- Australia

- /

- Professional Services

- /

- ASX:HIT

How Important Was Sentiment In Driving HiTech Group Australia's (ASX:HIT) Fantastic 1486% Share Price Gain?

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the HiTech Group Australia Limited (ASX:HIT) share price has soared 1486% over five years. If that doesn't get you thinking about long term investing, we don't know what will. On top of that, the share price is up 13% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for HiTech Group Australia

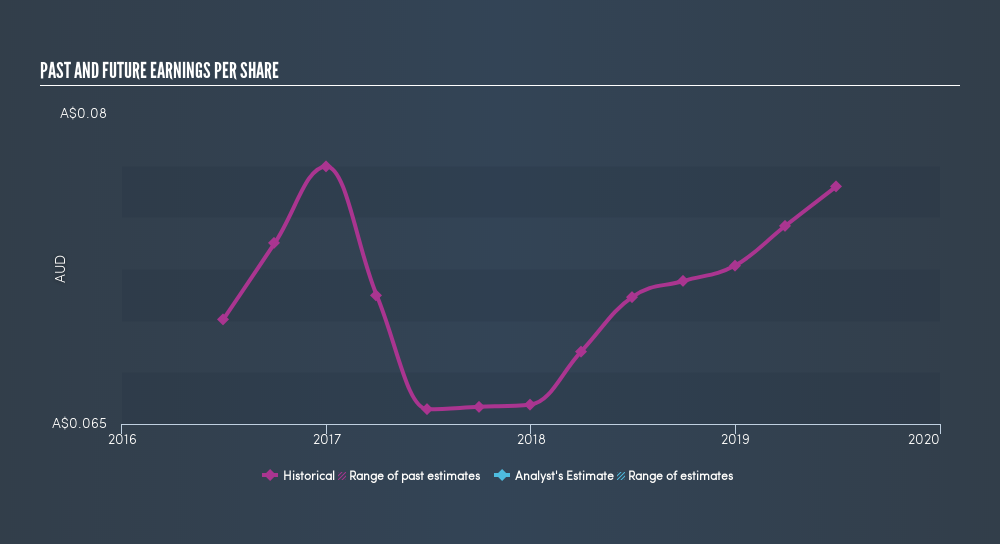

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the five years of share price growth, HiTech Group Australia moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the HiTech Group Australia share price has gained 88% in three years. Meanwhile, EPS is up 3.0% per year. Notably, the EPS growth has been slower than the annualised share price gain of 23% over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

It might be well worthwhile taking a look at our free report on HiTech Group Australia's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, HiTech Group Australia's TSR for the last 5 years was 2000%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that HiTech Group Australia shareholders have received a total shareholder return of 16% over the last year. That's including the dividend. However, the TSR over five years, coming in at 84% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Keeping this in mind, a solid next step might be to take a look at HiTech Group Australia's dividend track record. This free interactive graph is a great place to start.

Of course HiTech Group Australia may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:HIT

HiTech Group Australia

Provides recruitment services for permanent and contract staff to the information and communications technology (ICT) industry in public and private sectors in Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives