It's A Story Of Risk Vs Reward With Ai-Media Technologies Limited (ASX:AIM)

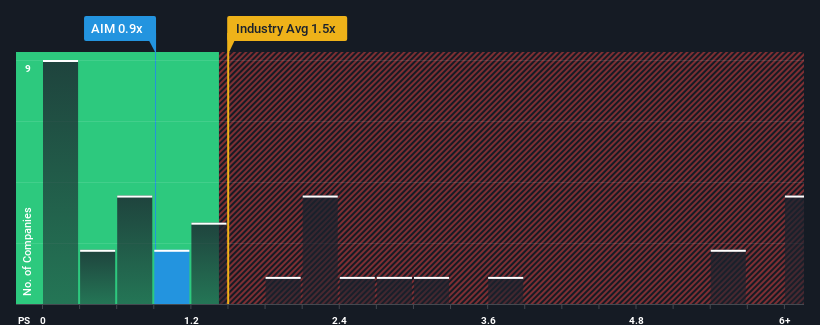

When close to half the companies operating in the Commercial Services industry in Australia have price-to-sales ratios (or "P/S") above 1.5x, you may consider Ai-Media Technologies Limited (ASX:AIM) as an attractive investment with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Ai-Media Technologies

What Does Ai-Media Technologies' Recent Performance Look Like?

Ai-Media Technologies could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Ai-Media Technologies' future stacks up against the industry? In that case, our free report is a great place to start.How Is Ai-Media Technologies' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ai-Media Technologies' to be considered reasonable.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. The latest three year period has also seen an excellent 139% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 6.6% per year during the coming three years according to the dual analysts following the company. That's shaping up to be similar to the 7.9% per annum growth forecast for the broader industry.

With this information, we find it odd that Ai-Media Technologies is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Ai-Media Technologies' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Ai-Media Technologies remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - Ai-Media Technologies has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Ai-Media Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AIM

Ai-Media Technologies

Provides captioning, transcription, and translation products and services in Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026