- Australia

- /

- Electrical

- /

- ASX:MYG

Optimistic Investors Push Mayfield Group Holdings Limited (ASX:MYG) Shares Up 26% But Growth Is Lacking

Mayfield Group Holdings Limited (ASX:MYG) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last month tops off a massive increase of 111% in the last year.

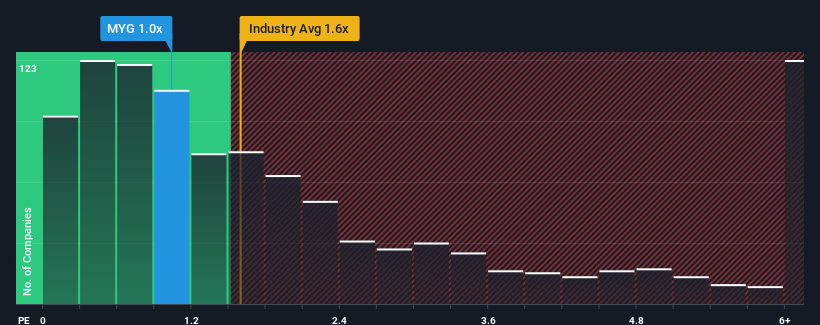

Even after such a large jump in price, there still wouldn't be many who think Mayfield Group Holdings' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Australia's Electrical industry is similar at about 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Mayfield Group Holdings

What Does Mayfield Group Holdings' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Mayfield Group Holdings over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Mayfield Group Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Mayfield Group Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.4%. Still, the latest three year period has seen an excellent 42% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Mayfield Group Holdings' P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Mayfield Group Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Mayfield Group Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Mayfield Group Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MYG

Mayfield Group Holdings

Provides electrical and telecommunications infrastructure products and services in Australia.

Flawless balance sheet and good value.

Market Insights

Community Narratives