- Australia

- /

- Construction

- /

- ASX:WOR

Could Worley’s (ASX:WOR) Gastech Engagement Reveal Its True Edge in the Energy Transition?

Reviewed by Simply Wall St

- Worley Limited took part in the Gastech Exhibition & Conference 2025 on September 9, with several senior executives discussing opportunities across LNG, FLNG, and emerging energy markets.

- This high-visibility engagement put a spotlight on Worley’s expertise in energy transition and its capabilities as a project partner for advanced gases and decarbonisation solutions.

- We'll explore how Worley's prominent presence at Gastech 2025 supports its positioning in the global energy transition market.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Worley Investment Narrative Recap

To own Worley, you need to believe in a future where demand for decarbonisation and the global energy transition continues to grow, underpinned by investment in LNG, hydrogen, and advanced low-carbon solutions. While Worley’s high-profile showing at Gastech 2025 highlights these strengths and boosts its market credibility, the event does not materially shift the most immediate catalyst, securing high-value consulting and advisory contracts in sustainability, or offset the key risk of a prolonged downturn in its chemicals and European markets. Recent client wins, such as the selection by Glenfarne for the Alaska LNG Pipeline, mirror the themes discussed at Gastech and reinforce Worley's positioning in large-scale energy projects. These contracts remain closely tied to Worley’s short-term backlog and earnings visibility, supporting growth amid sector shifts. However, unlike the optimism at industry events, investors should also be aware of...

Read the full narrative on Worley (it's free!)

Worley's outlook anticipates A$14.9 billion in revenue and A$598.7 million in earnings by 2028. This is based on a projected 10.0% annual revenue growth rate and an earnings increase of A$189.7 million from the current A$409.0 million level.

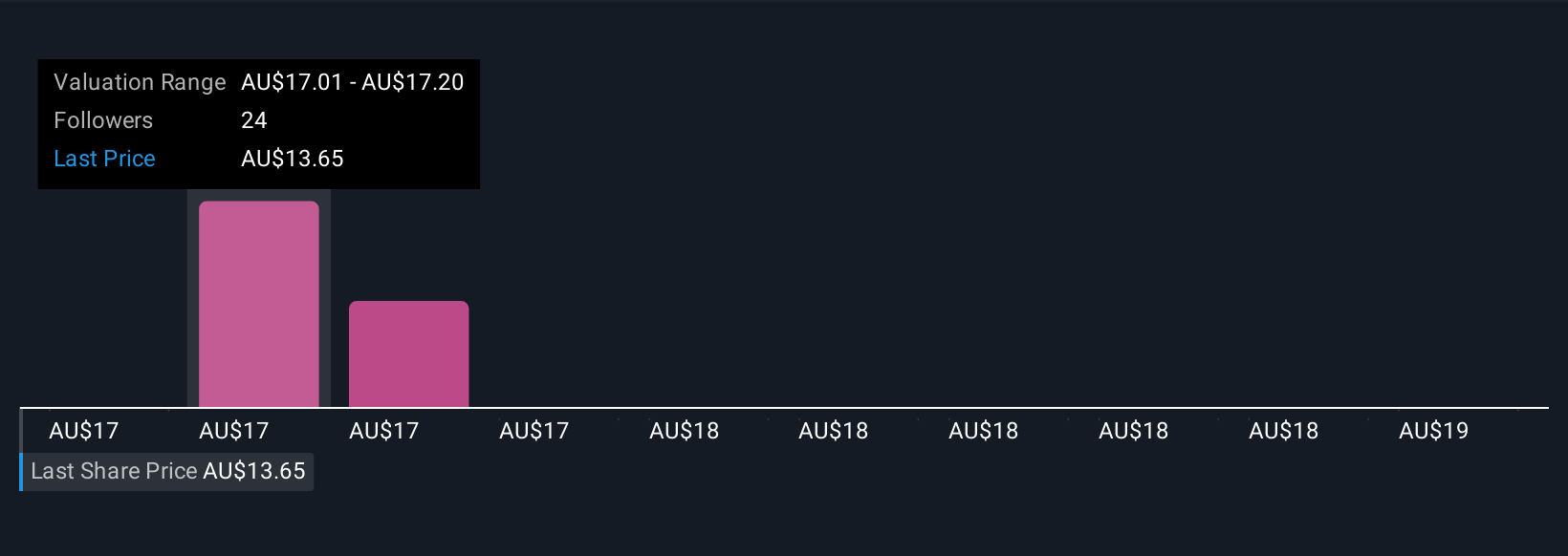

Uncover how Worley's forecasts yield a A$17.01 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three different estimates from the Simply Wall St Community place Worley’s fair value between A$17.01 and A$18.75 per share. Considering much of Worley’s future growth depends on accelerating demand for energy transition services, opinions vary widely, offering you plenty of alternative views to consider.

Explore 3 other fair value estimates on Worley - why the stock might be worth as much as 31% more than the current price!

Build Your Own Worley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Worley research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Worley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Worley's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Worley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WOR

Worley

Provides professional services to the energy, chemicals, and resources sectors in the Americas, Europe, the Middle East, Africa, Australia, the Asia Pacific, and China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives