Stock Analysis

- Australia

- /

- Specialty Stores

- /

- ASX:SUL

3 Top ASX Dividend Stocks Offering Up To 5.7% Yield

Reviewed by Simply Wall St

Amidst a fluctuating Australian market, where the ASX200 recently dipped and sectors like IT and Energy faced notable declines, investors may find solace in dividend stocks that promise steady returns. Given the current economic headwinds influenced by external factors such as China's economic data, focusing on robust dividend-yielding stocks could be a prudent strategy for those looking to mitigate risk and secure consistent income.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 7.06% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 5.20% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.86% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.74% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.63% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.31% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.64% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.78% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.10% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.57% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

NRW Holdings (ASX:NWH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited offers a range of contract services to the resources and infrastructure sectors in Australia, with a market capitalization of approximately A$1.33 billion.

Operations: NRW Holdings Limited generates its revenue primarily from three segments: Mining (A$1.49 billion), MET (A$739.07 million), and Civil (A$593.62 million).

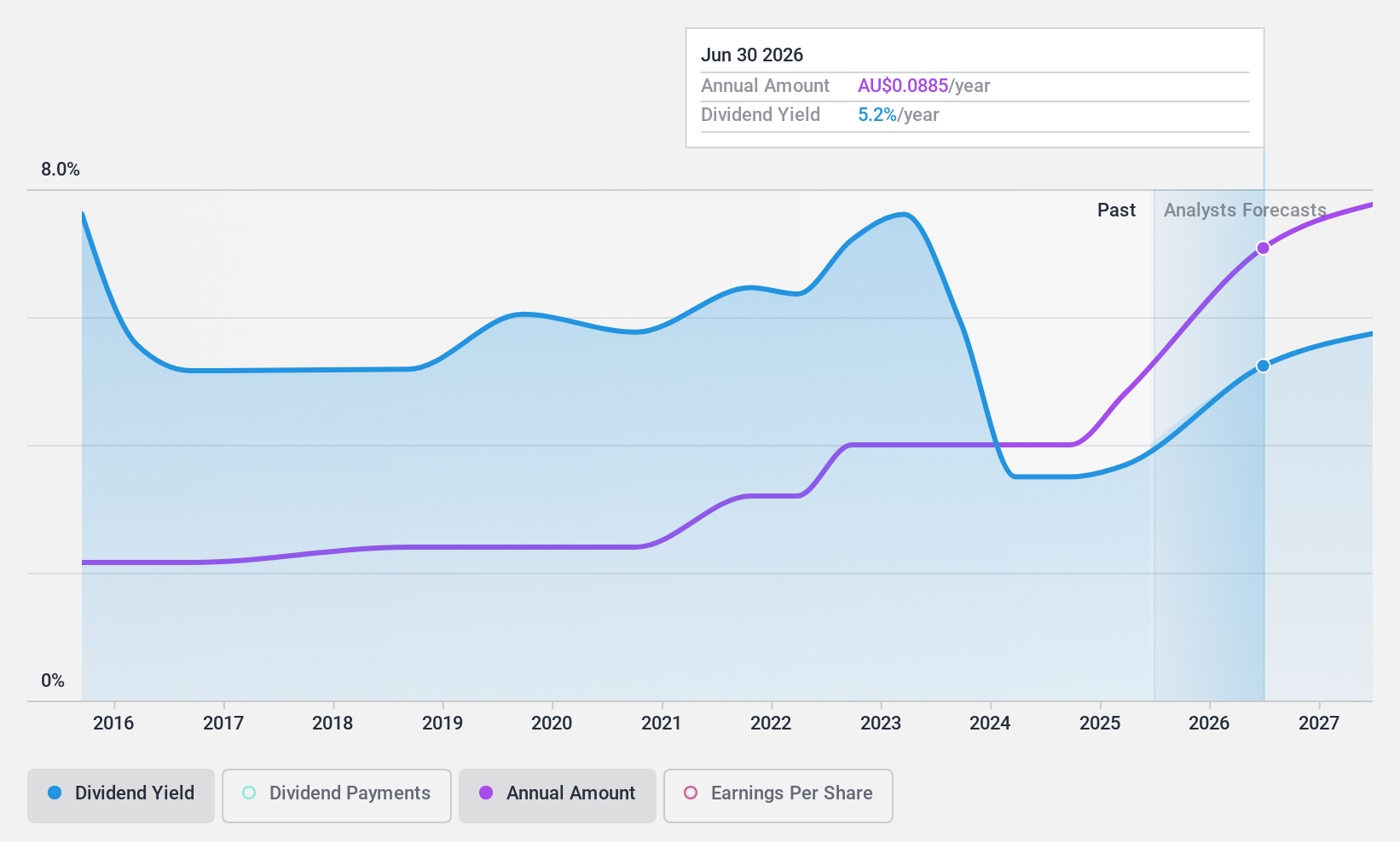

Dividend Yield: 5%

NRW Holdings has demonstrated a solid growth in earnings, increasing by 15.8% annually over the past five years. Despite a dividend yield of 4.97%, which is lower than the top Australian dividend payers, its dividends appear sustainable with a payout ratio of 74% and cash payout ratio of 68.6%. However, investors should be cautious as NRW's dividend history over the last decade shows volatility and unreliability in payments, despite recent increases in dividends.

- Unlock comprehensive insights into our analysis of NRW Holdings stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of NRW Holdings shares in the market.

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Super Retail Group Limited operates in Australia and New Zealand, specializing in the retail of auto, sports, and outdoor leisure products with a market capitalization of A$2.99 billion.

Operations: Super Retail Group Limited generates revenue through several key segments: Rebel at A$1.30 billion, Super Cheap Auto (SCA) at A$1.48 billion, and Boating, Camping and Fishing (BCF), excluding Macpac, at A$876 million, with Macpac contributing A$220.60 million.

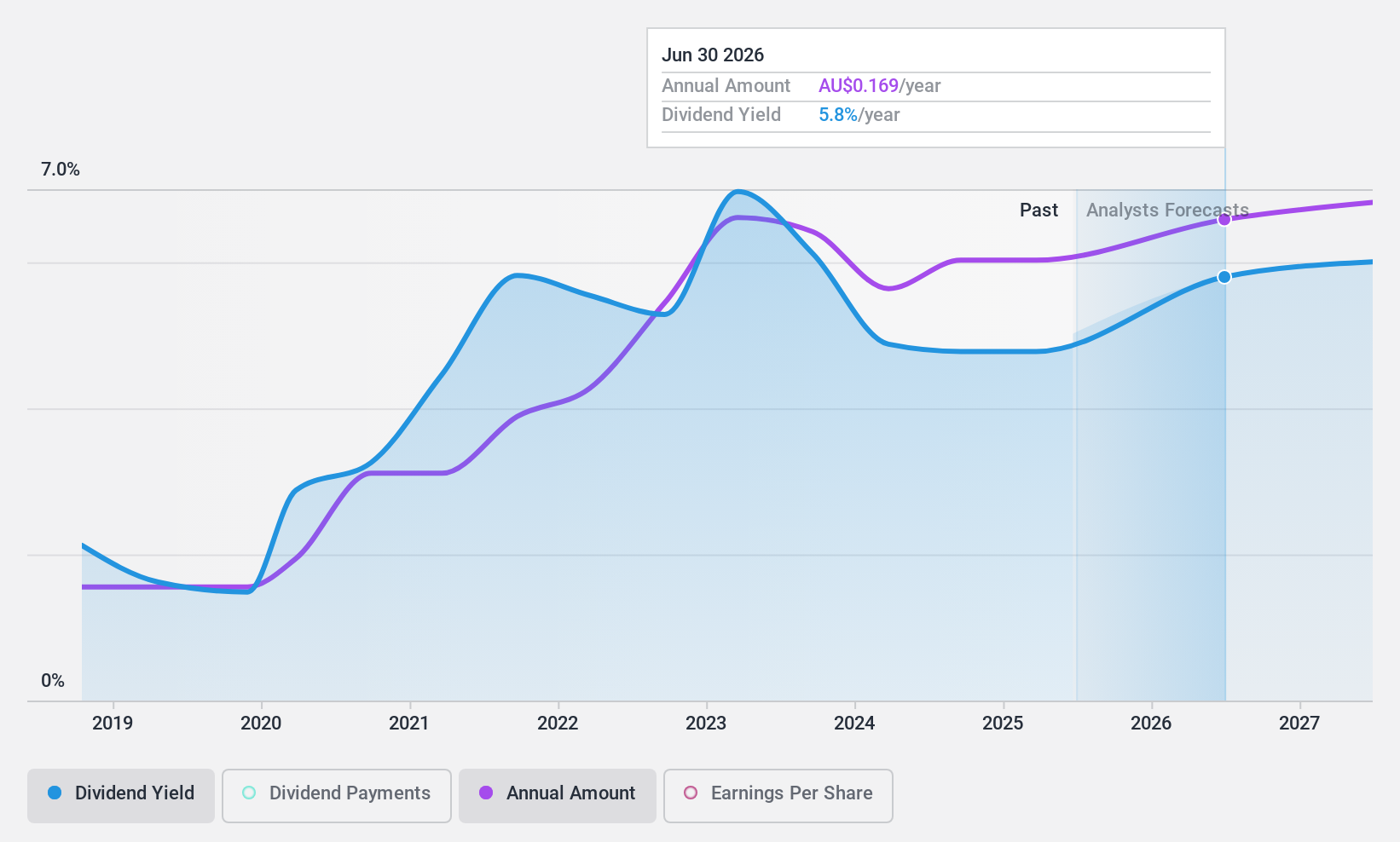

Dividend Yield: 5.7%

Super Retail Group's dividend history reveals a pattern of volatility with significant annual fluctuations over the past decade. Despite this, the dividends are reasonably covered by both earnings and cash flows, with a payout ratio of 65.5% and a cash payout ratio of 28.6%. Currently trading at 58.1% below its estimated fair value, SUL offers potential value compared to its peers, although its dividend yield of 5.72% is lower than the market's top quartile payers at 6.58%.

- Delve into the full analysis dividend report here for a deeper understanding of Super Retail Group.

- According our valuation report, there's an indication that Super Retail Group's share price might be on the cheaper side.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, operating in Australia, specializes in electrical, instrumentation, communication, and maintenance services with a market capitalization of A$396.14 million.

Operations: Southern Cross Electrical Engineering Limited generates A$464.88 million from its electrical services segment.

Dividend Yield: 3.3%

Southern Cross Electrical Engineering has shown a mixed dividend history, with fluctuations and unreliable payouts over the past decade. Despite this, its dividends are supported by earnings and cash flows, with a payout ratio of 66.5% and a cash payout ratio of 78.2%. The company's dividend yield stands at 3.32%, which is below the top quartile in the Australian market at 6.58%. Earnings have grown by an average of 13.3% annually over the past five years, with future growth expected at about 23.62% per year.

- Click here and access our complete dividend analysis report to understand the dynamics of Southern Cross Electrical Engineering.

- Upon reviewing our latest valuation report, Southern Cross Electrical Engineering's share price might be too optimistic.

Seize The Opportunity

- Unlock our comprehensive list of 27 Top ASX Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Super Retail Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SUL

Super Retail Group

Engages in the retail of auto, sports, and outdoor leisure products in Australia and New Zealand.

Flawless balance sheet, undervalued and pays a dividend.