Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that McMillan Shakespeare Limited (ASX:MMS) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for McMillan Shakespeare

What Is McMillan Shakespeare's Net Debt?

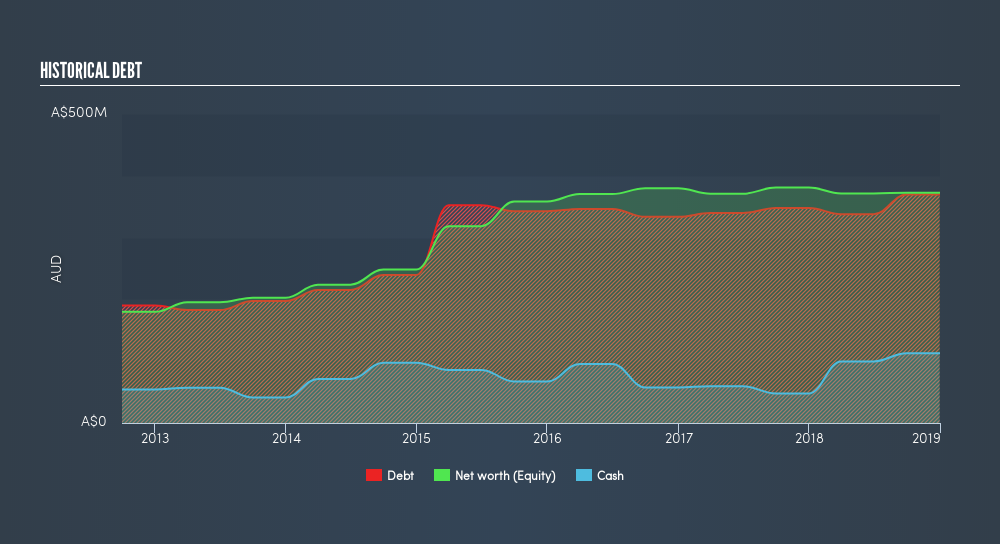

As you can see below, at the end of December 2018, McMillan Shakespeare had AU$369.9m of debt, up from AU$347.9m a year ago. Click the image for more detail. However, because it has a cash reserve of AU$113.0m, its net debt is less, at about AU$256.9m.

How Strong Is McMillan Shakespeare's Balance Sheet?

We can see from the most recent balance sheet that McMillan Shakespeare had liabilities of AU$143.3m falling due within a year, and liabilities of AU$371.3m due beyond that. On the other hand, it had cash of AU$113.0m and AU$53.5m worth of receivables due within a year. So its liabilities total AU$348.2m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because McMillan Shakespeare is worth AU$1.10b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Because it carries more debt than cash, we think it's worth watching McMillan Shakespeare's balance sheet over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

McMillan Shakespeare's net debt is only 1.20 times its EBITDA. And its EBIT easily covers its interest expense, being 14.2 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Fortunately, McMillan Shakespeare grew its EBIT by 2.2% in the last year, making that debt load look even more manageable. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if McMillan Shakespeare can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, McMillan Shakespeare's free cash flow amounted to 50% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On our analysis McMillan Shakespeare's interest cover should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. For example, its level of total liabilities makes us a little nervous about its debt. Considering this range of data points, we think McMillan Shakespeare is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that McMillan Shakespeare insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MMS

McMillan Shakespeare

Provides salary packaging, novated leasing, disability plan management, support co-ordination, asset management, and related financial products and services in Australia and New Zealand.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives