- Australia

- /

- Construction

- /

- ASX:SXE

Top ASX Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As the Australian market navigates a relatively stable period without significant volatility, the ASX200 closed at 7,760 points with Health Care leading the sectors. In such conditions, dividend stocks can offer investors a reliable income stream and potential stability amidst broader market fluctuations.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.59% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.84% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 9.36% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.54% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.76% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.57% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.18% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.81% | ★★★★★☆ |

| IVE Group (ASX:IGL) | 7.63% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

Smartgroup (ASX:SIQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smartgroup Corporation Ltd, with a market cap of A$991.03 million, provides employee management services in Australia.

Operations: Smartgroup Corporation Ltd generates revenue through its Vehicle Services segment, which contributes A$21.87 million, and its Outsourced Administration segment, which brings in A$287.87 million.

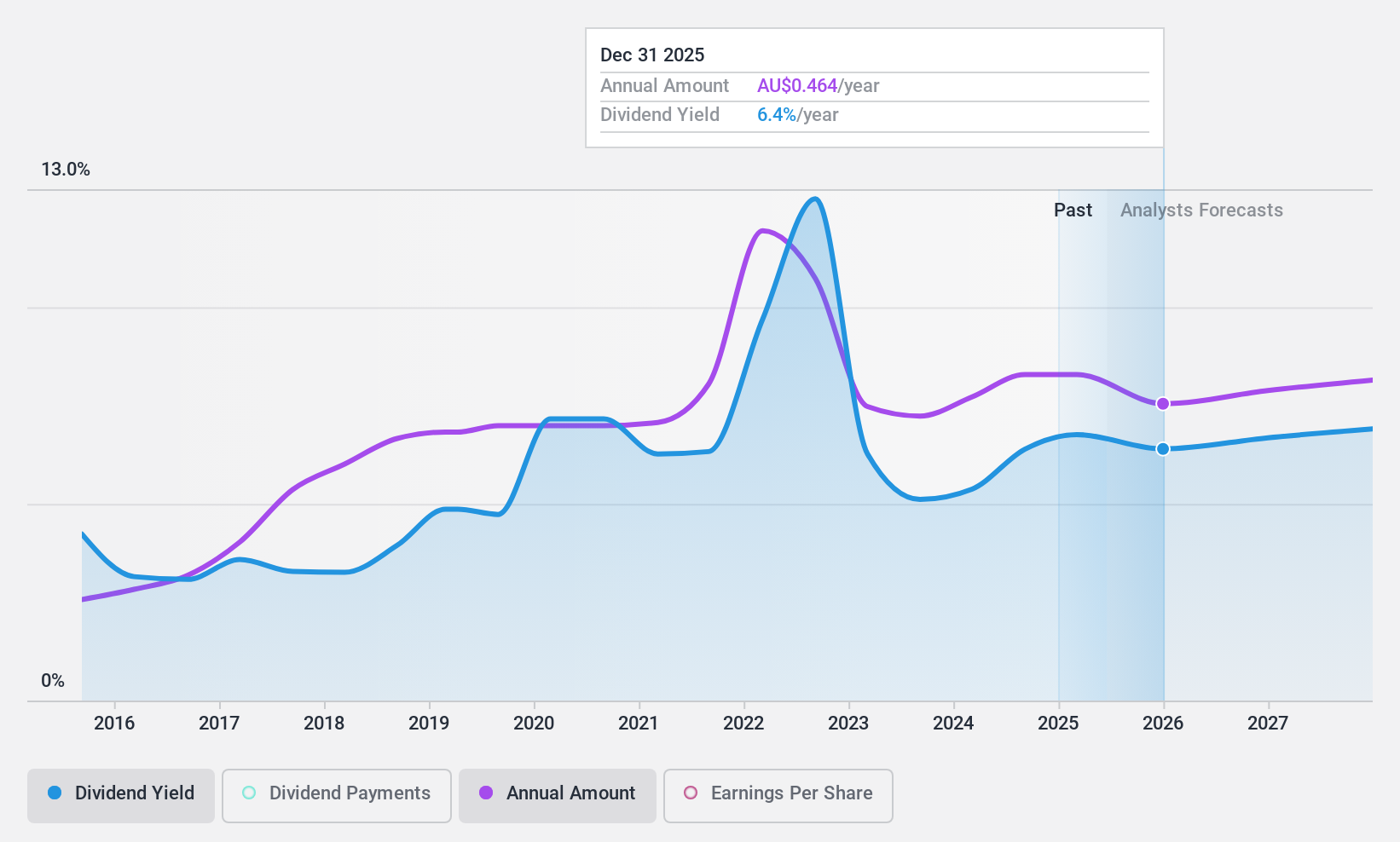

Dividend Yield: 6.7%

Smartgroup's dividend yield of 6.73% places it in the top 25% of Australian dividend payers, yet its dividends have been volatile over the past decade. Recent announcements include a fully franked special dividend and an increase in regular dividends, reflecting strong earnings growth with net income rising to A$75.6 million for 2024. However, the high cash payout ratio (134.8%) suggests dividends are not well covered by free cash flows, raising sustainability concerns despite analyst optimism on stock price potential.

- Click here and access our complete dividend analysis report to understand the dynamics of Smartgroup.

- The valuation report we've compiled suggests that Smartgroup's current price could be quite moderate.

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products in Australia and New Zealand, with a market cap of A$2.87 billion.

Operations: Super Retail Group Limited generates revenue through its segments: Rebel at A$1.32 billion, Macpac at A$215.80 million, Super Cheap Auto (SCA) at A$1.51 billion, and Boating, Camping and Fishing (BCF) excluding Macpac at A$912.60 million.

Dividend Yield: 9.4%

Super Retail Group's dividend yield of 9.36% ranks it among the top 25% in Australia, although its dividend history has been volatile over the past decade. The company's dividends are covered by earnings and cash flows with a payout ratio of 68.8%. Recent earnings reports show mixed results, with net income declining to A$129.8 million despite increased sales and revenue. The company declared a fully franked interim dividend of A$0.32 per share, payable on April 15, 2025.

- Unlock comprehensive insights into our analysis of Super Retail Group stock in this dividend report.

- Our valuation report here indicates Super Retail Group may be undervalued.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$458.51 million.

Operations: Southern Cross Electrical Engineering Limited generates revenue of A$693.73 million from providing electrical services to the resources, commercial, and infrastructure sectors in Australia.

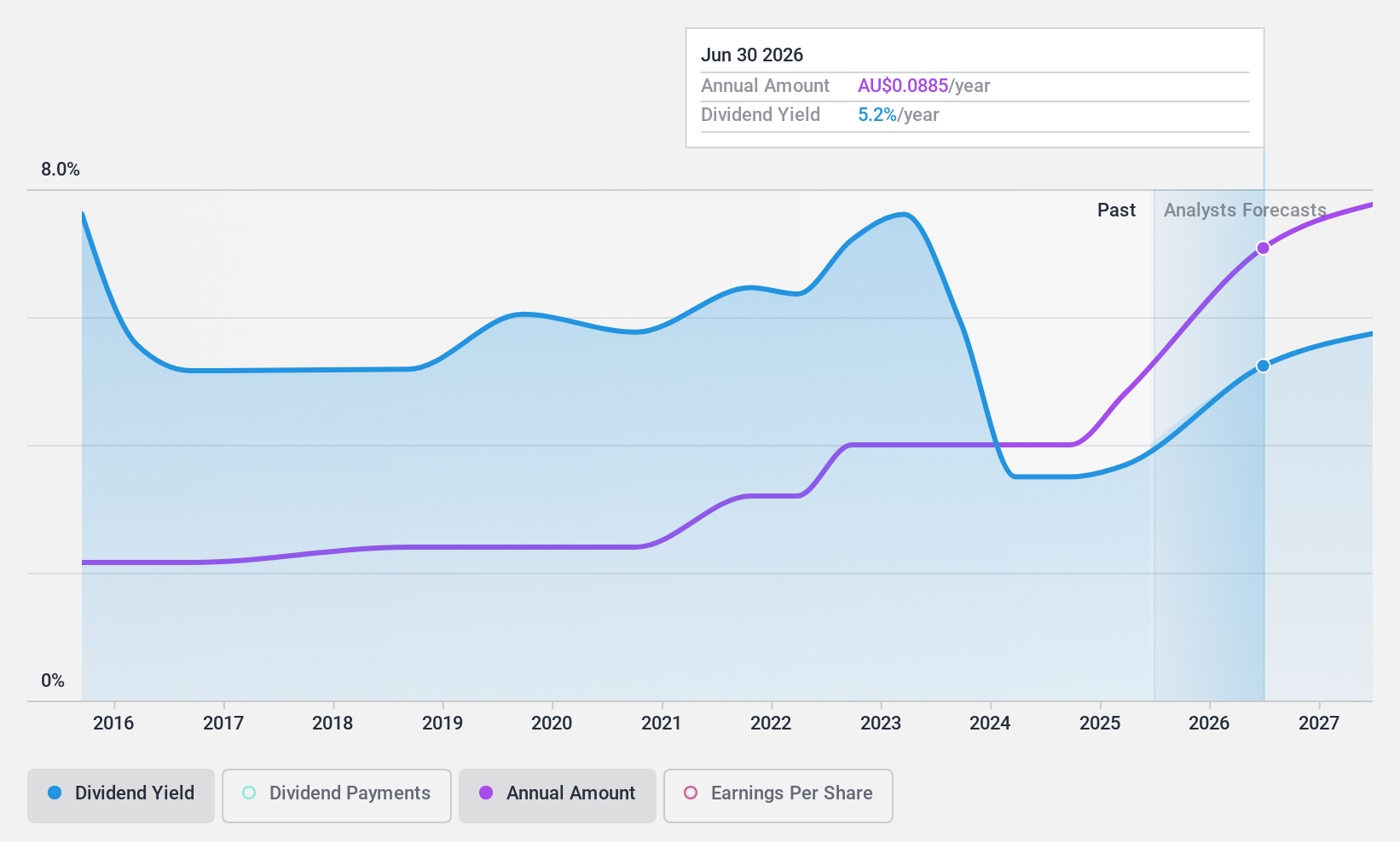

Dividend Yield: 3.5%

Southern Cross Electrical Engineering's dividend yield of 3.46% is modest compared to the top Australian payers, with a history of volatility over the past decade. However, dividends are well covered by earnings and cash flows, with payout ratios of 69.4% and 21.5%, respectively. Recent half-year results showed strong growth in sales to A$397.41 million and net income to A$16.18 million, supporting its fully franked interim dividend of A$0.025 per share paid on April 9, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Southern Cross Electrical Engineering.

- Upon reviewing our latest valuation report, Southern Cross Electrical Engineering's share price might be too pessimistic.

Turning Ideas Into Actions

- Navigate through the entire inventory of 31 Top ASX Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, and maintenance services and products to resources, commercial, and infrastructure sectors in Australia.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives