- Australia

- /

- Commercial Services

- /

- ASX:T3D

Could The 333D Limited (ASX:T3D) Ownership Structure Tell Us Something Useful?

A look at the shareholders of 333D Limited (ASX:T3D) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

333D is a smaller company with a market capitalization of AU$1.1m, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have not yet purchased much of the company. Let's delve deeper into each type of owner, to discover more about 333D.

See our latest analysis for 333D

What Does The Institutional Ownership Tell Us About 333D?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

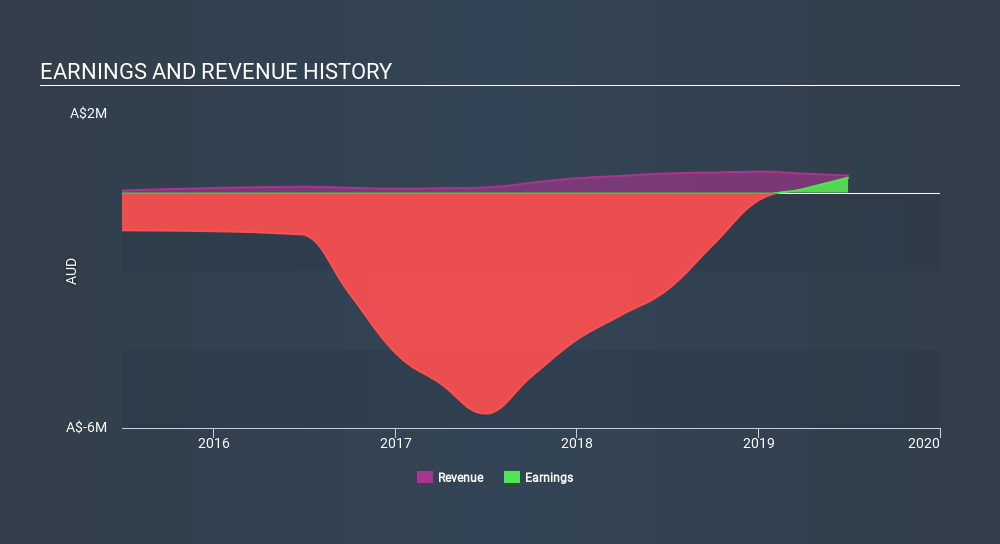

Since institutions own under 5% of 333D, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Hedge funds don't have many shares in 333D. The company's largest shareholder is Geok Lan Ng, with ownership of 12%, The second largest shareholder with 11%, is Michael Catanzariti, followed by Cerva Capital Pty Ltd, with an ownership of 9.7%.

We also observed that the top 7 shareholders account for 53% of the register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of 333D

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own the majority of 333D Limited. This means they can collectively make decisions for the company. So they have a AU$547k stake in this AU$1.1m business. Most would be pleased to see the board is investing alongside them. You may wish todiscover (for free) if they have been buying or selling.

General Public Ownership

The general public, with a 26% stake in the company, will not easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

It seems that Private Companies own 20%, of the T3D stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For example, we've discovered 5 warning signs for 333D (3 are concerning!) that you should be aware of before investing here.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:T3D

Medium-low with worrying balance sheet.

Market Insights

Community Narratives