- Australia

- /

- Construction

- /

- ASX:VNT

A$935 Million Defence Contract Might Change The Case For Investing In Ventia Services Group (ASX:VNT)

Reviewed by Sasha Jovanovic

- Ventia Services Group announced it has secured a new contract valued at approximately A$935 million to provide service and support for the Australian Defence Force’s clothing capability, commencing May 2026 for an initial term of seven years with extension options.

- This agreement appoints Ventia as the sole industry partner, enhancing its role in Defence supply chains and reinforcing its expertise in long-term government contracting.

- We’ll explore how this Defence contract win supports Ventia’s visibility of future revenues and alignment with government infrastructure growth themes.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ventia Services Group Investment Narrative Recap

To be a shareholder in Ventia Services Group, you need to believe in the strength and resilience of its recurring long-term government contracts, which anchor both revenue visibility and future earnings. The recent A$935 million Defence contract bolsters the company’s multi-year pipeline and reinforces its position as a preferred government partner, supporting the primary catalyst of work-in-hand growth. However, the announcement does not materially reduce Ventia’s biggest risk, which remains its heavy reliance on government spending and exposure to retendering cycles.

Recently, the two major Base Services Transformation contract wins with the Department of Defence (A$2.7 billion over six years) highlight Ventia’s deepening relationship with government clients, strengthening the same earnings visibility and contract renewal momentum that this latest Defence clothing deal further boosts. Such wins continue to expand the company’s presence in critical national infrastructure, creating a robust revenue base, but questions remain about how well Ventia can diversify away from concentrated customer risk if policy priorities change.

Yet while contract wins build confidence, investors should also be aware of the flip side: a concentrated exposure to government budgets and the risk that if priorities shift…

Read the full narrative on Ventia Services Group (it's free!)

Ventia Services Group's outlook anticipates A$7.2 billion in revenue and A$308.6 million in earnings by 2028. This scenario relies on a 5.7% annual revenue growth and a roughly A$55 million increase in earnings from A$253.3 million today.

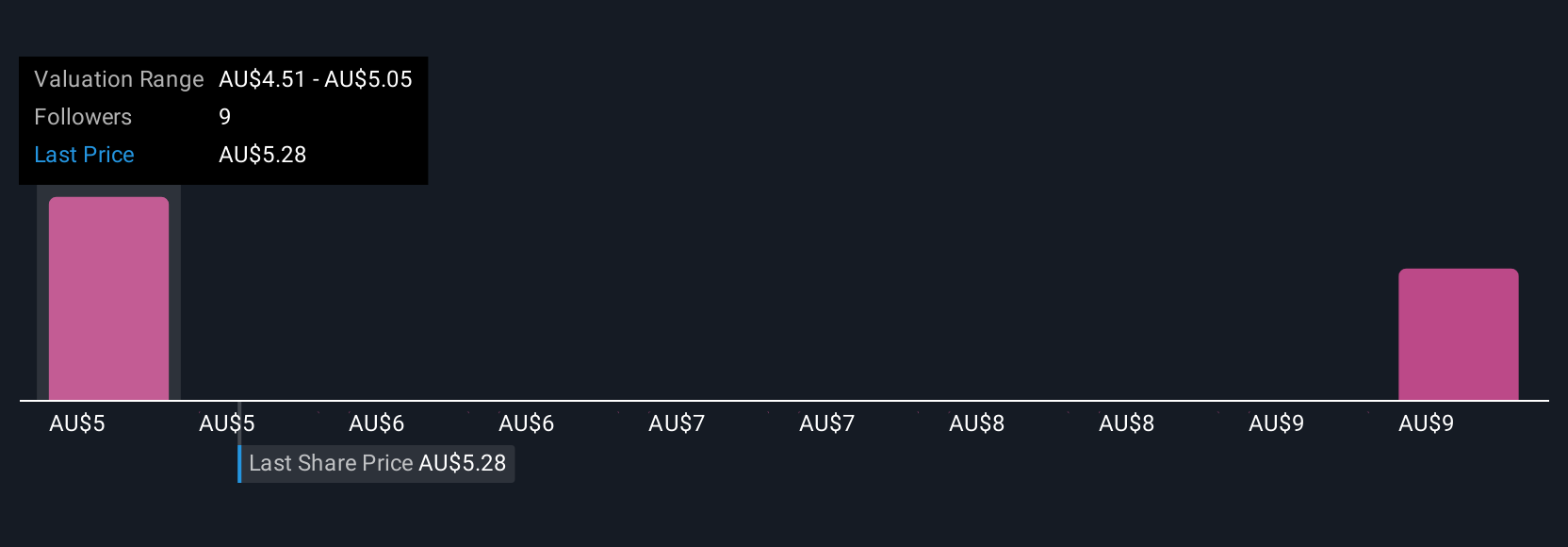

Uncover how Ventia Services Group's forecasts yield a A$5.40 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from A$5.40 to A$8.93, reflecting wide-ranging opinions from two individual contributors. With government contracts already accounting for 77 percent of revenue, these broad outlooks prompt you to consider how shifts in public sector policy can quickly reshape the company’s prospects.

Explore 2 other fair value estimates on Ventia Services Group - why the stock might be worth as much as 63% more than the current price!

Build Your Own Ventia Services Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ventia Services Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ventia Services Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ventia Services Group's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VNT

Ventia Services Group

Provides infrastructure services in Australia and New Zealand.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives