Do XRF Scientific's (ASX:XRF) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like XRF Scientific (ASX:XRF). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for XRF Scientific

XRF Scientific's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that XRF Scientific's EPS has grown 37% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

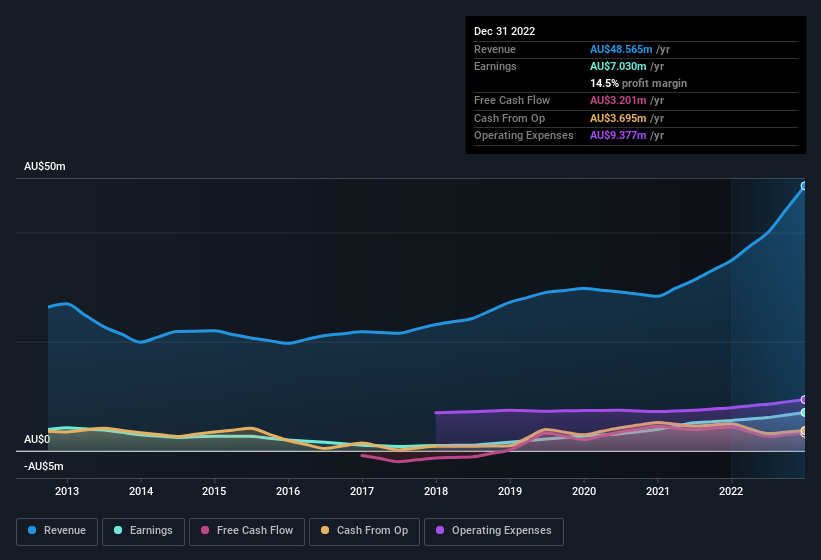

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for XRF Scientific remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 39% to AU$49m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since XRF Scientific is no giant, with a market capitalisation of AU$169m, you should definitely check its cash and debt before getting too excited about its prospects.

Are XRF Scientific Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that XRF Scientific insiders spent AU$204k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Non-Executive Director, David Brown, who made the biggest single acquisition, paying AU$89k for shares at about AU$1.09 each.

On top of the insider buying, it's good to see that XRF Scientific insiders have a valuable investment in the business. As a matter of fact, their holding is valued at AU$40m. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 24% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add XRF Scientific To Your Watchlist?

For growth investors, XRF Scientific's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if XRF Scientific is trading on a high P/E or a low P/E, relative to its industry.

The good news is that XRF Scientific is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:XRF

XRF Scientific

Manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries in Australia, Canada, and Europe.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives