- Australia

- /

- Electrical

- /

- ASX:SKS

3 ASX Penny Stocks With Market Caps Under A$500M To Consider

Reviewed by Simply Wall St

As Australian shares appear poised for a flat open, the market remains largely unaffected by global fluctuations, including recent tech sector turbulence in the U.S. Despite this calm on the broader indices, there's still room to explore opportunities within niche segments like penny stocks. Though often considered a relic of past market days, penny stocks can offer unique growth potential when backed by strong financial health and sound business strategies. In this article, we'll examine three such ASX-listed companies that may present promising prospects for investors interested in smaller-cap investments.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.26M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.80 | A$430.33M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.12 | A$230.45M | ✅ 4 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$2.89 | A$3.3B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.76 | A$363.6M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.20 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.90 | A$129.54M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.44 | A$639.96M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 432 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bellavista Resources (ASX:BVR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bellavista Resources Limited, with a market cap of A$58.03 million, is a mineral exploration company operating in Western Australia through its subsidiaries.

Operations: The company generates revenue from its Metals & Mining segment, specifically in Gold & Other Precious Metals, amounting to A$0.13 million.

Market Cap: A$58.03M

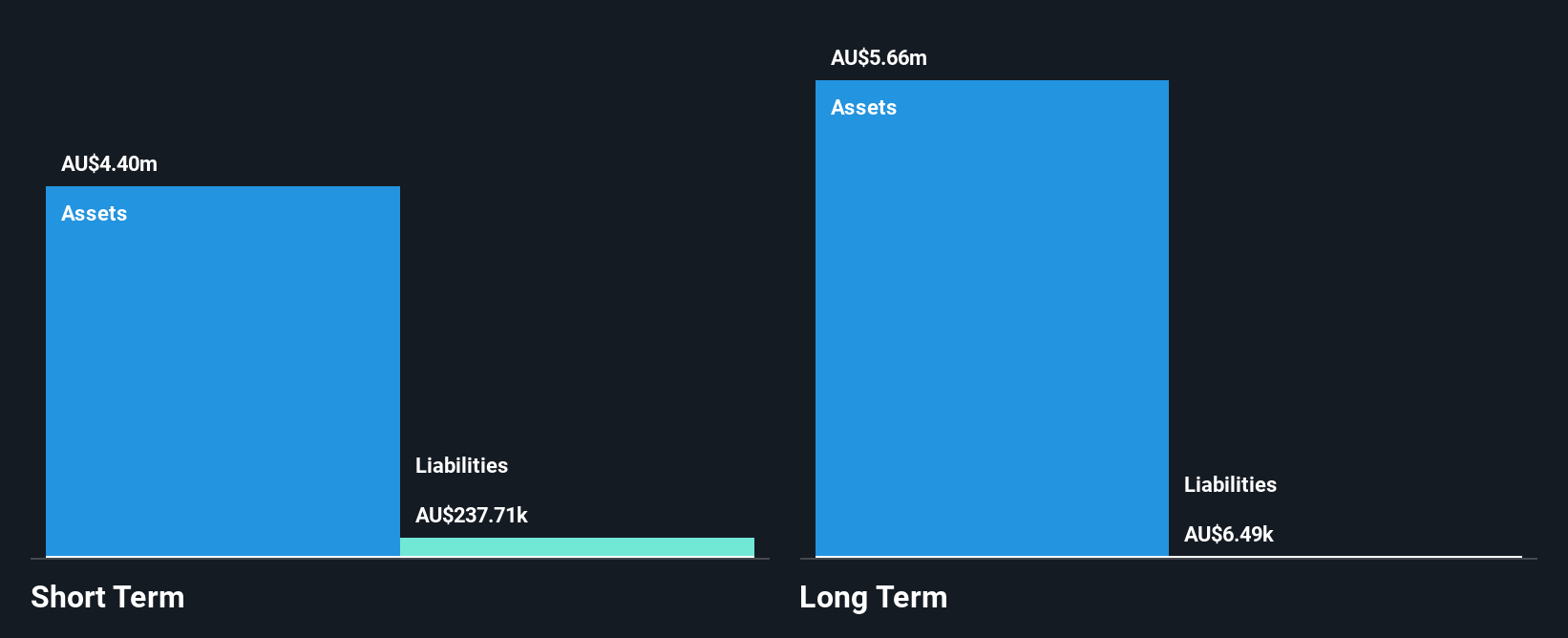

Bellavista Resources Limited, a pre-revenue mineral exploration company in Australia, has recently undergone significant leadership changes with the appointment of Glenn Jardine as Managing Director and Peter Canterbury as Finance Director. Despite its unprofitability and negative return on equity, the company maintains a strong financial position with short-term assets exceeding both short and long-term liabilities. However, Bellavista's share price remains highly volatile compared to most Australian stocks. The company's revenue doubled over the past year but remains under A$1 million. With no debt on its books, Bellavista has a cash runway of less than one year if expenditures continue to grow.

- Jump into the full analysis health report here for a deeper understanding of Bellavista Resources.

- Explore historical data to track Bellavista Resources' performance over time in our past results report.

Centrepoint Alliance (ASX:CAF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centrepoint Alliance Limited, with a market cap of A$79.88 million, operates in Australia offering financial advice and licensee support services through its subsidiaries.

Operations: Centrepoint Alliance generates revenue from Consulting Services (A$1.23 million), Licensee and Advice Services (A$323.18 million), and Funds Management and Administration (A$1.91 million).

Market Cap: A$79.88M

Centrepoint Alliance Limited, with a market cap of A$79.88 million, shows mixed financial health typical of penny stocks. Its short-term assets (A$22.0 million) cover both short and long-term liabilities, providing some balance sheet stability. The company has more cash than its total debt and its operating cash flow covers debt well at 304%. However, profit margins have declined from 2.7% to 1.6%, and earnings growth was negative over the past year despite a profitable trajectory over five years. The dividend yield is high at 7.79% but not well covered by earnings, indicating potential sustainability issues.

- Dive into the specifics of Centrepoint Alliance here with our thorough balance sheet health report.

- Gain insights into Centrepoint Alliance's historical outcomes by reviewing our past performance report.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$471.45 million.

Operations: The company generates revenue of A$261.66 million from its operations in the lighting and audio-visual markets.

Market Cap: A$471.45M

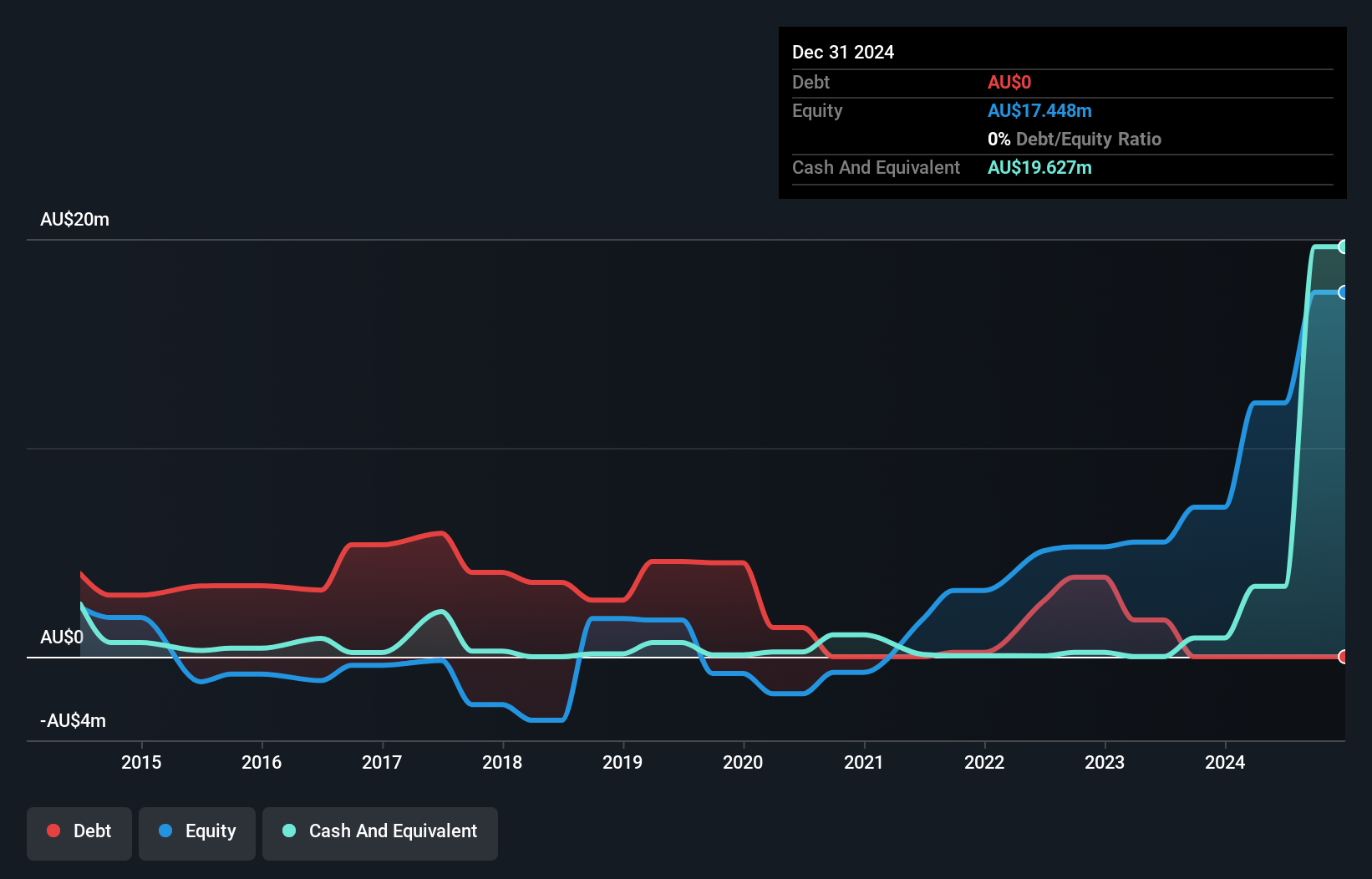

SKS Technologies Group, with a market cap of A$471.45 million, operates debt-free and has not diluted shareholders over the past year. Its earnings growth of 111.8% in the last year surpasses both its five-year average and industry growth rates, indicating strong performance momentum. The company benefits from seasoned management and board members, enhancing strategic stability. SKS's short-term assets comfortably cover liabilities, while its return on equity is outstanding at 57.2%. Despite stable weekly volatility at 8%, SKS trades slightly below estimated fair value, suggesting potential for capital appreciation without immediate financial distress concerns.

- Unlock comprehensive insights into our analysis of SKS Technologies Group stock in this financial health report.

- Assess SKS Technologies Group's future earnings estimates with our detailed growth reports.

Key Takeaways

- Click through to start exploring the rest of the 429 ASX Penny Stocks now.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SKS

SKS Technologies Group

Engages in the design, supply, and installation of audio visual, electrical, and communication products and services in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)