Amidst global market fluctuations, Asian small-cap stocks have been navigating a challenging landscape influenced by AI-related valuation concerns and economic policy shifts. Despite these headwinds, certain small-cap companies in Asia are garnering attention due to insider buying activities, suggesting potential confidence in their underlying value and growth prospects.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.4x | 1.0x | 22.38% | ★★★★★★ |

| East West Banking | 3.0x | 0.7x | 19.56% | ★★★★☆☆ |

| Centurion | 3.8x | 3.2x | -57.73% | ★★★★☆☆ |

| Eureka Group Holdings | 10.5x | 4.6x | 26.97% | ★★★★☆☆ |

| PSC | 9.7x | 0.4x | 21.04% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.58% | ★★★★☆☆ |

| Nickel Asia | 12.5x | 1.9x | 13.96% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -432.14% | ★★★☆☆☆ |

| Chinasoft International | 22.0x | 0.7x | -1208.63% | ★★★☆☆☆ |

| Vital Healthcare Property Trust | NA | 7.6x | 14.14% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

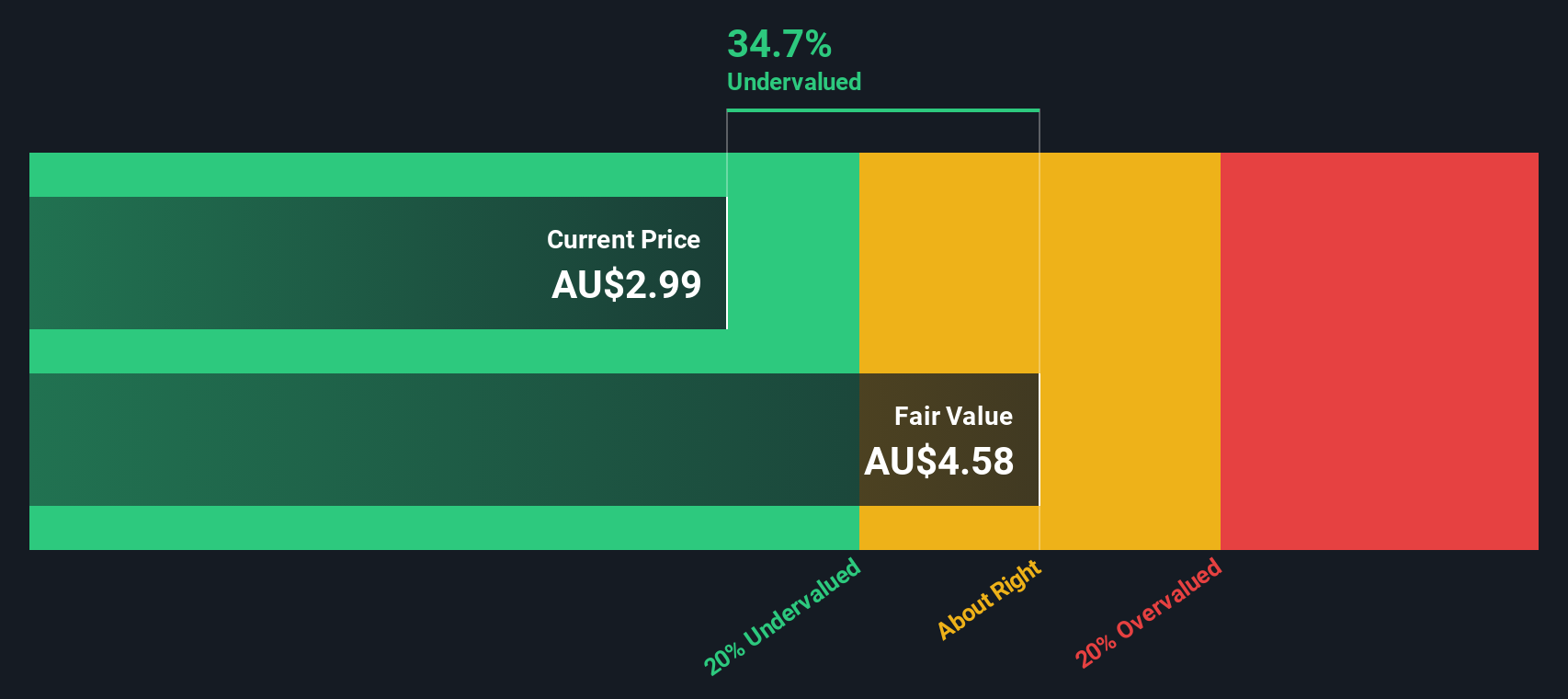

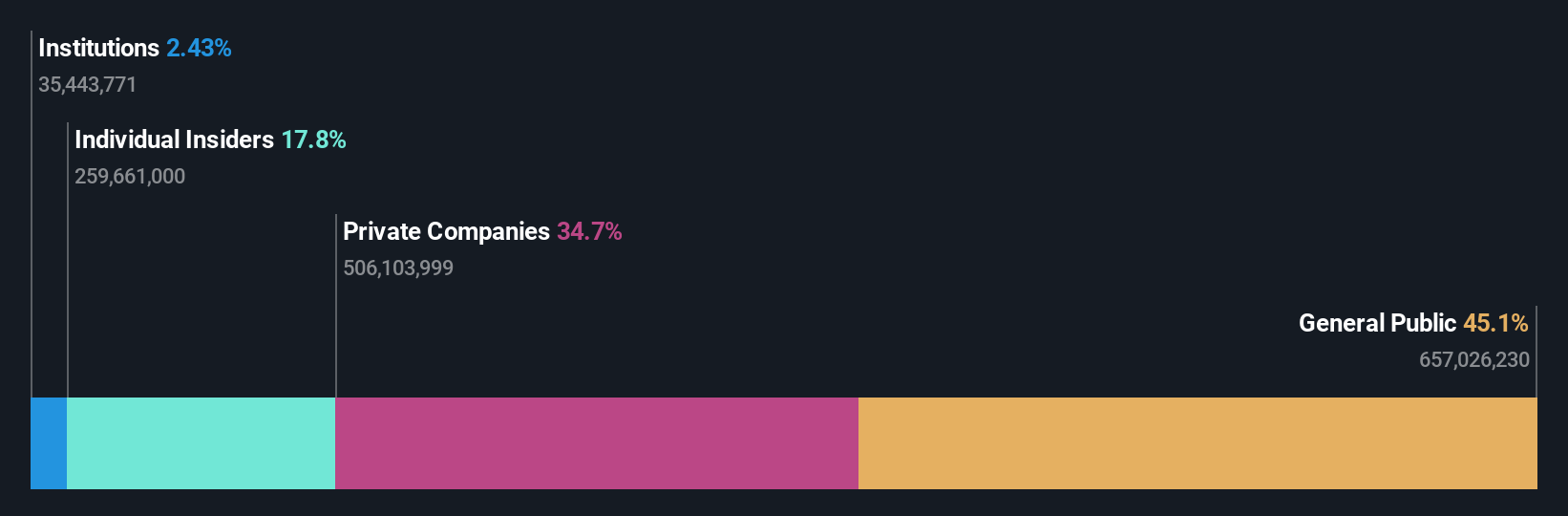

FleetPartners Group (ASX:FPR)

Simply Wall St Value Rating: ★★★★★★

Overview: FleetPartners Group is a company that specializes in fleet management and leasing solutions, with a market capitalization of A$1.2 billion.

Operations: FleetPartners Group generates revenue primarily through its operations, with the cost of goods sold (COGS) being a significant expense. The company's gross profit margin has shown variation, reaching a peak at 42.28% in September 2017 and declining to 28.44% by September 2025. Operating expenses are another major cost component, with general and administrative expenses consistently forming a substantial part of these costs over the periods reviewed.

PE: 8.0x

FleetPartners Group, a small-cap company in Asia, recently reported sales of A$786.23 million for the year ending September 2025, showing an increase from the previous year's A$761.63 million. However, net income slightly dipped to A$75.34 million from A$77.88 million. Despite a forecasted earnings decline of 4.4% annually over the next three years, insider confidence is evident with Mitsubishi Motors increasing its stake to 19.93% as of September 2025 at A$3.10 per share, highlighting potential future interest and value recognition in this stock's market position amidst its higher-risk funding structure and dividend affirmations for shareholders.

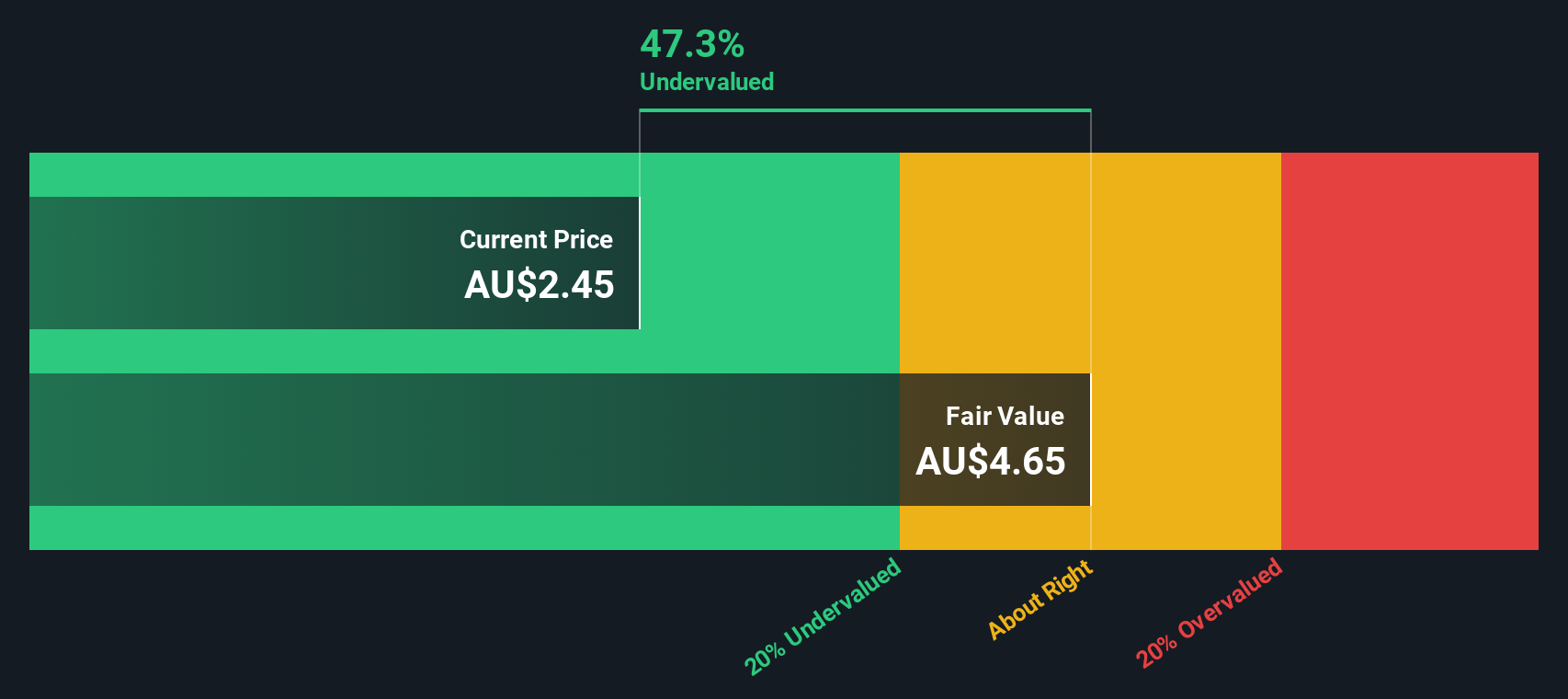

Symal Group (ASX:SYL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Symal Group operates primarily in the contracting services and plant & equipment sectors, with a market capitalization of A$1.23 billion.

Operations: Symal Group generates revenue primarily from Contracting Services and Plant & Equipment, with Contracting Services contributing the majority. The company's gross profit margin has shown an upward trend, reaching 21.55% in recent periods. Operating expenses have increased alongside revenue growth, with General & Administrative expenses being a significant component.

PE: 16.7x

Symal Group, a small company in Asia, has shown insider confidence with Joseph Bartolo purchasing 50,000 shares for A$100,135 recently. Despite facing higher risk due to reliance on external borrowing for funding, the company's earnings are expected to grow by 18% annually. Recent executive changes saw CFO Geoff Trumbull resigning while David Gill steps in as interim CFO. For the year ending June 2025, Symal reported sales of A$879.6 million and net income of A$34.64 million amidst stable dividend payouts.

- Dive into the specifics of Symal Group here with our thorough valuation report.

Evaluate Symal Group's historical performance by accessing our past performance report.

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China XLX Fertiliser is engaged in the production and sale of chemical fertilizers and related products, with a focus on urea, methanol, compound fertilizers, and other segments within the industry.

Operations: The company's primary revenue streams include Urea, Methanol, and Compound Fertiliser. Over recent periods, the gross profit margin has shown variability, with a notable figure of 18.83% as of June 2024. Operating expenses have been consistently significant, impacting net income margins which stood at 5.78% in June 2025.

PE: 7.1x

China XLX Fertiliser, a smaller company in the Asian market, shows potential for growth despite its challenges. Insider confidence is evident as Qingjin Zhang increased their stake by purchasing 450,000 shares for approximately US$1.99 million between late 2024 and early 2025. This move suggests belief in the company's future prospects amidst ongoing share repurchases intended to enhance earnings per share. However, reliance on external borrowing presents financial risks. Recent leadership changes may also impact corporate governance positively with experienced professionals stepping into key roles.

Turning Ideas Into Actions

- Delve into our full catalog of 47 Undervalued Asian Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1866

China XLX Fertiliser

An investment holding company, engages in the development, manufacture, and sale of urea primarily in Mainland China and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives