- Australia

- /

- Commercial Services

- /

- ASX:MAD

Exploring Cobram Estate Olives And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As the Australian stock market navigates a mixed landscape, with sectors like Real Estate and IT showing resilience while Utilities and Financials face challenges, investors are keenly observing small-cap stocks for potential opportunities. In this climate, identifying promising small caps such as Cobram Estate Olives can be crucial, as these companies often offer unique value propositions that align with evolving market dynamics and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in olive farming and the production and marketing of olive oil across Australia, the United States, and internationally, with a market cap of A$867.21 million.

Operations: The company's revenue streams include its US operations, contributing A$67.16 million, and a segment adjustment of A$177.91 million. The financial data indicates eliminations and corporate adjustments amounting to -A$6.30 million.

Cobram Estate Olives, a company with promising prospects, is enhancing its production capabilities through strategic U.S. and Australian expansions. The firm aims to double its planted area in the U.S., increasing supply to meet demand and leveraging maturing olive groves for economies of scale. Infrastructure upgrades at Boort mill and Woodland site are set to boost efficiency. Despite these positives, high product pricing and rising net debt ratios pose financial risks. Analysts forecast an 18% annual revenue growth over three years, with profit margins improving from 9% to 10%. The stock is currently priced at A$1.84 against a target of A$2.14, suggesting potential upside but requiring careful consideration of market conditions.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★★★

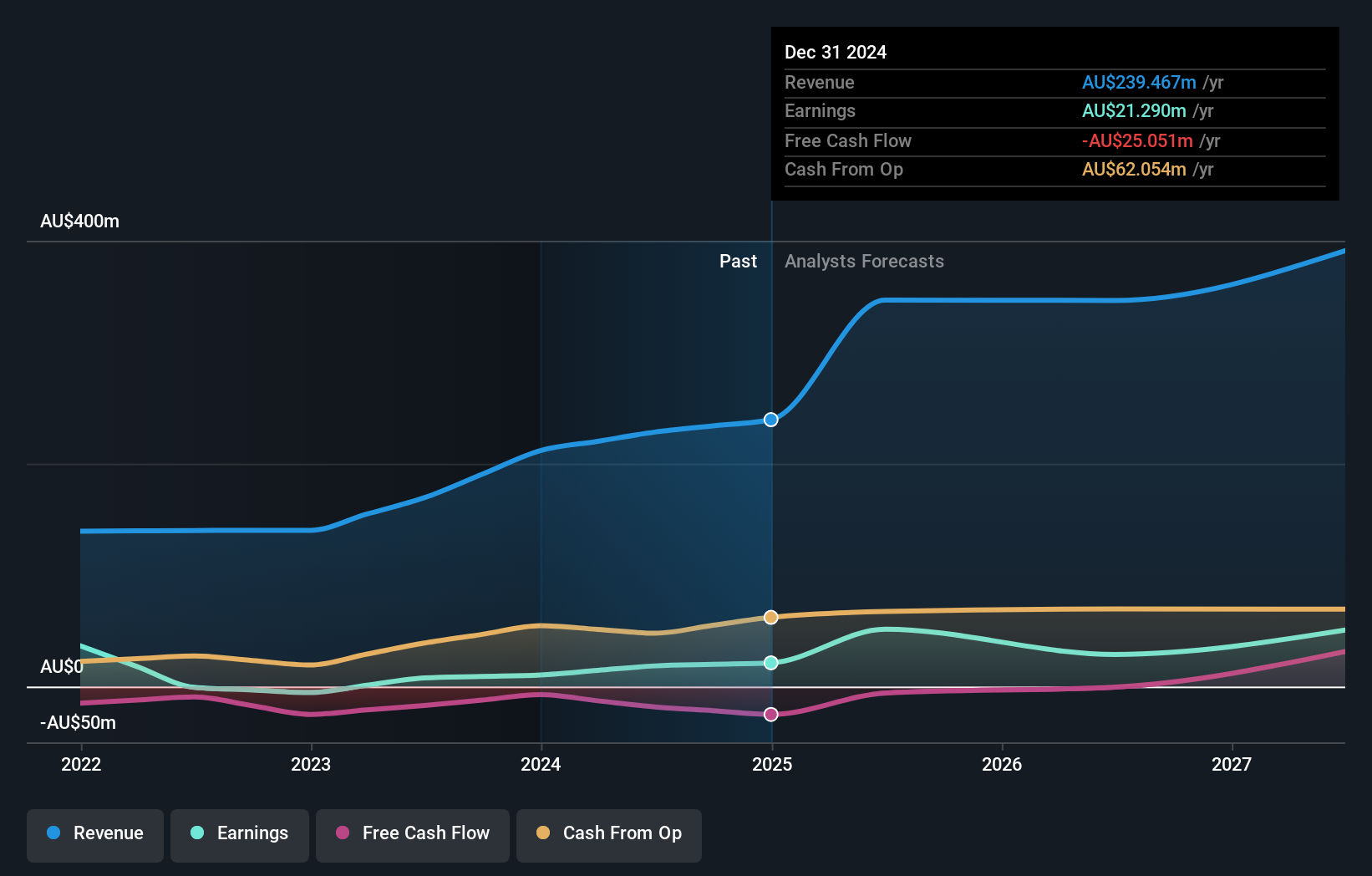

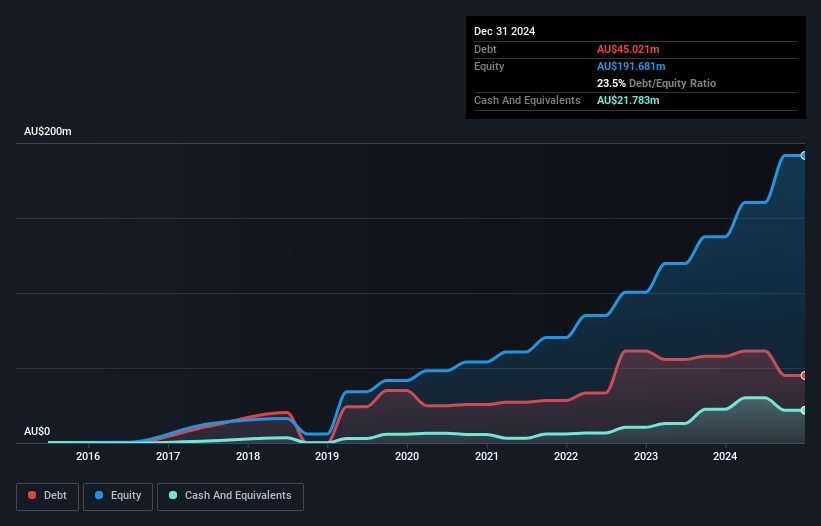

Overview: Mader Group Limited is a contracting company that offers specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of approximately A$1.23 billion.

Operations: Mader Group generates revenue primarily from its Staffing & Outsourcing Services, amounting to A$811.54 million.

Mader Group, a nimble player in the contracting space, is making waves with its strategic push into energy and transport logistics. This move aims to diversify revenue streams beyond its stronghold in Australia, which currently contributes 79% of its income. The company has successfully reduced its debt to equity ratio from 84% to a satisfactory 23.5% over five years, showcasing prudent financial management. With interest payments well covered by EBIT at 20.5 times and earnings growth outpacing the industry at 15.5%, Mader is positioned for robust expansion while trading at an attractive valuation below estimated fair value by nearly 26%.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★☆

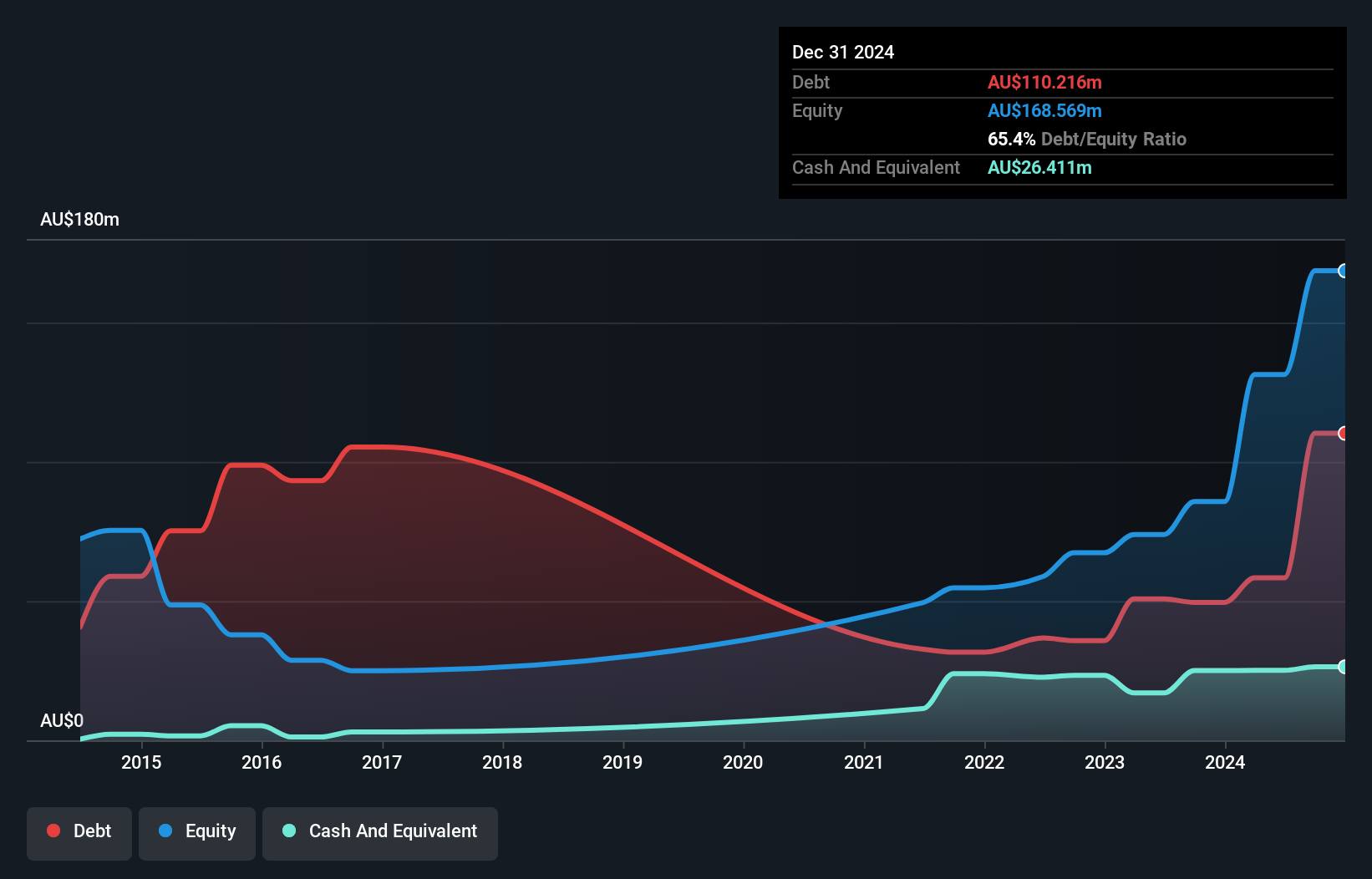

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services across Australia with a market capitalization of A$751.63 million.

Operations: Tasmea generates revenue primarily through its service offerings in shutdown, maintenance, emergency breakdown, and capital upgrades across Australia. The company's market capitalization stands at A$751.63 million.

Tasmea, a small player in the construction sector, has been making waves with its impressive earnings growth of 75.3% over the past year, outpacing the industry average of 28.7%. The company's debt to equity ratio has notably improved from 137.6% to 65.4% over five years, indicating better financial management despite still having high debt levels with a net debt to equity ratio at 49.7%. Tasmea's interest payments are comfortably covered by EBIT at a multiple of 10.7x, reflecting robust earnings quality and profitability that supports future cash flow positivity and strategic initiatives driving anticipated growth in FY26.

- Dive into the specifics of Tasmea here with our thorough health report.

Explore historical data to track Tasmea's performance over time in our Past section.

Taking Advantage

- Embark on your investment journey to our 44 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives