Why VEEM (ASX:VEE) Is Up 7.9% After Securing a US Navy Supply Deal With Northrop Grumman

Reviewed by Sasha Jovanovic

- VEEM Limited recently announced a nine-year manufacturing licence agreement with Northrop Grumman, valued initially at up to US$33 million, to supply precision components for the US Navy's Virginia Class submarine program, and completed a A$14 million capital raise to support its growing defence sector operations.

- This move marks VEEM's entry into critical US defence supply chains and follows new accreditations with top-tier naval contractors, highlighting the company's expanding global footprint in defence manufacturing.

- We'll explore how the Northrop Grumman partnership could reshape VEEM's investment narrative as the company deepens its US defence sector involvement.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is VEEM's Investment Narrative?

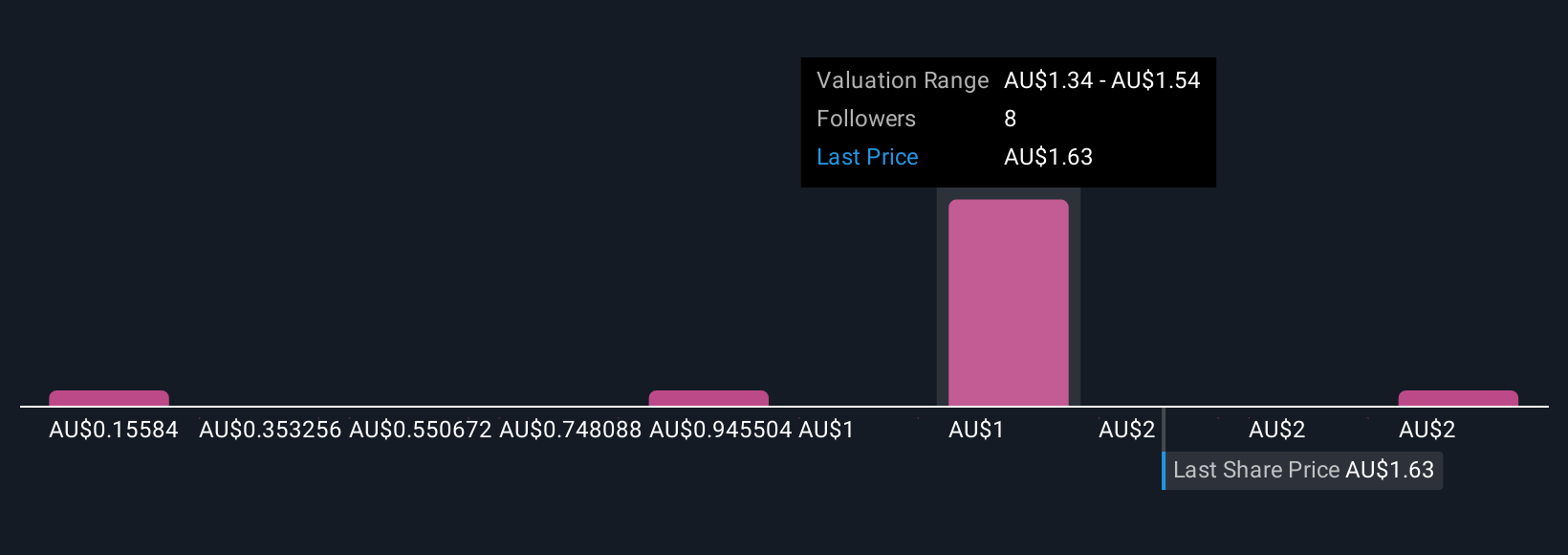

For anyone considering VEEM, the core belief is that the company can convert promising defence contracts into strong, sustainable earnings growth. The Northrop Grumman agreement squarely addresses near-term questions about market access and VEEM’s credibility in complex naval supply chains, a catalyst that could shift perceptions after recent softness in sales and declining earnings. This contract adds visibility to future revenue, offering the kind of multi-year order pipeline previously missing from the VEEM story, and aligns well with past accreditations and recent capital raising. Still, the company's high relative valuation, challenged profit margins, and new management team keep risk in sharp focus, not least if contract execution proves tougher than anticipated. The recent price surge might reflect optimism, but careful attention to delivery timelines and margin recovery remains crucial.

But risks around contract execution and profit margins are now in sharper focus. VEEM's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 5 other fair value estimates on VEEM - why the stock might be worth as much as 31% more than the current price!

Build Your Own VEEM Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VEEM research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free VEEM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VEEM's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VEE

VEEM

Engages in designing, manufacturing, and selling of marine propulsion and stabilization systems in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives