- Australia

- /

- Commercial Services

- /

- ASX:AEI

How Much Is Aeris Environmental Ltd (ASX:AEI) CEO Getting Paid?

This article will reflect on the compensation paid to Peter Bush who has served as CEO of Aeris Environmental Ltd (ASX:AEI) since 2013. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Aeris Environmental.

See our latest analysis for Aeris Environmental

Comparing Aeris Environmental Ltd's CEO Compensation With the industry

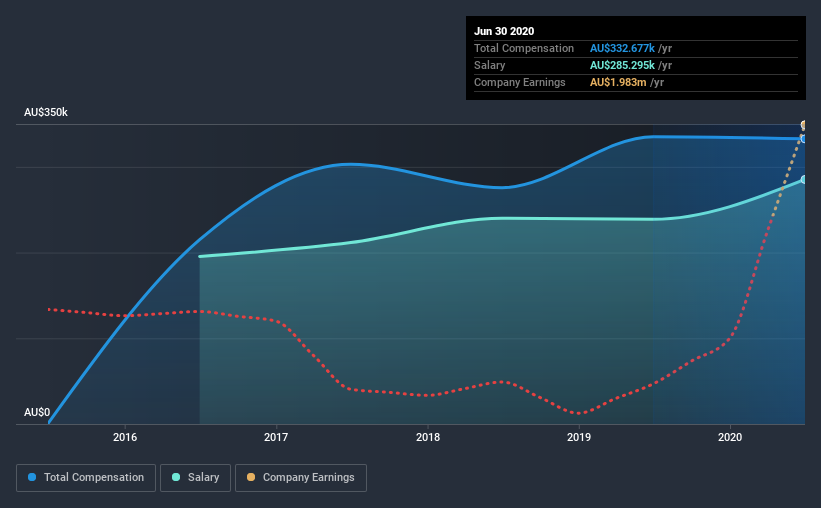

At the time of writing, our data shows that Aeris Environmental Ltd has a market capitalization of AU$71m, and reported total annual CEO compensation of AU$333k for the year to June 2020. That is, the compensation was roughly the same as last year. Notably, the salary which is AU$285.3k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under AU$258m, the reported median total CEO compensation was AU$368k. This suggests that Aeris Environmental remunerates its CEO largely in line with the industry average. What's more, Peter Bush holds AU$210k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$285k | AU$239k | 86% |

| Other | AU$47k | AU$96k | 14% |

| Total Compensation | AU$333k | AU$335k | 100% |

Talking in terms of the industry, salary represented approximately 71% of total compensation out of all the companies we analyzed, while other remuneration made up 29% of the pie. According to our research, Aeris Environmental has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Aeris Environmental Ltd's Growth

Aeris Environmental Ltd has seen its earnings per share (EPS) increase by 44% a year over the past three years. It achieved revenue growth of 113% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Aeris Environmental Ltd Been A Good Investment?

With a total shareholder return of 14% over three years, Aeris Environmental Ltd shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

As previously discussed, Peter is compensated close to the median for companies of its size, and which belong to the same industry. But EPS growth for the company has been strong over the last three years, though shareholder returns in comparison haven't been as impressive. As a result of these considerations, we would suggest the compensation is reasonable, but looking ahead shareholders will likely want to see healthier returns.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 4 warning signs (and 1 which makes us a bit uncomfortable) in Aeris Environmental we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Aeris Environmental, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AEI

Aeris Environmental

Engages in the research, development, and commercialization of proprietary technologies in Australia and internationally.

Moderate risk with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.