- Australia

- /

- Professional Services

- /

- ASX:HIT

If You Like EPS Growth Then Check Out HiTech Group Australia (ASX:HIT) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like HiTech Group Australia (ASX:HIT). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for HiTech Group Australia

How Quickly Is HiTech Group Australia Increasing Earnings Per Share?

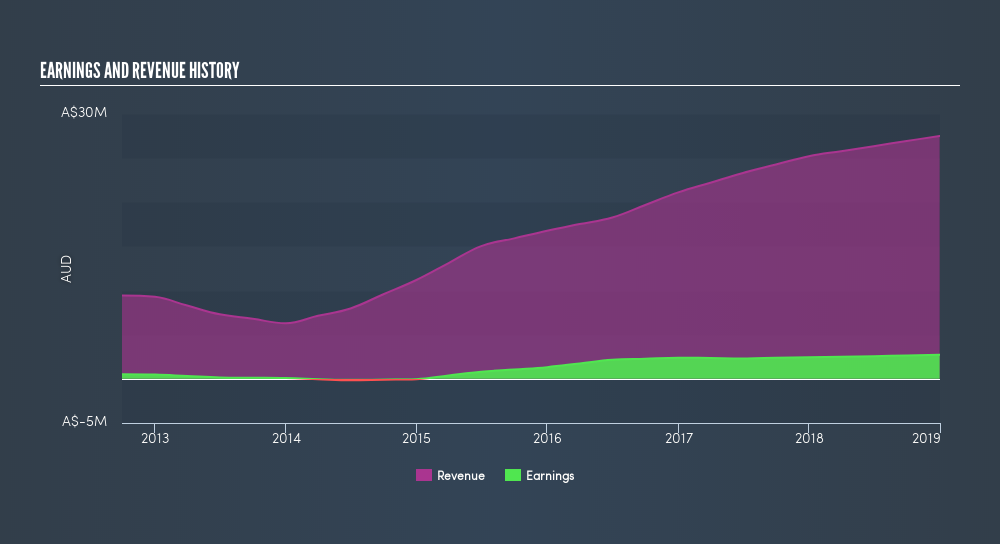

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, HiTech Group Australia has grown EPS by 19% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note HiTech Group Australia's EBIT margins were flat over the last year, revenue grew by a solid 9.1% to AU$28m. That's progress.

Since HiTech Group Australia is no giant, with a market capitalization of AU$45m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are HiTech Group Australia Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that HiTech Group Australia insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 76%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about AU$34m riding on the stock, at current prices. That's nothing to sneeze at!

Does HiTech Group Australia Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about HiTech Group Australia's strong EPS growth. Further, the high level of insider buying impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. Of course, just because HiTech Group Australia is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although HiTech Group Australia certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:HIT

HiTech Group Australia

Provides recruitment services for permanent and contract staff to the information and communications technology (ICT) industry in public and private sectors in Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives