- Australia

- /

- Professional Services

- /

- ASX:CDE

The YPB Group (ASX:YPB) Share Price Is Down 97% So Some Shareholders Are Very Salty

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of YPB Group Limited (ASX:YPB), who have seen the share price tank a massive 97% over a three year period. That'd be enough to cause even the strongest minds some disquiet. The more recent news is of little comfort, with the share price down 70% in a year. It's down 6.7% in the last seven days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for YPB Group

YPB Group isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years YPB Group saw its revenue shrink by 4.4% per year. That's not what investors generally want to see. Having said that the 69% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

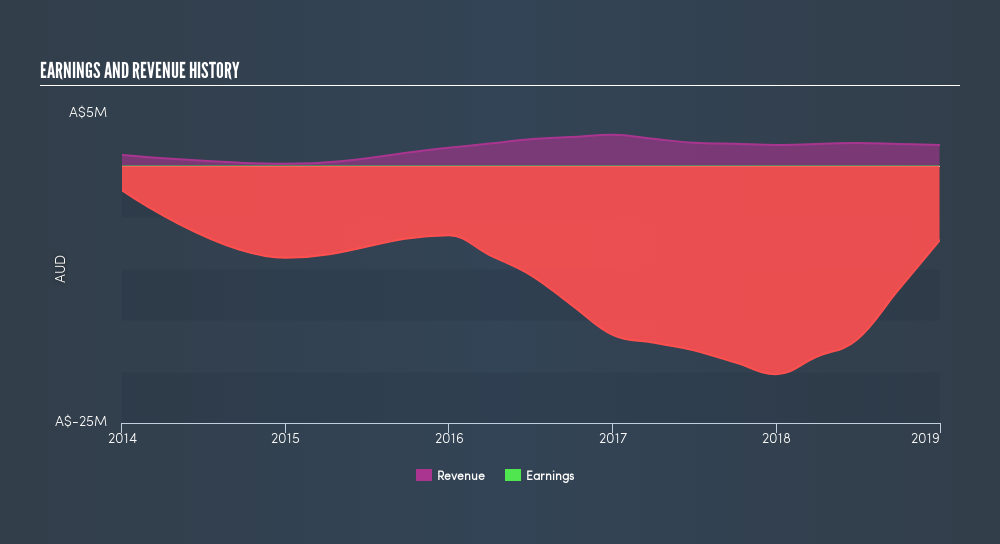

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on YPB Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Over the last year, YPB Group shareholders took a loss of 70%. In contrast the market gained about 10%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 69% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:CDE

Codeifai

Develops, markets, and sells anti-counterfeiting, product authentication, and consumer engagement solutions in Australia, the People’s Republic of China, Thailand, and the United States of America.

Adequate balance sheet slight.

Market Insights

Community Narratives