- Australia

- /

- Construction

- /

- ASX:TEA

Tasmea (ASX:TEA) Valuation in Focus After Director Stephen Young Ups Stake

Reviewed by Simply Wall St

Tasmea (ASX:TEA) has caught attention following news that director Stephen Elliott Young has increased his stake by acquiring more ordinary shares via the company’s Dividend Reinvestment Plan. Moves like this by insiders often prompt investors to more closely consider company prospects.

See our latest analysis for Tasmea.

Tasmea’s momentum has been hard to miss lately, with a 1-year total shareholder return of 86.3% and the share price jumping more than 73% since January. The director’s recent buy adds to the positive sentiment, as the stock continues to build on strong gains and outpace many peers.

If insider buying has you curious about what’s powering other fast-movers, now is an ideal moment to broaden your view and discover fast growing stocks with high insider ownership

Yet with shares up sharply and insiders showing confidence, the key question is whether Tasmea remains undervalued after its run or if the market has already priced in future growth and optimism. Could there still be a buying opportunity?

Price-to-Earnings of 25.1x: Is it justified?

With Tasmea currently trading at a price-to-earnings (P/E) ratio of 25.1x, the stock appears expensive relative to the global construction industry, which averages 15.2x. Despite strong recent momentum, this premium may signal that much optimism is now priced in.

The price-to-earnings ratio reflects how much investors are willing to pay for each dollar of the company's earnings. It is frequently used in the construction sector because it highlights perceived profit potential relative to other companies in the industry.

Tasmea's multiple sits not only above the industry average but also above its estimated fair P/E of 21.2x. This suggests the market is assigning a lofty growth premium to the company, potentially anticipating continued strong performance or unique positioning, even as its forward earnings growth is forecast to lag the broader Australian market.

The contrast between Tasmea's valuation and both industry and fair P/E levels is striking. If sentiment shifts or results fall short, this premium could narrow in future trading.

Explore the SWS fair ratio for Tasmea

Result: Price-to-Earnings of 25.1x (OVERVALUED)

However, further share price gains may be limited if Tasmea’s recent revenue and profit growth begin to slow, or if sentiment toward the sector changes.

Find out about the key risks to this Tasmea narrative.

Another View: Discounted Cash Flow Perspective

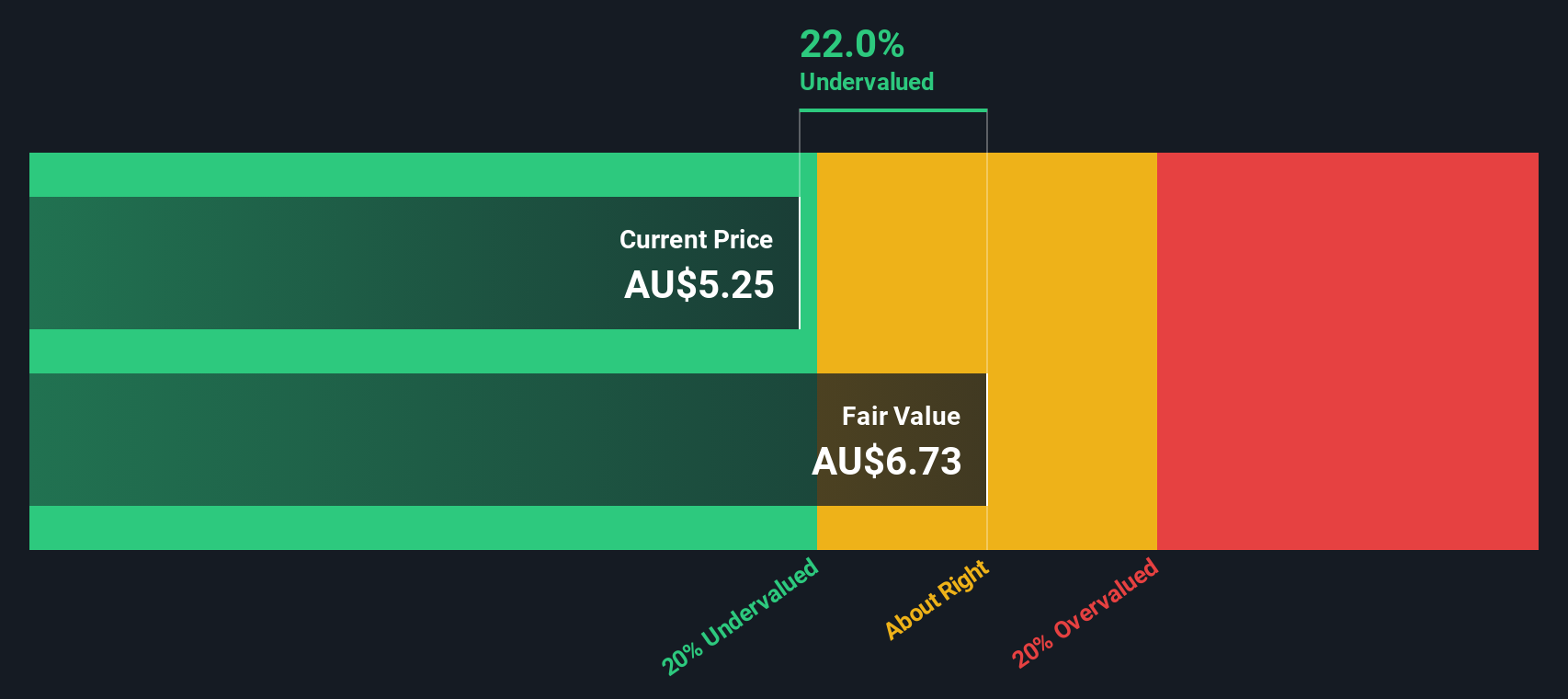

While Tasmea appears pricey when looking at its price-to-earnings ratio, our DCF model suggests a different conclusion. Based on projected future cash flows, the SWS DCF model finds Tasmea trading about 22% below its estimated fair value. Could the market be underestimating its longer-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tasmea for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tasmea Narrative

If you have your own perspective or prefer hands-on research, you can craft your own narrative quickly and see how your view stacks up. Do it your way

A great starting point for your Tasmea research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an edge by seeking out fresh opportunities. Don’t miss your chance to tap into unique markets and potential winners now.

- Tap into powerful income streams by uncovering these 16 dividend stocks with yields > 3%, featuring reliable companies offering yields above 3 percent and consistent payout records.

- Fuel your portfolio’s growth with these 25 AI penny stocks, which harness artificial intelligence to transform entire industries and redefine what’s possible in the tech space.

- Gain the upper hand by searching for hidden value with these 879 undervalued stocks based on cash flows, where the market may have overlooked future upside and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tasmea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TEA

Tasmea

Provides shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives