- Australia

- /

- Auto Components

- /

- ASX:ABV

Advanced Braking Technology And 2 More ASX Penny Stocks With Promising Potential

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.36% as it adjusts to new political and economic landscapes, including a favorable tariff outcome. Amidst these broader market shifts, investors are increasingly looking at smaller or newer companies for growth opportunities. Although the term "penny stocks" might seem outdated, they still represent a viable investment area where strong financial health can lead to significant potential returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.945 | A$316.68M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$240.95M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.985 | A$110.44M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Advanced Braking Technology (ASX:ABV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Advanced Braking Technology Limited is involved in the research, design, development, manufacture, distribution, and sale of braking solutions globally with a market cap of A$34.63 million.

Operations: The company's revenue is primarily derived from its Failsafe Wet Sealed Braking Systems and The Terra Dura Dry Sealed Braking System, totaling A$15.29 million.

Market Cap: A$34.63M

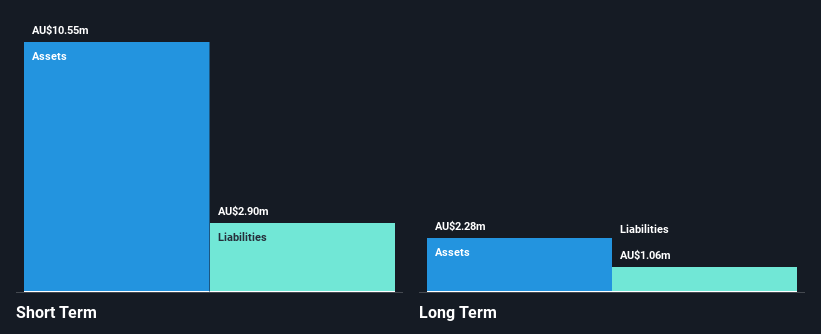

Advanced Braking Technology Limited, with a market cap of A$34.63 million, derives A$15.29 million in revenue primarily from its braking systems. The company has demonstrated consistent profitability growth over the past five years and maintains strong financial health, with more cash than total debt and short-term assets exceeding liabilities. Recent changes in leadership include the appointment of Mark Pitts as Company Secretary, bringing extensive experience in corporate compliance within publicly listed companies. Despite stable weekly volatility and no significant shareholder dilution recently, there has been notable insider selling over the past quarter which could warrant attention.

- Click here and access our complete financial health analysis report to understand the dynamics of Advanced Braking Technology.

- Learn about Advanced Braking Technology's historical performance here.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers technology-driven captioning, transcription, and translation services across several regions including Australia and North America, with a market cap of A$172.27 million.

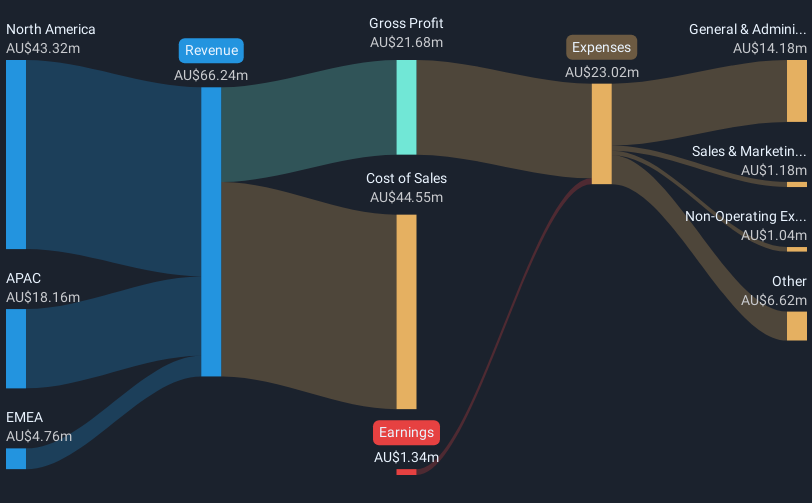

Operations: The company generated A$66.24 million in revenue from its Internet Software & Services segment.

Market Cap: A$172.27M

Ai-Media Technologies Limited, with a market cap of A$172.27 million, is focused on technology-driven captioning and transcription services. Despite being unprofitable, the company has reduced its losses by 23.3% annually over the past five years and maintains a strong cash position, with short-term assets (A$26.8M) covering both short-term (A$14.1M) and long-term liabilities (A$3.1M). The absence of debt and positive free cash flow growth provide financial stability for over three years without significant shareholder dilution recently, although management experience remains limited with an average tenure below two years.

- Dive into the specifics of Ai-Media Technologies here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Ai-Media Technologies' future.

Smart Parking (ASX:SPZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Parking Limited designs, develops, and manages parking management solutions across New Zealand, Australia, Germany, and the United Kingdom with a market cap of A$308.16 million.

Operations: The company's revenue segments include the Technology Division generating A$6.28 million, and Parking Management operations in the United Kingdom with A$43.99 million, New Zealand with A$4.57 million, Germany with A$2.79 million, Denmark with A$0.11 million, and Australia contributing A$0.07 million.

Market Cap: A$308.16M

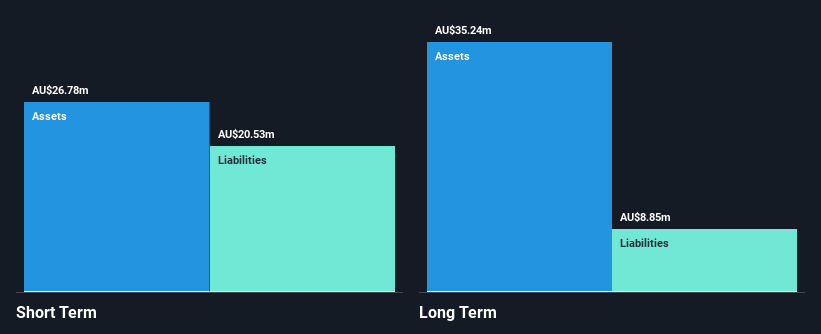

Smart Parking Limited, with a market cap of A$308.16 million, is trading below its estimated fair value and has not diluted shareholders recently. The company maintains a strong financial position with short-term assets exceeding both short-term and long-term liabilities. Despite a decline in profit margins from 14.1% to 6.7%, Smart Parking's interest payments are well covered by EBIT, and it holds more cash than debt. The management team is experienced, averaging three years of tenure, while the board boasts over 12 years on average. Recently, the company expressed interest in strategic acquisitions to expand its operations conservatively.

- Get an in-depth perspective on Smart Parking's performance by reading our balance sheet health report here.

- Evaluate Smart Parking's prospects by accessing our earnings growth report.

Taking Advantage

- Embark on your investment journey to our 1,026 ASX Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABV

Advanced Braking Technology

Engages in the research, design, development, manufacture, distribution, and sale of braking solutions worldwide.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives