- Australia

- /

- Electrical

- /

- ASX:RFT

Not Many Are Piling Into Rectifier Technologies Limited (ASX:RFT) Stock Yet As It Plummets 27%

Rectifier Technologies Limited (ASX:RFT) shares have had a horrible month, losing 27% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 86% share price decline.

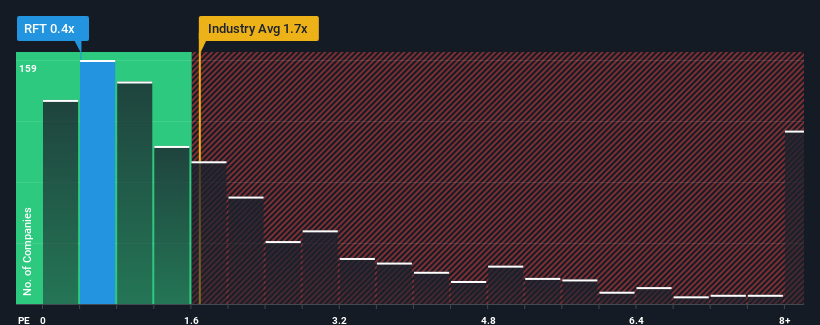

Although its price has dipped substantially, Rectifier Technologies' price-to-sales (or "P/S") ratio of 0.4x might still make it look like a buy right now compared to the Electrical industry in Australia, where around half of the companies have P/S ratios above 0.9x and even P/S above 14x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Rectifier Technologies

What Does Rectifier Technologies' Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Rectifier Technologies' revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Rectifier Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Rectifier Technologies?

In order to justify its P/S ratio, Rectifier Technologies would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 132% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

When compared to the industry's one-year growth forecast of 17%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Rectifier Technologies' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Rectifier Technologies' P/S?

Rectifier Technologies' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Rectifier Technologies revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Rectifier Technologies (3 are a bit unpleasant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Rectifier Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RFT

Rectifier Technologies

Designs and manufactures power rectifiers in Australia, Asia, North America, South America, Europe, and Oceania.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives