Lacklustre Performance Is Driving Reliance Worldwide Corporation Limited's (ASX:RWC) Low P/E

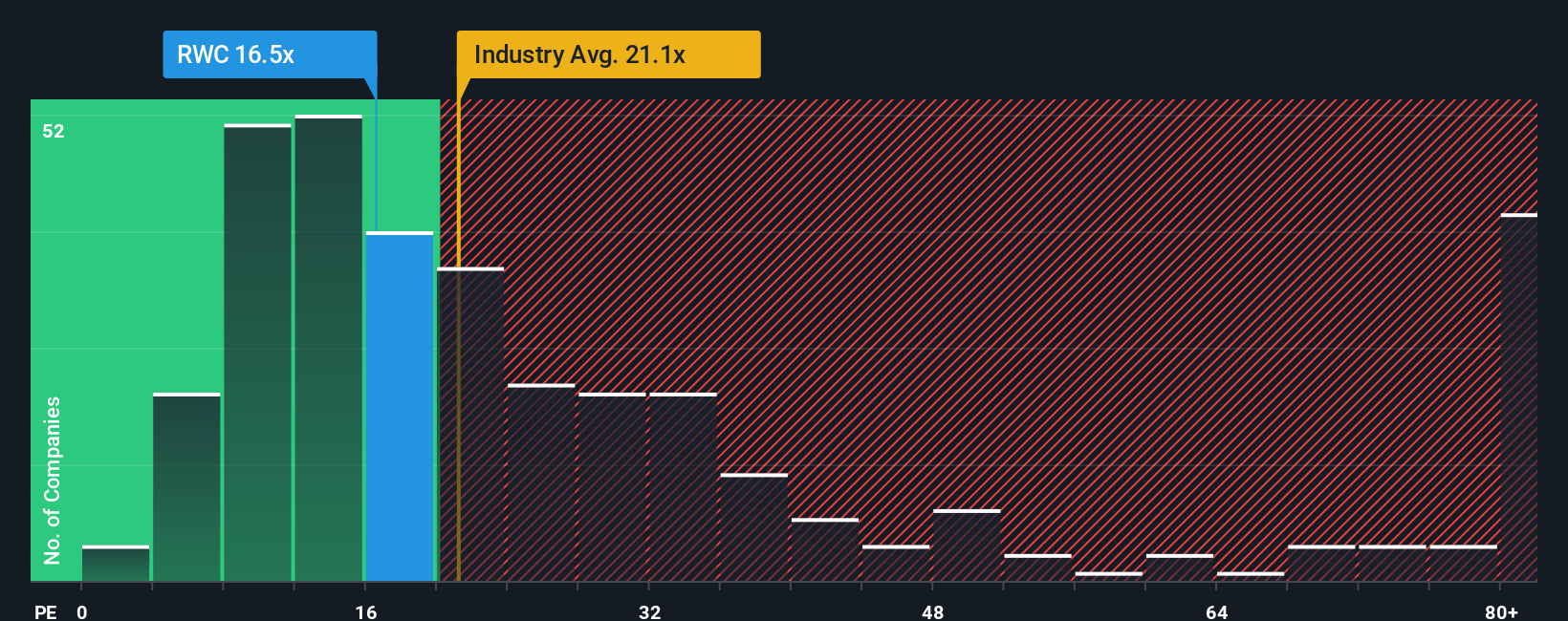

Reliance Worldwide Corporation Limited's (ASX:RWC) price-to-earnings (or "P/E") ratio of 16.5x might make it look like a buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 22x and even P/E's above 40x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Reliance Worldwide has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Reliance Worldwide

Is There Any Growth For Reliance Worldwide?

The only time you'd be truly comfortable seeing a P/E as low as Reliance Worldwide's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Still, lamentably EPS has fallen 6.8% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 15% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is noticeably more attractive.

With this information, we can see why Reliance Worldwide is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Reliance Worldwide maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Reliance Worldwide with six simple checks.

If these risks are making you reconsider your opinion on Reliance Worldwide, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RWC

Reliance Worldwide

Engages in the design, manufacture, and supply of water flow, control, and monitoring products and solutions for the plumbing and heating industries.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives