- Australia

- /

- Commercial Services

- /

- ASX:H2G

Such Is Life: How Tempo Australia (ASX:TPP) Shareholders Saw Their Shares Drop 70%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Tempo Australia Limited (ASX:TPP) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 70% drop in the share price over that period. And the ride hasn't got any smoother in recent times over the last year, with the price 56% lower in that time. The falls have accelerated recently, with the share price down 34% in the last three months.

Check out our latest analysis for Tempo Australia

Tempo Australia isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Tempo Australia saw its revenue shrink by 47% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 33% per year over that time. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. It could be a while before the company repays long suffering shareholders with share price gains.

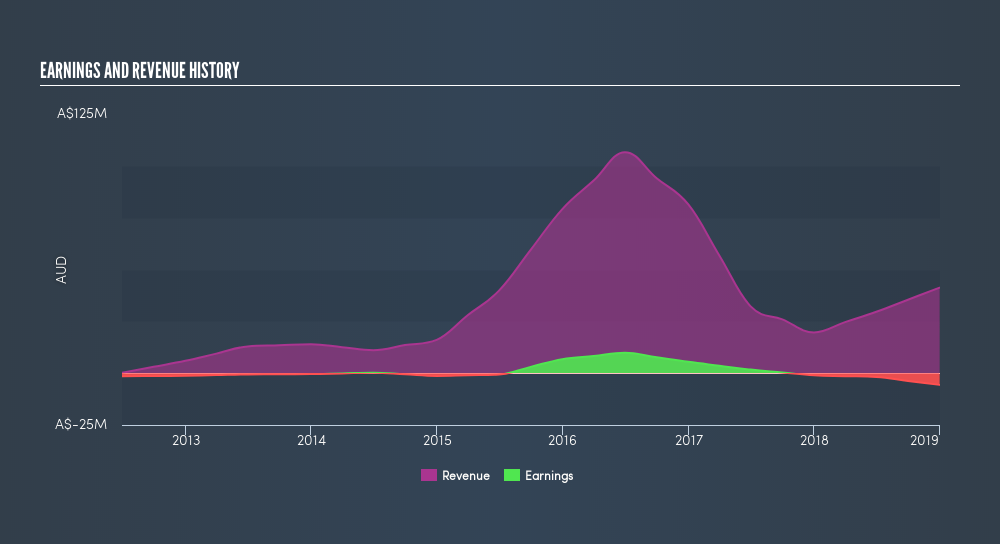

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Tempo Australia stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 11% in the last year, Tempo Australia shareholders lost 56%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7.5% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Tempo Australia by clicking this link.

Tempo Australia is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:H2G

Flawless balance sheet slight.

Market Insights

Community Narratives