%, GTN's debt reduction and favorable interest coverage highlight financial prudence, trading well below estimated fair value and maintaining stable weekly volatility without shareholder dilution recently.

- Jump into the full analysis health report here for a deeper understanding of GTN.

- Learn about GTN's future growth trajectory here.

Tyranna Resources (ASX:TYX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyranna Resources Limited is engaged in the exploration and development of mineral properties both in Australia and internationally, with a market cap of A$16.44 million.

Operations: The company generates revenue from its exploration activities in Angola, amounting to A$0.06 million.

Market Cap: A$16.44M

Tyranna Resources Limited, with a market cap of A$16.44 million, is pre-revenue and currently unprofitable, experiencing increased losses over the past five years at 37.6% per year. Despite this, the company maintains a strong cash position with sufficient runway for over a year and no debt or long-term liabilities. The management team is experienced with an average tenure of 5.2 years; however, the board's shorter tenure suggests recent changes in leadership strategy. Share price volatility remains high compared to most Australian stocks, though shareholders have not faced significant dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Tyranna Resources.

- Review our historical performance report to gain insights into Tyranna Resources' track record.

Make It Happen

- Investigate our full lineup of 1,031 ASX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GTN

GTN

Operates broadcast media advertising platforms that supply traffic and news information reports to radio stations in Australia, Canada, the United Kingdom, and Brazil.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives