- Australia

- /

- Trade Distributors

- /

- ASX:RDX

Has Redox Limited's (ASX:RDX) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Redox's (ASX:RDX) stock is up by a considerable 23% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Redox's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Redox

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Redox is:

17% = AU$90m ÷ AU$531m (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. That means that for every A$1 worth of shareholders' equity, the company generated A$0.17 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Redox's Earnings Growth And 17% ROE

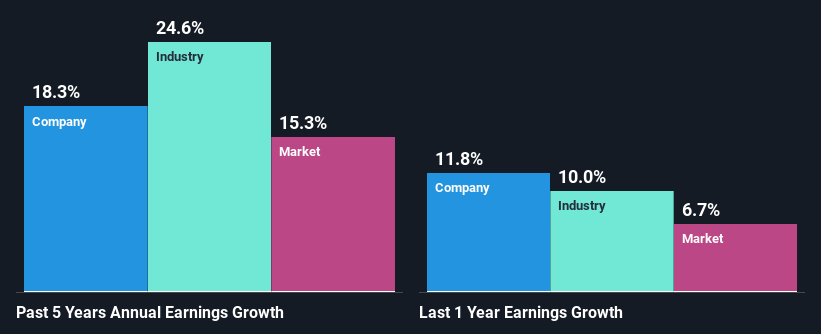

To begin with, Redox seems to have a respectable ROE. Especially when compared to the industry average of 7.1% the company's ROE looks pretty impressive. Probably as a result of this, Redox was able to see a decent growth of 18% over the last five years.

We then compared Redox's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 25% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is RDX fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Redox Using Its Retained Earnings Effectively?

Redox has a very high three-year median payout ratio of 14,672% suggesting that the company's shareholders are getting paid from more than just the company's earnings. In spite of this, the company was able to grow its earnings respectably, as we saw above. Although, the high payout ratio is certainly something we would keep an eye on if the company is not able to keep up its growth, or if business deteriorates.

While Redox has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 73% over the next three years. Regardless, the ROE is not expected to change much for the company despite the lower expected payout ratio.

Conclusion

On the whole, we do feel that Redox has some positive attributes. Its earnings have grown respectably as we saw earlier, probably due to its high returns. However, it does reinvest little to almost none of its profits, so we wonder what effect this could have on its future growth prospects. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RDX

Redox

Supplies and distributes chemicals, ingredients, and raw materials in Australia, New Zealand, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success