- Australia

- /

- Commercial Services

- /

- NSX:SUG

3 Promising ASX Penny Stocks With Market Caps Under A$1B

Reviewed by Simply Wall St

As the ASX 200 futures indicate a slight decline, Australian investors are keeping an eye on global markets, with the S&P 500 reaching its third record high of the year. Amidst this backdrop, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies that can offer growth opportunities at lower price points. By focusing on those with strong financials and solid fundamentals, investors may find hidden gems within this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$68.05M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.95 | A$91.99M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.47 | A$291.47M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.21 | A$342.3M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.05 | A$65.38M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.525 | A$103.1M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.78 | A$98.46M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$99.04M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

archTIS (ASX:AR9)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: archTIS Limited focuses on designing and developing secure information sharing and collaboration solutions, with a market cap of A$23.79 million.

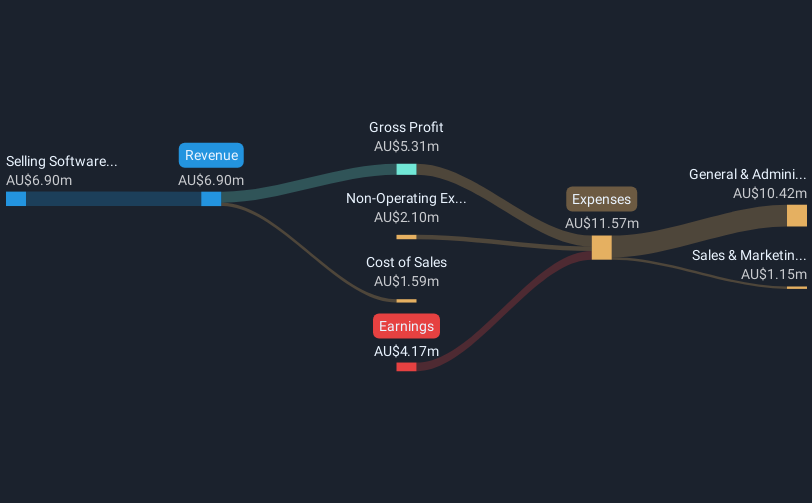

Operations: The company generates revenue of A$9.80 million from selling software and services.

Market Cap: A$23.79M

archTIS Limited, with a market cap of A$23.79 million and revenue of A$9.80 million, is currently unprofitable but maintains a stable cash runway exceeding one year based on its free cash flow. The company's short-term assets surpass both its long-term and short-term liabilities, indicating solid liquidity management. Despite an increase in debt to equity ratio over five years, archTIS holds more cash than total debt. Recent board changes include the appointment of Dr. Marcus Thompson as a non-executive director, potentially strengthening governance with his extensive military and cybersecurity background.

- Click to explore a detailed breakdown of our findings in archTIS' financial health report.

- Understand archTIS' track record by examining our performance history report.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, focuses on the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia with a market cap of A$925.24 million.

Operations: The company generates revenue primarily from its investment activities, accounting for A$604.42 million, and land development and resale operations, contributing A$250.14 million.

Market Cap: A$925.24M

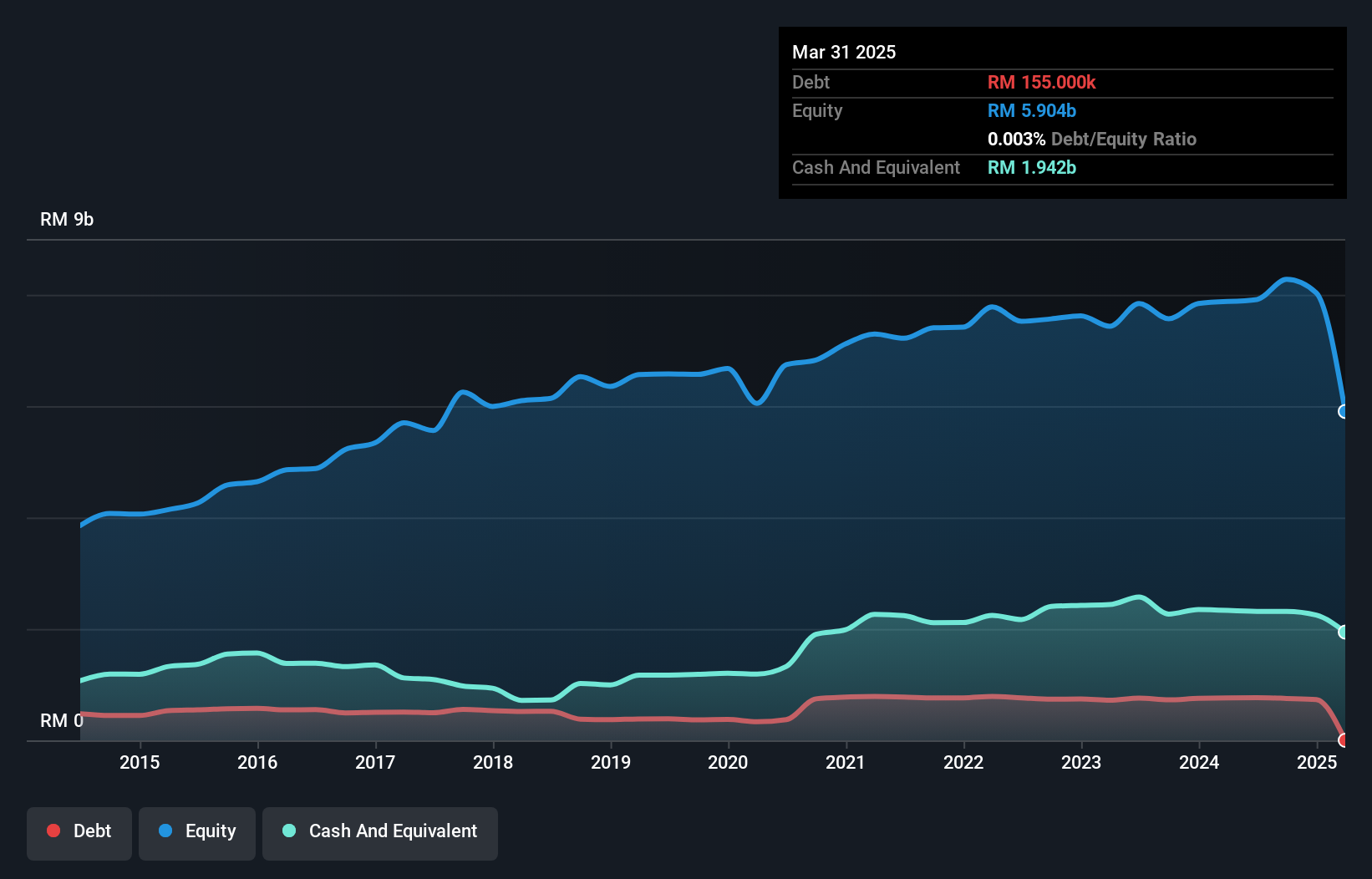

United Overseas Australia Ltd, with a market cap of A$925.24 million, demonstrates a mixed financial profile in the penny stock landscape. The company boasts strong liquidity, with short-term assets (A$1.4 billion) significantly outstripping both short-term (A$406.6 million) and long-term liabilities (A$41.4 million). However, its Return on Equity is low at 4.8%, and earnings growth has been sluggish compared to the industry standard. Despite stable weekly volatility and seasoned management, profit margins have been influenced by large one-off gains, suggesting that underlying earnings quality may require scrutiny for potential investors seeking stability in this segment.

- Unlock comprehensive insights into our analysis of United Overseas Australia stock in this financial health report.

- Assess United Overseas Australia's previous results with our detailed historical performance reports.

Sugar Terminals (NSX:SUG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$381.60 million.

Operations: The company generates revenue primarily from the sugar industry, amounting to A$115.38 million.

Market Cap: A$381.6M

Sugar Terminals Limited, with a market cap of A$381.60 million, offers a robust financial profile in the penny stock domain. The company is debt-free and maintains strong liquidity, with short-term assets (A$37.7 million) comfortably covering both short-term (A$23.8 million) and long-term liabilities (A$17.1 million). Earnings have grown by 11.4% over the past year, surpassing its five-year average growth rate of 3.5%, while maintaining high-quality earnings and improved profit margins from last year at 28.1%. Despite trading below fair value estimates, its Return on Equity remains low at 9.5%.

- Click here and access our complete financial health analysis report to understand the dynamics of Sugar Terminals.

- Explore historical data to track Sugar Terminals' performance over time in our past results report.

Summing It All Up

- Discover the full array of 1,032 ASX Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSX:SUG

Sugar Terminals

Provides storage and handling solutions for bulk sugar and other commodities in Australia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives