- Australia

- /

- Metals and Mining

- /

- ASX:AME

Discover Alto Metals And 2 More Exciting Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market is poised for a modest rise, buoyed by positive developments on Wall Street and reports of a potential Middle East ceasefire. Amidst these broader market movements, investors often look to smaller or newer companies for unique opportunities. Penny stocks, despite their somewhat outdated name, can still offer significant value when backed by strong financials. In this article, we explore three such penny stocks on the ASX that combine balance sheet strength with the potential for notable growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.965 | A$319.94M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$234.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$325.58M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.65 | A$117.72M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.445 | A$87.21M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.1525 | A$66.44M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.10 | A$118.22M | ★★★★★★ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alto Metals (ASX:AME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alto Metals Limited focuses on the exploration of gold properties in Western Australia and has a market cap of A$66.38 million.

Operations: The company generates revenue primarily from its mineral exploration activities, amounting to A$0.07 million.

Market Cap: A$66.38M

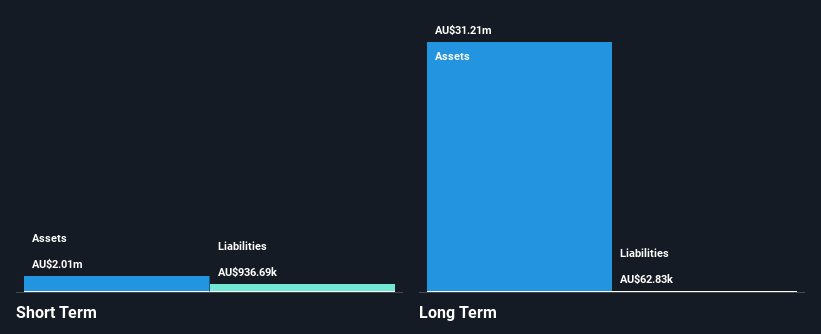

Alto Metals Limited, with a market cap of A$66.38 million, is pre-revenue and currently unprofitable, having reported a net loss of A$1.9 million for the year ending June 30, 2024. Despite this, its financial position is somewhat stable as short-term assets exceed both short-term and long-term liabilities. The company remains debt-free with no significant shareholder dilution over the past year. However, it faces challenges with less than a year's cash runway if current cash flow trends continue to decline. Recently, Patronus Resources acquired an 8.42% stake in Alto Metals for A$5.16 million on November 14, 2024.

- Jump into the full analysis health report here for a deeper understanding of Alto Metals.

- Explore historical data to track Alto Metals' performance over time in our past results report.

Mayne Pharma Group (ASX:MYX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mayne Pharma Group Limited is a specialty pharmaceutical company that manufactures and sells branded and generic pharmaceutical products across Australia, New Zealand, the United States, Canada, Europe, Asia, and internationally with a market cap of A$393.57 million.

Operations: The company's revenue is primarily derived from its Dermatology segment at A$174.86 million, followed by Women's Health at A$142.83 million, and International operations contributing A$70.71 million.

Market Cap: A$393.57M

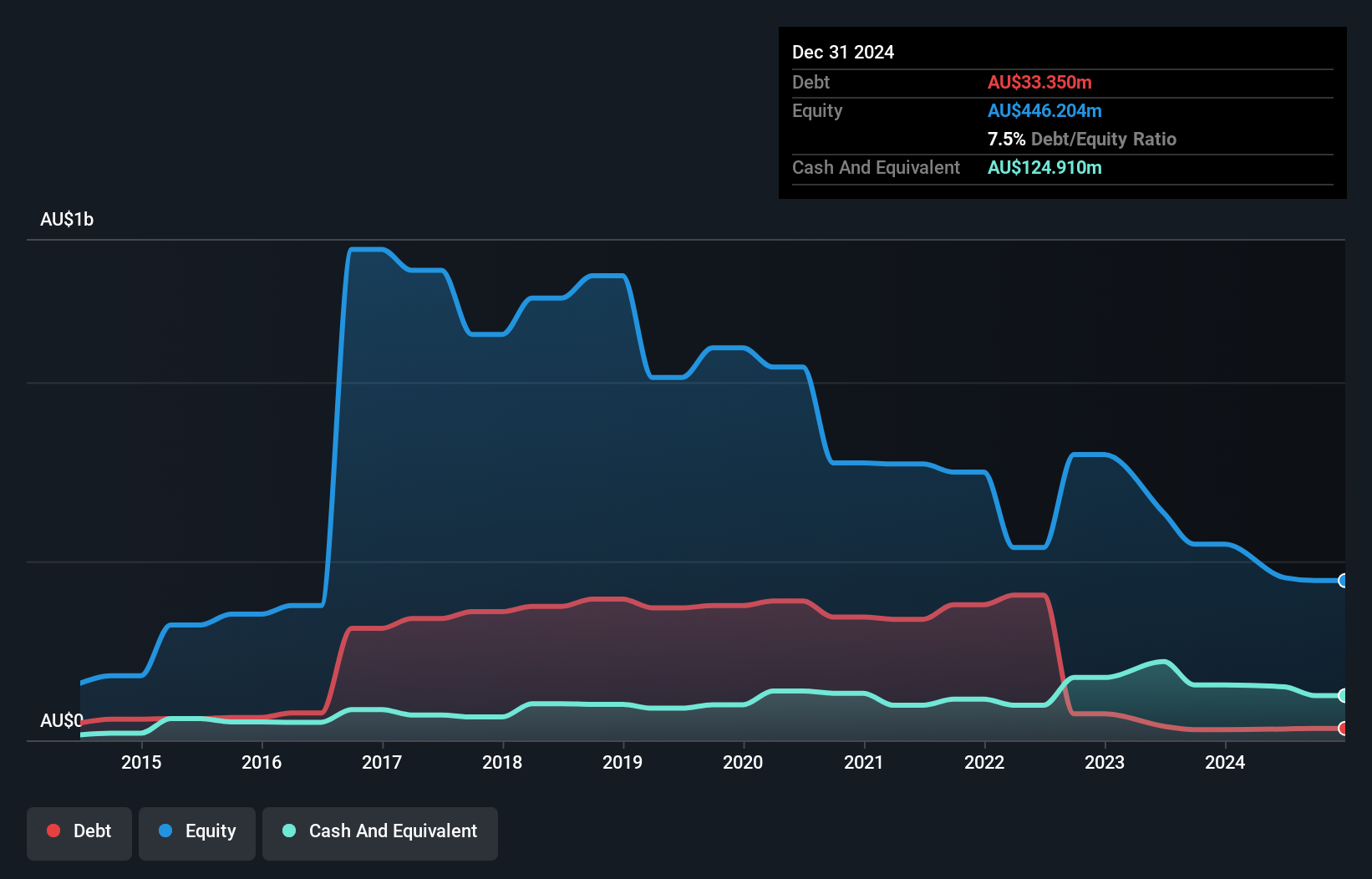

Mayne Pharma Group, with a market cap of A$393.57 million, is currently unprofitable but has shown some financial resilience. The company’s short-term assets of A$460.6 million exceed both its short-term and long-term liabilities, indicating a stable balance sheet despite operational losses increasing at 0.9% annually over the past five years. It has reduced its debt significantly from 36.5% to 7% in five years and holds more cash than total debt, suggesting prudent financial management. However, the board's average tenure of 2.7 years indicates limited experience, potentially impacting strategic decisions as earnings are forecasted to grow substantially by 110% annually.

- Dive into the specifics of Mayne Pharma Group here with our thorough balance sheet health report.

- Understand Mayne Pharma Group's earnings outlook by examining our growth report.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries across Australia, Canada, and Europe with a market cap of A$249.91 million.

Operations: The company's revenue is derived from three main segments: Consumables at A$18.82 million, Precious Metals at A$21.50 million, and Capital Equipment at A$21.75 million.

Market Cap: A$249.91M

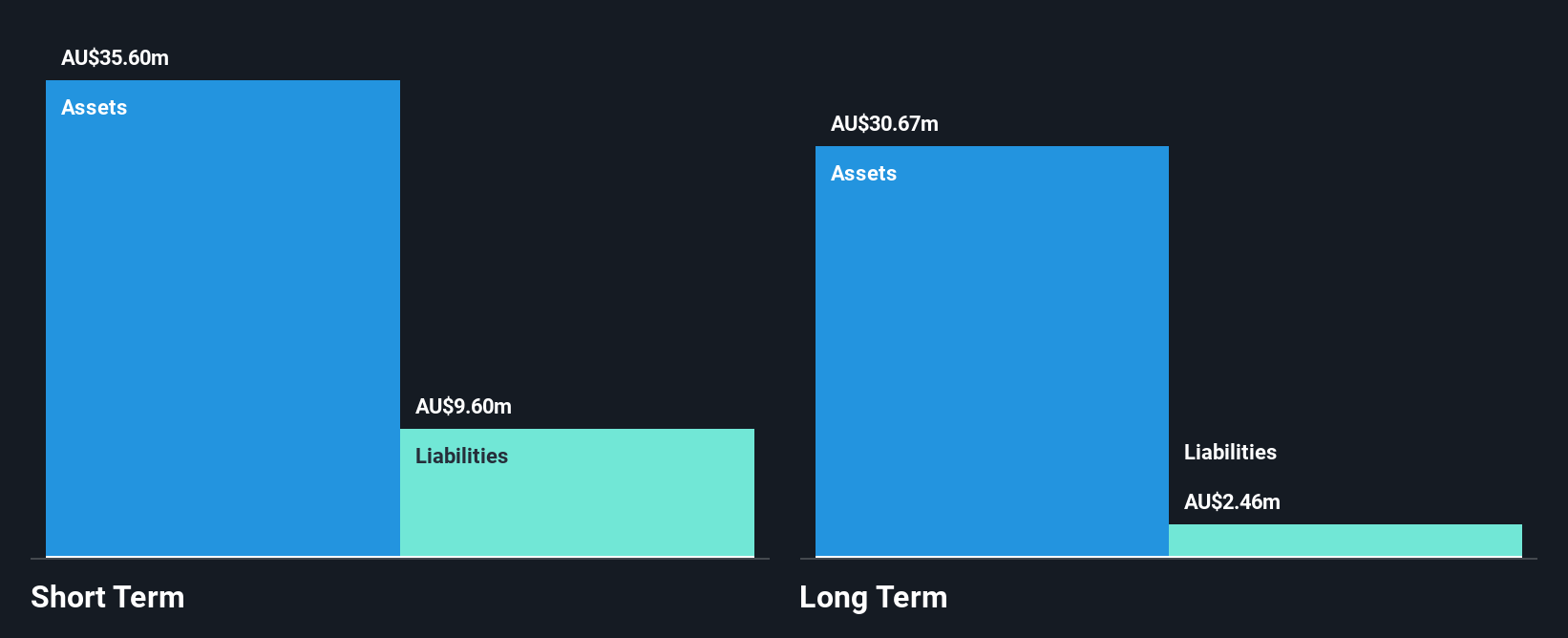

XRF Scientific, with a market cap of A$249.91 million, has demonstrated robust financial health and growth potential. The company’s earnings have grown significantly by 25.8% annually over the past five years, supported by a seasoned management team and board with average tenures of 11.3 and 12.5 years respectively. XRF's debt to equity ratio has improved from 12.5% to 5.3%, with short-term assets (A$39.2M) comfortably covering both short-term (A$10.4M) and long-term liabilities (A$2.2M). Additionally, its interest payments are well covered by EBIT at 47.8 times coverage, indicating strong operational efficiency and financial stability in the penny stock segment.

- Click here and access our complete financial health analysis report to understand the dynamics of XRF Scientific.

- Examine XRF Scientific's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1,046 ASX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AME

Adequate balance sheet slight.

Market Insights

Community Narratives