- Australia

- /

- Commercial Services

- /

- ASX:SGF

SG Fleet Group Limited's (ASX:SGF) Stock Is Going Strong: Have Financials A Role To Play?

Most readers would already be aware that SG Fleet Group's (ASX:SGF) stock increased significantly by 25% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on SG Fleet Group's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for SG Fleet Group

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for SG Fleet Group is:

14% = AU$37m ÷ AU$271m (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every A$1 worth of equity, the company was able to earn A$0.14 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

SG Fleet Group's Earnings Growth And 14% ROE

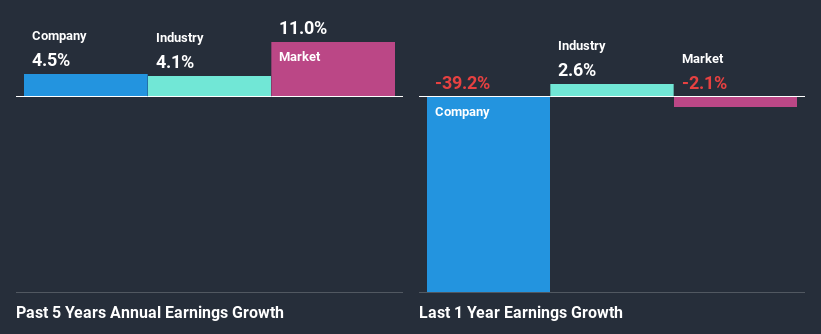

To start with, SG Fleet Group's ROE looks acceptable. And on comparing with the industry, we found that the the average industry ROE is similar at 12%. Despite the modest returns, SG Fleet Group's five year net income growth was quite low, averaging at only 4.5%. A few likely reasons that could be keeping earnings growth low are - the company has a high payout ratio or the business has allocated capital poorly, for instance.

As a next step, we compared SG Fleet Group's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 4.1% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is SGF worth today? The intrinsic value infographic in our free research report helps visualize whether SGF is currently mispriced by the market.

Is SG Fleet Group Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 71% (or a retention ratio of 29%), most of SG Fleet Group's profits are being paid to shareholders. This definitely contributes to the low earnings growth seen by the company.

Moreover, SG Fleet Group has been paying dividends for six years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 66% of its profits over the next three years. However, SG Fleet Group's ROE is predicted to rise to 20% despite there being no anticipated change in its payout ratio.

Conclusion

In total, it does look like SG Fleet Group has some positive aspects to its business. Its earnings have grown respectably as we saw earlier, which was likely due to the company reinvesting its earnings at a pretty high rate of return. However, given the high ROE, we do think that the company is reinvesting a small portion of its profits. This could likely be preventing the company from growing to its full extent. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 4 risks we have identified for SG Fleet Group by visiting our risks dashboard for free on our platform here.

If you decide to trade SG Fleet Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SGF

SG Fleet Group

Provides motor vehicle fleet management, vehicle leasing, short-term hire, consumer vehicle finance, and salary packaging services in Australia, New Zealand, and the United Kingdom.

Undervalued second-rate dividend payer.