Zicom Group Limited's (ASX:ZGL) Subdued P/S Might Signal An Opportunity

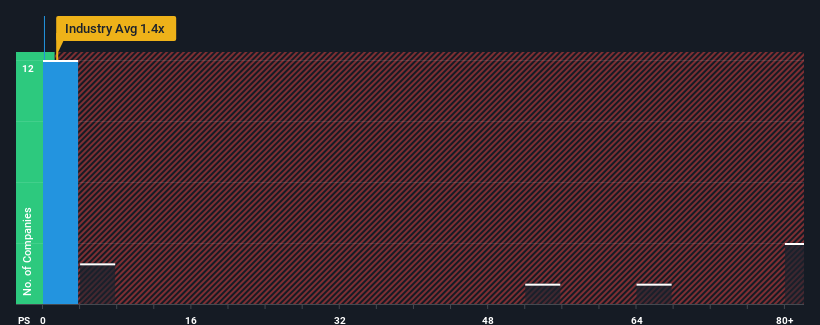

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Zicom Group Limited (ASX:ZGL) is definitely a stock worth checking out, seeing as almost half of all the Machinery companies in Australia have P/S ratios greater than 2.2x and even P/S above 55x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Zicom Group

What Does Zicom Group's P/S Mean For Shareholders?

Zicom Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Zicom Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Zicom Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 38% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that Zicom Group's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at the figures, it's surprising to see Zicom Group currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Zicom Group that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zicom Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ZGL

Zicom Group

Manufactures and sells marine deck machinery, fluid regulating and metering stations, transit concrete mixers, foundation and geotechnical equipment, and precision engineered and automation equipment.

Flawless balance sheet and good value.

Market Insights

Community Narratives