- Australia

- /

- Capital Markets

- /

- ASX:MFG

Undervalued Small Caps In Australia With Insider Buying To Consider

Reviewed by Simply Wall St

As the Australian market prepares for a modest rise, with the ASX200 expected to increase by 0.4%, investors are closely watching economic developments such as China's recent stimulus measures and US inflation trends. In this environment, identifying promising small-cap stocks can be crucial, especially those that demonstrate potential resilience and growth opportunities amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 7.8x | 4.9x | 35.78% | ★★★★★☆ |

| GWA Group | 17.1x | 1.6x | 39.55% | ★★★★★☆ |

| SHAPE Australia | 14.1x | 0.3x | 34.91% | ★★★★☆☆ |

| Collins Foods | 18.1x | 0.7x | 7.33% | ★★★★☆☆ |

| Centuria Capital Group | 22.4x | 5.0x | 43.54% | ★★★★☆☆ |

| Eagers Automotive | 11.2x | 0.3x | 36.47% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.5x | 17.52% | ★★★★☆☆ |

| Dicker Data | 21.4x | 0.8x | -76.01% | ★★★☆☆☆ |

| Corporate Travel Management | 22.1x | 2.6x | -4.05% | ★★★☆☆☆ |

| Abacus Storage King | 12.6x | 7.9x | -33.00% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading car retailing company in Australia, with operations primarily focused on the sale of new and used vehicles, and it has a market capitalization of approximately A$3.47 billion.

Operations: Car Retailing is the primary revenue stream, contributing significantly to total earnings. The company's gross profit margin has shown fluctuations, with a recent figure of 18.17%. Operating expenses have consistently been a substantial portion of costs.

PE: 11.2x

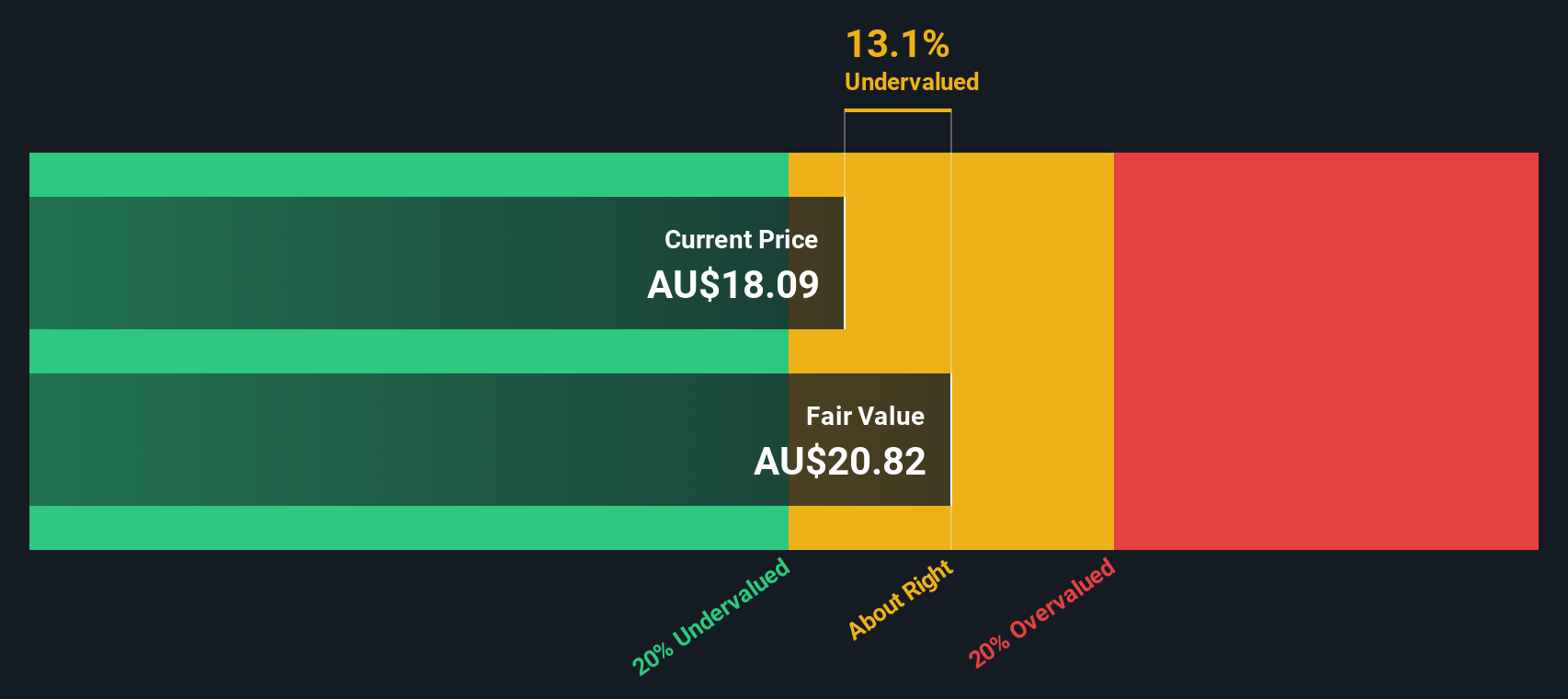

Eagers Automotive, a company in the Australian market often overlooked, recently reported A$5.46 billion in sales for H1 2024, up from A$4.82 billion the previous year. Despite a dip in net income to A$116 million from A$137.76 million, insider confidence is evident with Nicholas Politis purchasing 200,000 shares valued at approximately A$2.09 million between July and August 2024. While relying on external borrowing poses some risks, the company remains financially stable with operating cash flow covering its debt obligations effectively.

- Click here to discover the nuances of Eagers Automotive with our detailed analytical valuation report.

Examine Eagers Automotive's past performance report to understand how it has performed in the past.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mader Group specializes in providing staffing and outsourcing services, with a market capitalization of A$1.06 billion.

Operations: Mader Group's primary revenue stream is from Staffing & Outsourcing Services, with recent revenues reaching A$774.47 million. The company's gross profit margin has shown an upward trend, peaking at 22.92% as of June 2024. Operating expenses are a significant cost component, with General & Administrative Expenses being the largest portion within this category.

PE: 22.1x

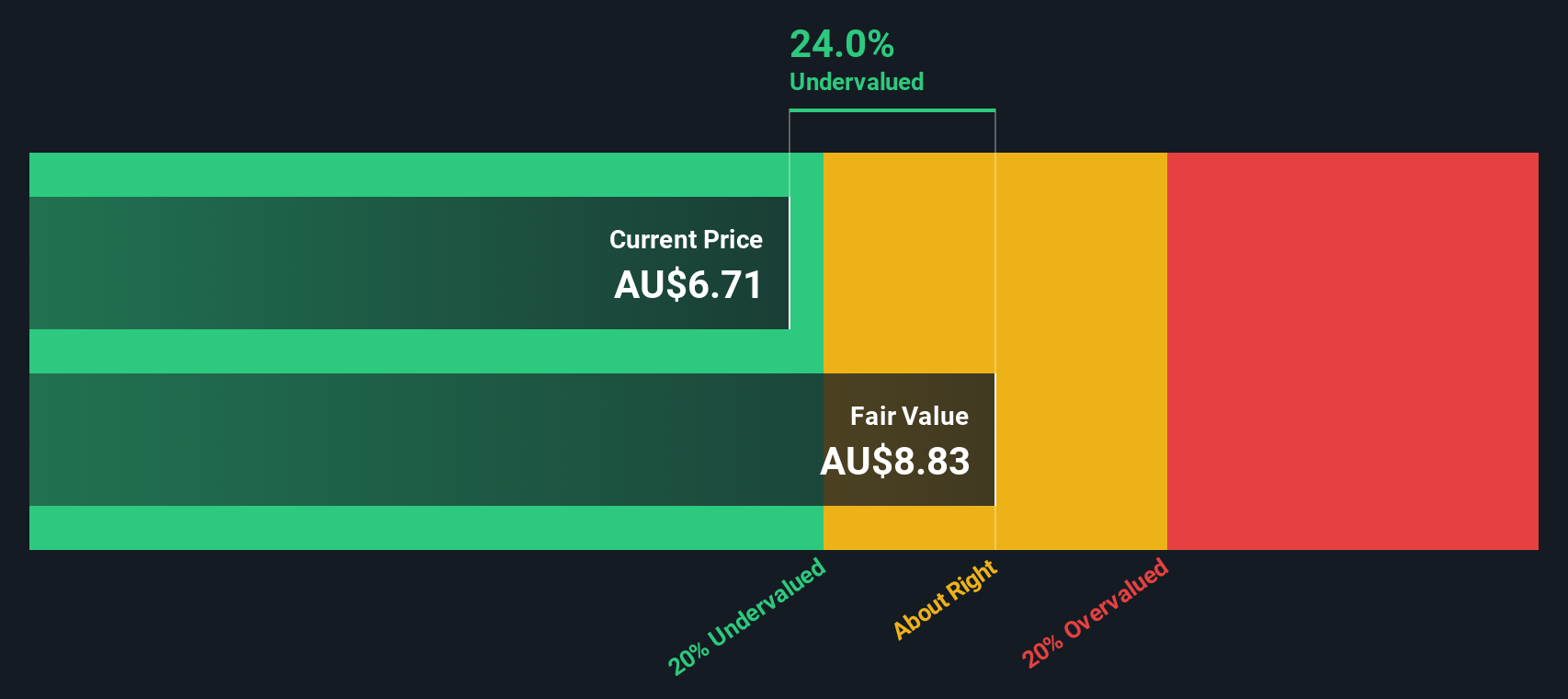

Mader Group, recently added to the S&P Global BMI Index, showcases potential as an undervalued stock in Australia. With fiscal 2024 revenue at A$774.5 million and a net income rise to A$50.4 million from A$38.5 million the previous year, they project further growth with fiscal 2025 revenue expected at least A$870 million. Insider confidence is evident through share purchases over recent months, reflecting trust in future prospects despite reliance on external borrowing for funding.

- Click here and access our complete valuation analysis report to understand the dynamics of Mader Group.

Explore historical data to track Mader Group's performance over time in our Past section.

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is a financial services company specializing in investment management, with a market capitalization of A$3.72 billion.

Operations: Magellan Financial Group generates revenue primarily through Investment Management Services, contributing A$279.83 million, with additional income from Fund Investments and Corporate activities. The company's cost structure includes Cost of Goods Sold (COGS) at A$72.77 million and operating expenses such as General & Administrative and Sales & Marketing costs. Notably, the net profit margin has shown variability over time, reaching 63.07% in the most recent period ending October 13, 2024.

PE: 7.8x

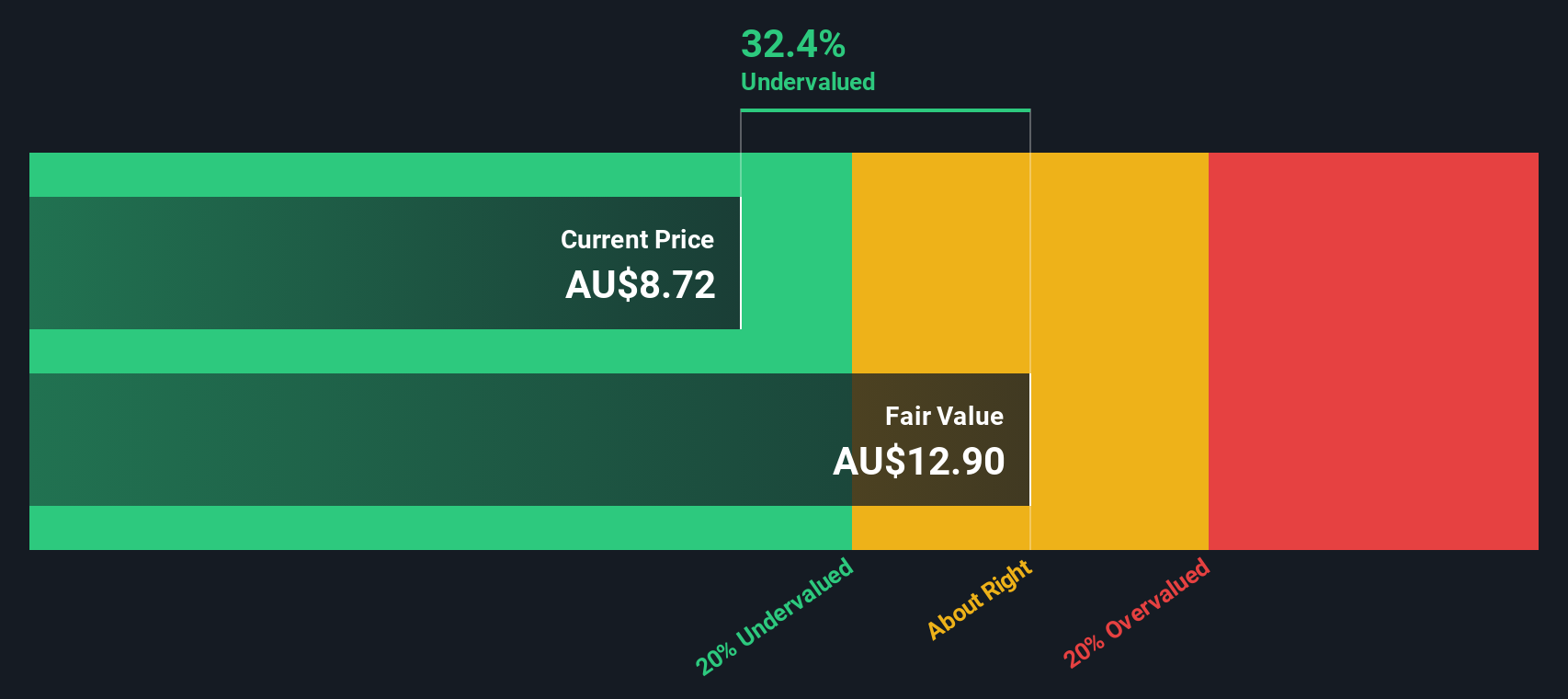

Magellan Financial Group, a smaller player in the Australian market, recently reported a net income of A$238.76 million for the year ending June 30, 2024, up from A$182.66 million the previous year. Despite this positive financial performance and an increased dividend to A$0.357 per share, earnings are projected to decline by 9.2% annually over the next three years due to reliance on external borrowing for funding. The company repurchased 685,571 shares between July 2023 and June 2024 for A$5.19 million as part of its ongoing buyback program extended until April 2025, signaling potential insider confidence in its long-term value despite anticipated challenges ahead.

- Dive into the specifics of Magellan Financial Group here with our thorough valuation report.

Gain insights into Magellan Financial Group's past trends and performance with our Past report.

Summing It All Up

- Click through to start exploring the rest of the 21 Undervalued ASX Small Caps With Insider Buying now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFG

Flawless balance sheet, undervalued and pays a dividend.