The Australian market has recently seen mixed performance, with the ASX200 closing slightly down by 0.11% at 8,511 points. Despite some sectors facing declines, IT and Staples have shown resilience, highlighting potential opportunities for investors exploring beyond traditional large-cap stocks. Penny stocks, though an older term, continue to attract attention as they often represent smaller or newer companies that can offer unique growth prospects when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.88M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.495 | A$310.07M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$104.82M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.065 | A$65.38M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.56 | A$108.99M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$324.82M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.19 | A$342.3M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$246.55M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tissue Repair (ASX:TRP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tissue Repair Ltd (ASX:TRP) is a clinical stage biopharmaceutical company focused on developing advanced wound healing products for chronic wounds and cosmetic procedure aftercare in Australia, with a market cap of A$18.74 million.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, amounting to A$1.79 million.

Market Cap: A$18.74M

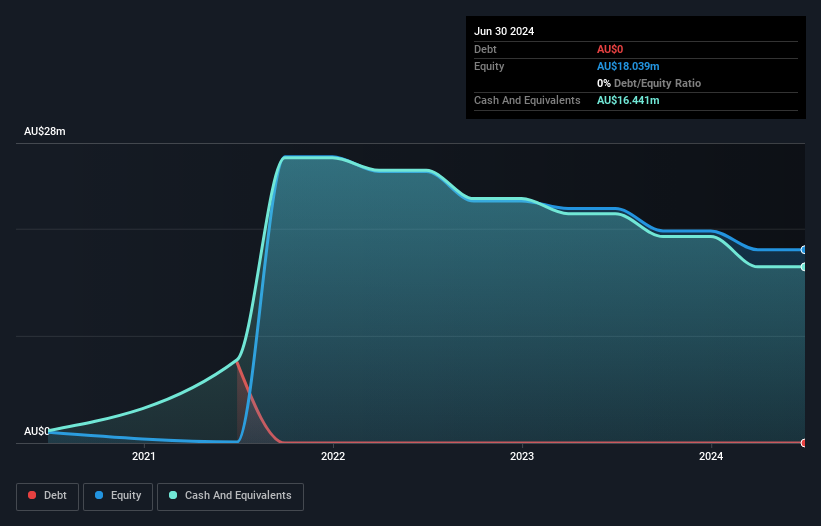

Tissue Repair Ltd, a clinical-stage biopharmaceutical company, is currently pre-revenue with limited revenue of A$2 million. Despite this, the company maintains a strong cash position with short-term assets of A$19.4 million exceeding both its long-term (A$13.8K) and short-term liabilities (A$1.3M), providing a cash runway for over three years even if free cash flow declines at historical rates. While unprofitable and experiencing declining earnings over the past five years, it remains debt-free and has seen reduced volatility in its stock price recently. However, the board's lack of experience might be a concern for potential investors.

- Click here to discover the nuances of Tissue Repair with our detailed analytical financial health report.

- Explore historical data to track Tissue Repair's performance over time in our past results report.

Venus Metals (ASX:VMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Venus Metals Corporation Limited is involved in the exploration of mineral tenements in Western Australia and has a market capitalization of A$14.32 million.

Operations: The company's revenue is derived entirely from the exploration of minerals, amounting to A$0.03 million.

Market Cap: A$14.32M

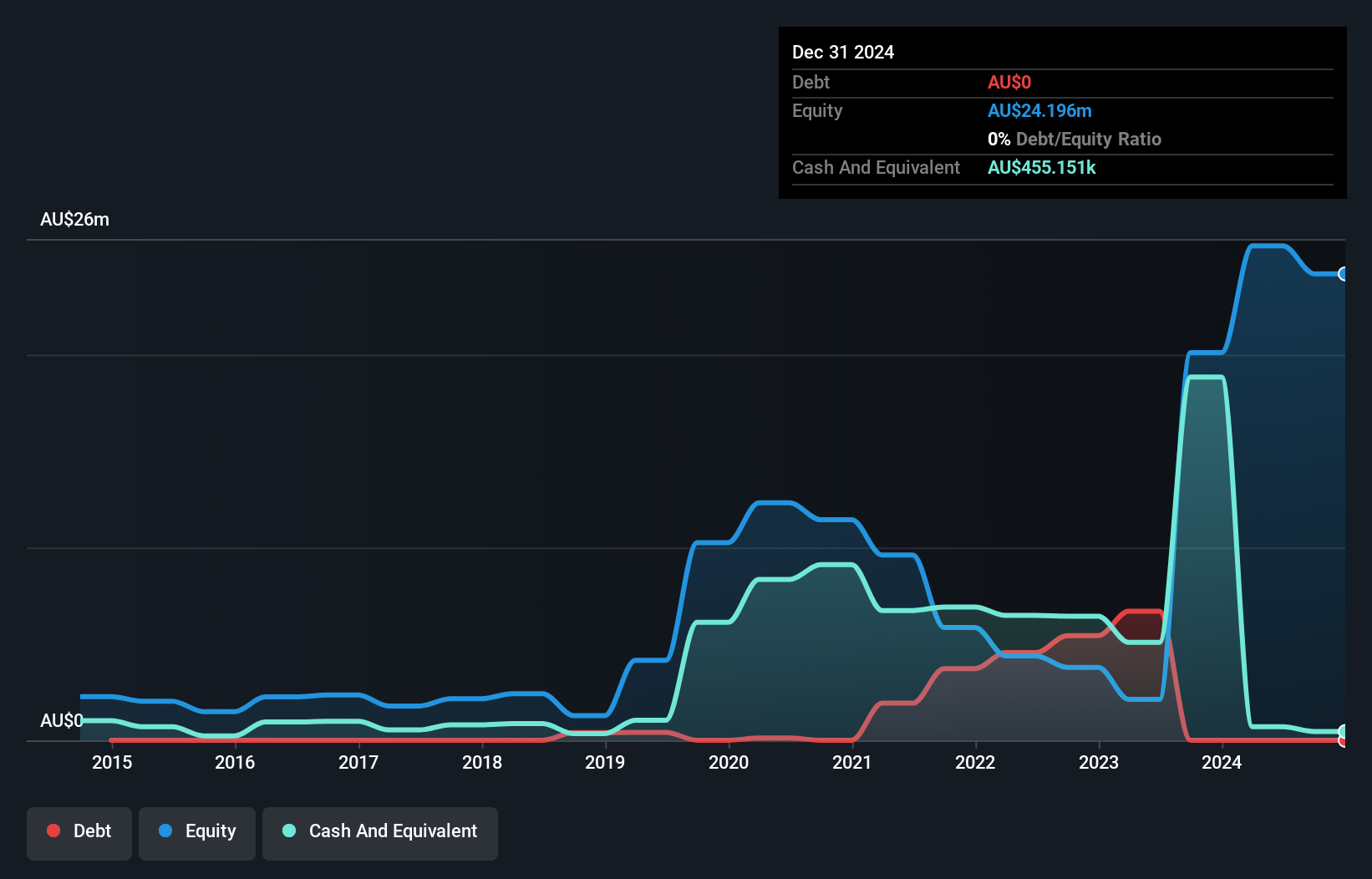

Venus Metals Corporation Limited, with a market capitalization of A$14.32 million, is a pre-revenue entity focused on mineral exploration in Western Australia. The company has recently become profitable and boasts an outstanding return on equity of 114.9%. It operates debt-free, having reduced its debt from a 9.8% debt-to-equity ratio five years ago to none currently, eliminating concerns about interest payments or cash flow coverage for liabilities. Despite its high volatility relative to most Australian stocks, Venus Metals' short-term assets comfortably cover both short- and long-term liabilities, indicating sound financial health amidst its exploratory focus.

- Jump into the full analysis health report here for a deeper understanding of Venus Metals.

- Learn about Venus Metals' historical performance here.

Veris (ASX:VRS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Veris Limited offers surveying and spatial data services mainly in Australia, with a market cap of A$22.92 million.

Operations: The company generates A$92.59 million in revenue from delivering comprehensive spatial data solutions.

Market Cap: A$22.92M

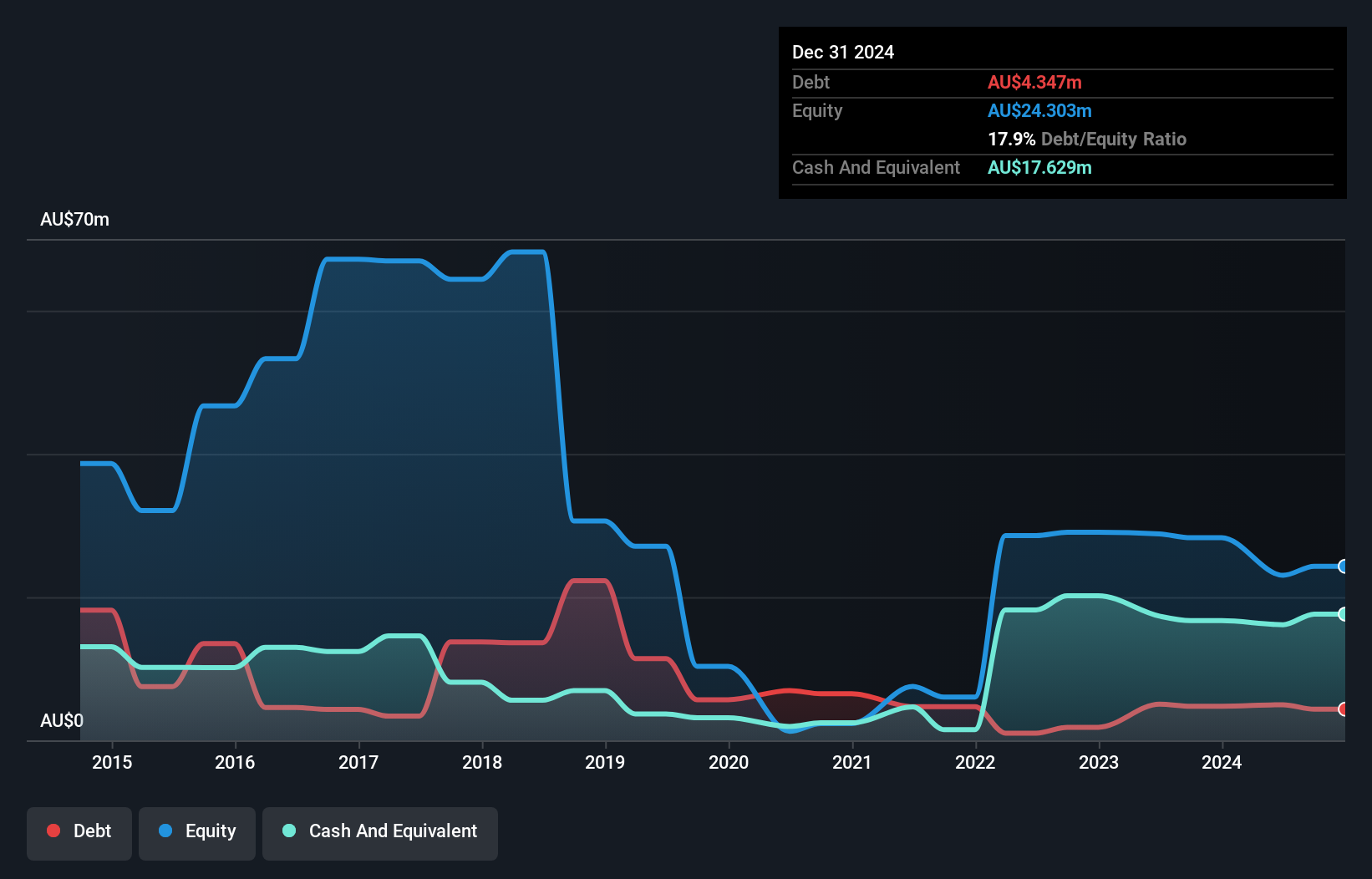

Veris Limited, with a market cap of A$22.92 million, operates in the surveying and spatial data sector, generating A$92.59 million in revenue. Despite being unprofitable, Veris maintains a strong financial position with short-term assets exceeding both short- and long-term liabilities and more cash than total debt. The company has not diluted shareholders recently and has reduced its debt-to-equity ratio significantly over five years. While its return on equity remains negative due to ongoing losses, Veris's positive free cash flow provides it with a cash runway exceeding three years if current conditions persist.

- Dive into the specifics of Veris here with our thorough balance sheet health report.

- Examine Veris' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Unlock our comprehensive list of 1,032 ASX Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tissue Repair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TRP

Tissue Repair

A clinical stage biopharmaceutical company, develops advanced wound healing products for chronic wounds and the aftercare of cosmetic procedures in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives