- Australia

- /

- Construction

- /

- ASX:SSM

A Look at Service Stream's (ASX:SSM) Valuation After Securing $1.6 Billion Defence Contract

Reviewed by Simply Wall St

If you’ve been tracking Service Stream (ASX:SSM), the $1.6 billion base services contract it just landed with the Australian Department of Defence is big news. This agreement covers 113 sites and training facilities over an initial six-year term and positions Service Stream to broaden its reach well beyond its traditional markets. For investors, this win clearly signals a major shift as the company moves further into the defence sector and secures stable, government-backed revenue streams for years to come.

The share price jumped 15% on the announcement, and momentum has been building all year. Service Stream has returned 68% in the past year and over 50% this year to date. The contract was announced alongside plans to hire hundreds of new employees, and it adds another layer to the company’s ongoing strategy to diversify revenue and reduce risk concentration. While the market was broadly lower, Service Stream’s performance has stood out, raising questions about how much upside remains.

So is this Defence contract the spark for a fresh leg of growth, or has the market already priced in Service Stream’s new direction? Let’s dig into the numbers to find out.

Most Popular Narrative: 2% Overvalued

According to the most widely followed narrative, Service Stream is currently valued about 2% above its estimated fair value. The consensus is built on expectations around long-term growth, profitability, and visible order flow secured by government contracts.

Record-high contract wins and a $7.6 billion (potentially $12.6 billion including extensions) work-in-hand position significantly enhance forward revenue visibility. This is supported by long-term, lower-risk operations and maintenance agreements in critical infrastructure, positioning Service Stream to benefit from rising government and private investment in infrastructure renewal, climate resilience, and population-driven upgrades. These factors may provide future potential for revenue and earnings growth.

Curious how Service Stream is being valued at a premium usually reserved for market leaders? The current narrative hinges on bold assumptions about profit expansion, recurring revenue, and margin breakthroughs. Wondering which financial forecasts really drive that target price? Follow the numbers behind the headline to uncover the catalyst for Service Stream's high expectations.

Result: Fair Value of $2.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing telecom revenues or tighter government budgets could challenge margin growth. This puts the bullish outlook for Service Stream’s next phase under real scrutiny.

Find out about the key risks to this Service Stream narrative.Another View: Discounted Cash Flow Perspective

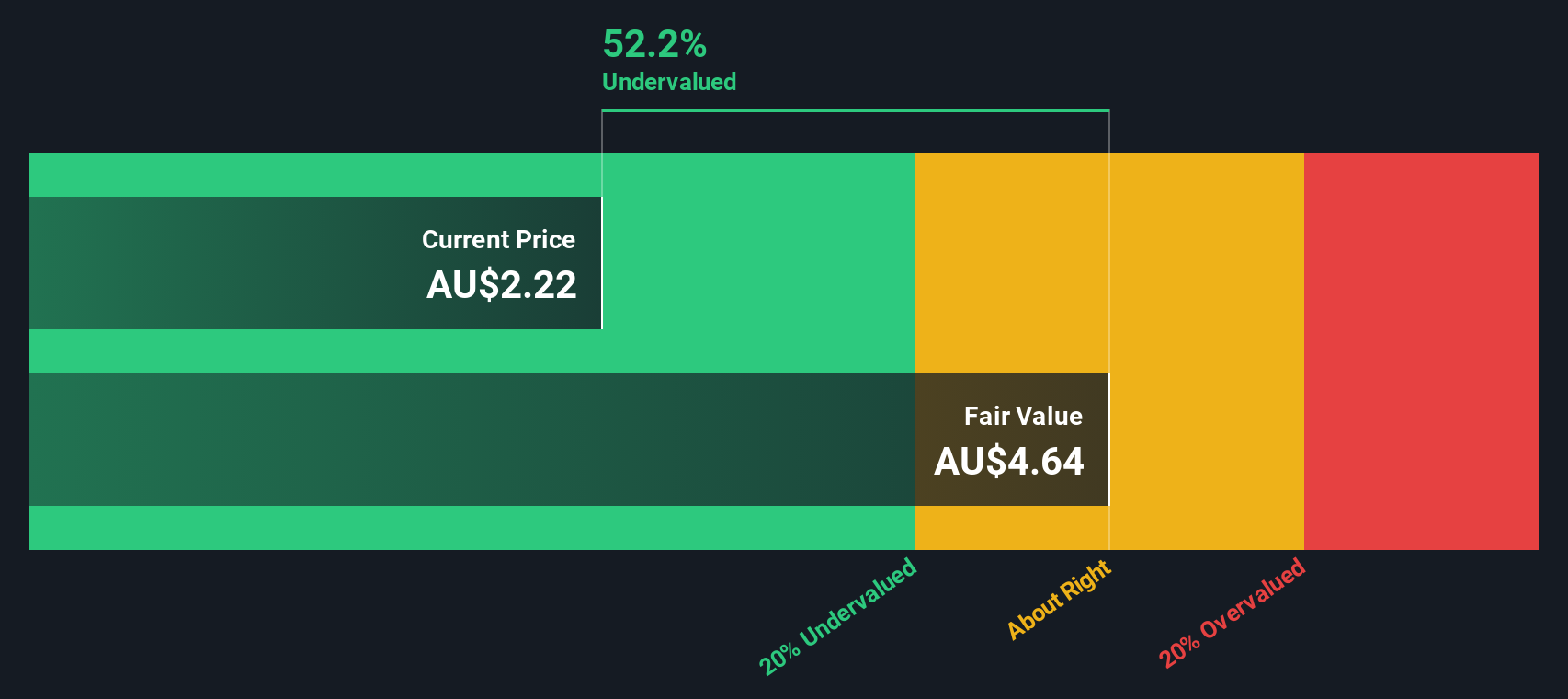

Taking a closer look with the SWS DCF model, Service Stream actually appears undervalued and provides a very different outcome compared to conventional multiples-based valuations. Could the market be missing a hidden opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Service Stream for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Service Stream Narrative

Not convinced by the prevailing forecasts, or want to try your own approach to Service Stream’s outlook? You can easily build your own perspective in just a few minutes and Do it your way.

A great starting point for your Service Stream research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity slip by while you focus on just one stock. Quickly scan the market for stocks that match your style using these powerful tools:

- Capture growth by targeting companies at the frontier of artificial intelligence with AI penny stocks. Automation and machine learning are changing entire industries.

- Boost potential income by searching for market leaders that pay generous yields through dividend stocks with yields > 3%. This tool is built for investors who want strong dividends alongside stability.

- Seize undervalued gems before the crowd with undervalued stocks based on cash flows. It helps you spot stocks currently trading below their true worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SSM

Service Stream

Engages in the design, construction, operation, and maintenance of infrastructure networks across the telecommunications, utilities, and transport sectors in Australia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion