We'd be surprised if Service Stream Limited (ASX:SSM) shareholders haven't noticed that the Non-Executive Chairman of the Board, Brett Gallagher, recently sold AU$571k worth of stock at AU$2.28 per share. That sale was 11% of their holding, so it does make us raise an eyebrow.

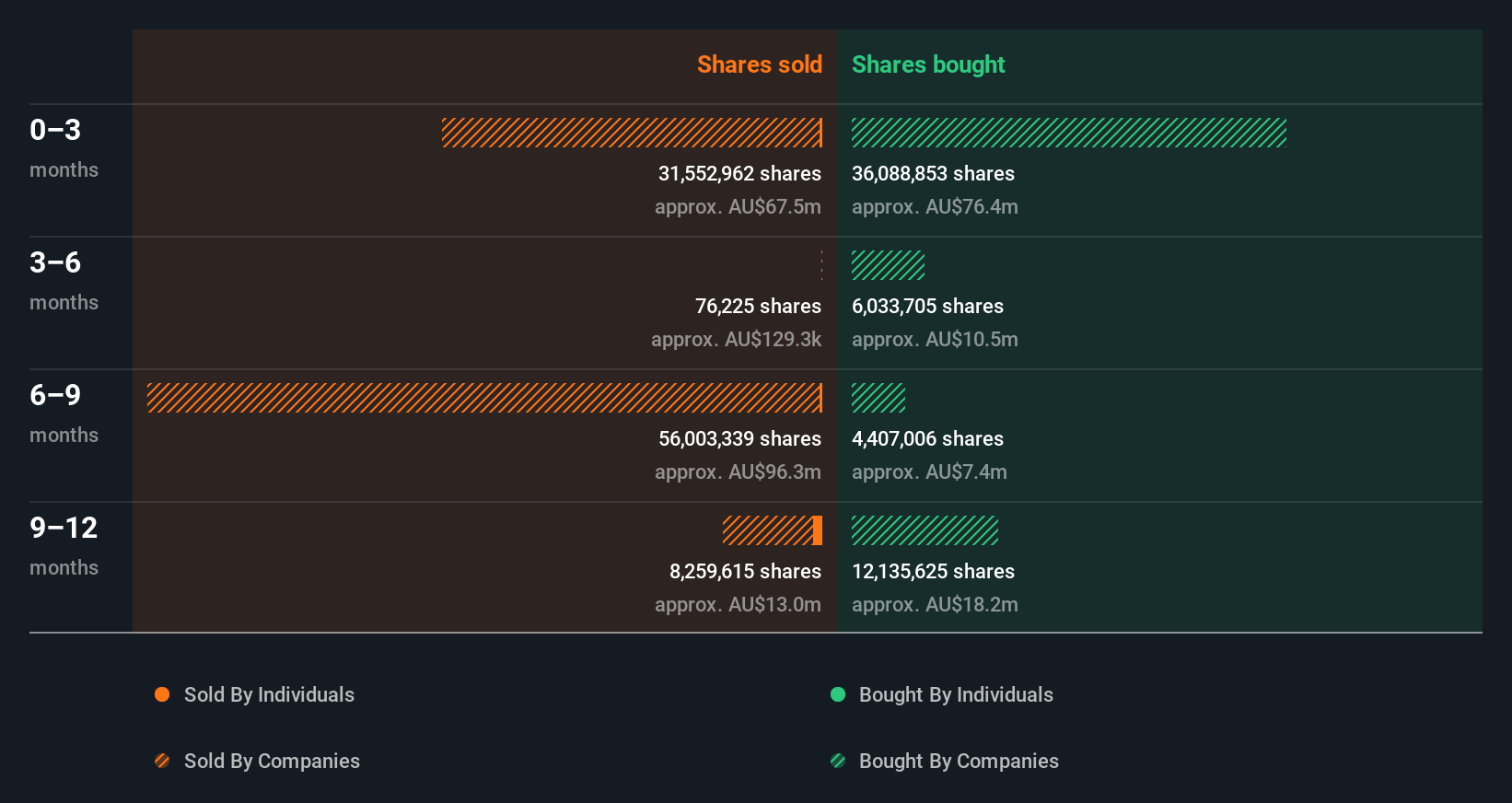

Service Stream Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the CEO, MD & Director, Leigh MacKender, sold AU$1.2m worth of shares at a price of AU$1.53 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of AU$2.20. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 31% of Leigh MacKender's stake.

Insiders in Service Stream didn't buy any shares in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Check out our latest analysis for Service Stream

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Service Stream insiders own about AU$54m worth of shares. That equates to 4.0% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Service Stream Insider Transactions Indicate?

An insider sold Service Stream shares recently, but they didn't buy any. And there weren't any purchases to give us comfort, over the last year. But since Service Stream is profitable and growing, we're not too worried by this. While insiders do own shares, they don't own a heap, and they have been selling. We're in no rush to buy! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Service Stream. While conducting our analysis, we found that Service Stream has 2 warning signs and it would be unwise to ignore these.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SSM

Service Stream

Engages in the design, construction, operation, and maintenance of infrastructure networks across the telecommunications, utilities, and transport sectors in Australia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives