- Australia

- /

- Professional Services

- /

- ASX:QIP

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For QANTM Intellectual Property Limited's (ASX:QIP) CEO For Now

Key Insights

- QANTM Intellectual Property's Annual General Meeting to take place on 23rd of November

- Salary of AU$674.7k is part of CEO Craig Dower's total remuneration

- Total compensation is 60% above industry average

- QANTM Intellectual Property's total shareholder return over the past three years was 4.6% while its EPS was down 7.9% over the past three years

The anaemic share price growth at QANTM Intellectual Property Limited (ASX:QIP) over the past few years has probably not impressed shareholders and may be due to earnings not growing over that period. Some of these issues will occupy shareholders' minds as the AGM rolls around on 23rd of November. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for QANTM Intellectual Property

Comparing QANTM Intellectual Property Limited's CEO Compensation With The Industry

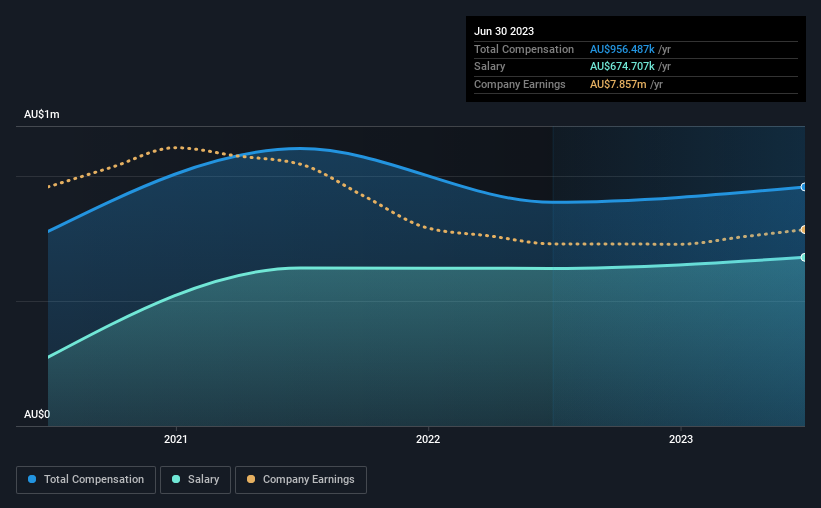

At the time of writing, our data shows that QANTM Intellectual Property Limited has a market capitalization of AU$130m, and reported total annual CEO compensation of AU$956k for the year to June 2023. That's a fairly small increase of 6.9% over the previous year. In particular, the salary of AU$674.7k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Australian Professional Services industry with market capitalizations under AU$307m, the reported median total CEO compensation was AU$598k. Accordingly, our analysis reveals that QANTM Intellectual Property Limited pays Craig Dower north of the industry median. Moreover, Craig Dower also holds AU$274k worth of QANTM Intellectual Property stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$675k | AU$630k | 71% |

| Other | AU$282k | AU$264k | 29% |

| Total Compensation | AU$956k | AU$895k | 100% |

On an industry level, around 65% of total compensation represents salary and 35% is other remuneration. There isn't a significant difference between QANTM Intellectual Property and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at QANTM Intellectual Property Limited's Growth Numbers

QANTM Intellectual Property Limited has reduced its earnings per share by 7.9% a year over the last three years. It achieved revenue growth of 7.6% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has QANTM Intellectual Property Limited Been A Good Investment?

With a total shareholder return of 4.6% over three years, QANTM Intellectual Property Limited has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

While it's true that the share price growth hasn't been bad, it's hard to overlook the lack of earnings growth and this makes us question whether there will be any strong catalyst for the stock to improve. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for QANTM Intellectual Property that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if QANTM Intellectual Property might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:QIP

QANTM Intellectual Property

Provides intellectual property services for start-up technology businesses, SMEs, multinationals, public sector research institutions, and universities in Australia, New Zealand, the United Kingdom, Singapore, Malaysia, and Hongkong.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives