- Australia

- /

- Construction

- /

- ASX:MGH

ASX Stocks Priced Below Intrinsic Value Estimates Include Guzman y Gomez And Two More

Reviewed by Simply Wall St

The Australian stock market has shown resilience, with the ASX200 gaining 10% over the past ten months, despite a relatively uneventful September. Recent developments in critical minerals and healthcare have sparked investor interest, highlighting opportunities for stocks priced below their intrinsic value estimates. In this context, identifying undervalued stocks requires a keen understanding of market trends and potential catalysts like geopolitical shifts or sector-specific growth drivers.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.15 | A$5.67 | 44.4% |

| Resimac Group (ASX:RMC) | A$1.145 | A$2.18 | 47.4% |

| Reckon (ASX:RKN) | A$0.62 | A$1.19 | 47.8% |

| NRW Holdings (ASX:NWH) | A$4.98 | A$9.23 | 46% |

| MAAS Group Holdings (ASX:MGH) | A$4.65 | A$9.16 | 49.3% |

| Liontown Resources (ASX:LTR) | A$1.18 | A$2.10 | 43.7% |

| James Hardie Industries (ASX:JHX) | A$34.27 | A$65.75 | 47.9% |

| Cynata Therapeutics (ASX:CYP) | A$0.22 | A$0.44 | 49.9% |

| Credit Clear (ASX:CCR) | A$0.265 | A$0.47 | 43.4% |

| Airtasker (ASX:ART) | A$0.36 | A$0.71 | 49.5% |

Let's uncover some gems from our specialized screener.

Guzman y Gomez (ASX:GYG)

Overview: Guzman y Gomez Limited operates quick service restaurants across Australia, Singapore, Japan, and the United States with a market cap of A$2.61 billion.

Operations: The company generates revenue of A$465.04 million from its quick service restaurant operations in multiple countries.

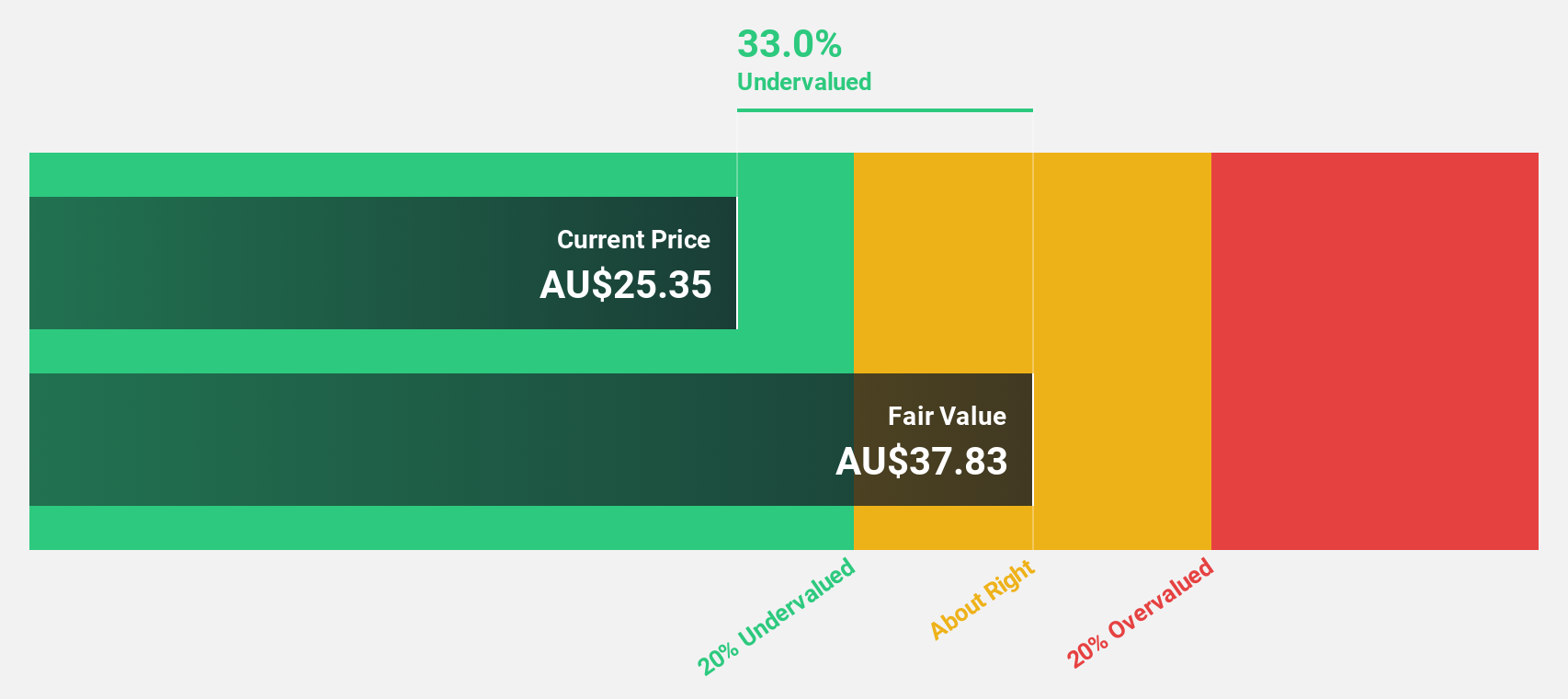

Estimated Discount To Fair Value: 32.8%

Guzman y Gomez appears undervalued, trading at A$25.31, which is 32.8% below its estimated fair value of A$37.65. The company has transitioned to profitability with a net income of A$14.48 million for FY2025 and forecasts significant earnings growth of 32.74% annually over the next three years, outpacing the broader Australian market's growth rate. Recent share buyback plans and expansion efforts underscore its commitment to enhancing shareholder returns while supporting future growth ambitions in Australia.

- Our expertly prepared growth report on Guzman y Gomez implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Guzman y Gomez's balance sheet health report.

MAAS Group Holdings (ASX:MGH)

Overview: MAAS Group Holdings Limited, with a market cap of A$1.68 billion, operates through its subsidiaries to provide construction materials for the civil infrastructure, renewable energy, building and construction, and mining sectors.

Operations: MAAS Group Holdings Limited generates revenue from several segments, including Manufacturing (A$33.62 million), Commercial Real Estate (A$119.78 million), Construction Materials (A$535.74 million), Residential Real Estate (A$78.32 million), and Civil, Construction and Hire (A$321.94 million).

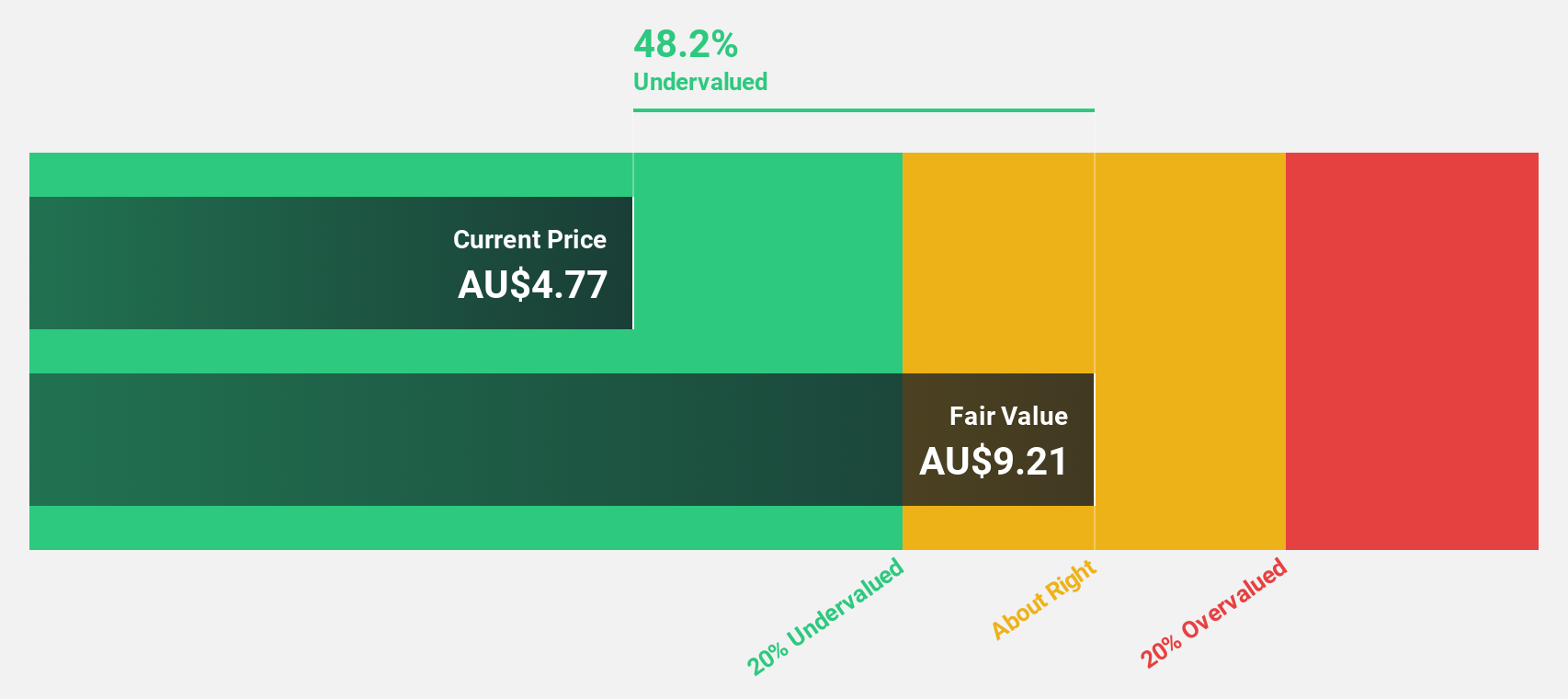

Estimated Discount To Fair Value: 49.3%

MAAS Group Holdings trades at A$4.65, significantly undervalued by 49.3% compared to its fair value of A$9.16, based on discounted cash flow analysis. The company forecasts a robust earnings growth of 21.7% annually, surpassing the Australian market's average growth rate and indicating strong potential for future profitability despite lower revenue growth projections and insufficient interest coverage from earnings. Recent share buybacks and dividend increases reflect strategic efforts to enhance shareholder value amidst steady financial performance.

- In light of our recent growth report, it seems possible that MAAS Group Holdings' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of MAAS Group Holdings.

SRG Global (ASX:SRG)

Overview: SRG Global Limited operates in engineering, mining, maintenance, and construction contracting across Australia and New Zealand, with a market cap of A$1.60 billion.

Operations: The company's revenue segments include Engineering and Construction, generating A$455.93 million, and Maintenance and Industrial Services, contributing A$867.38 million.

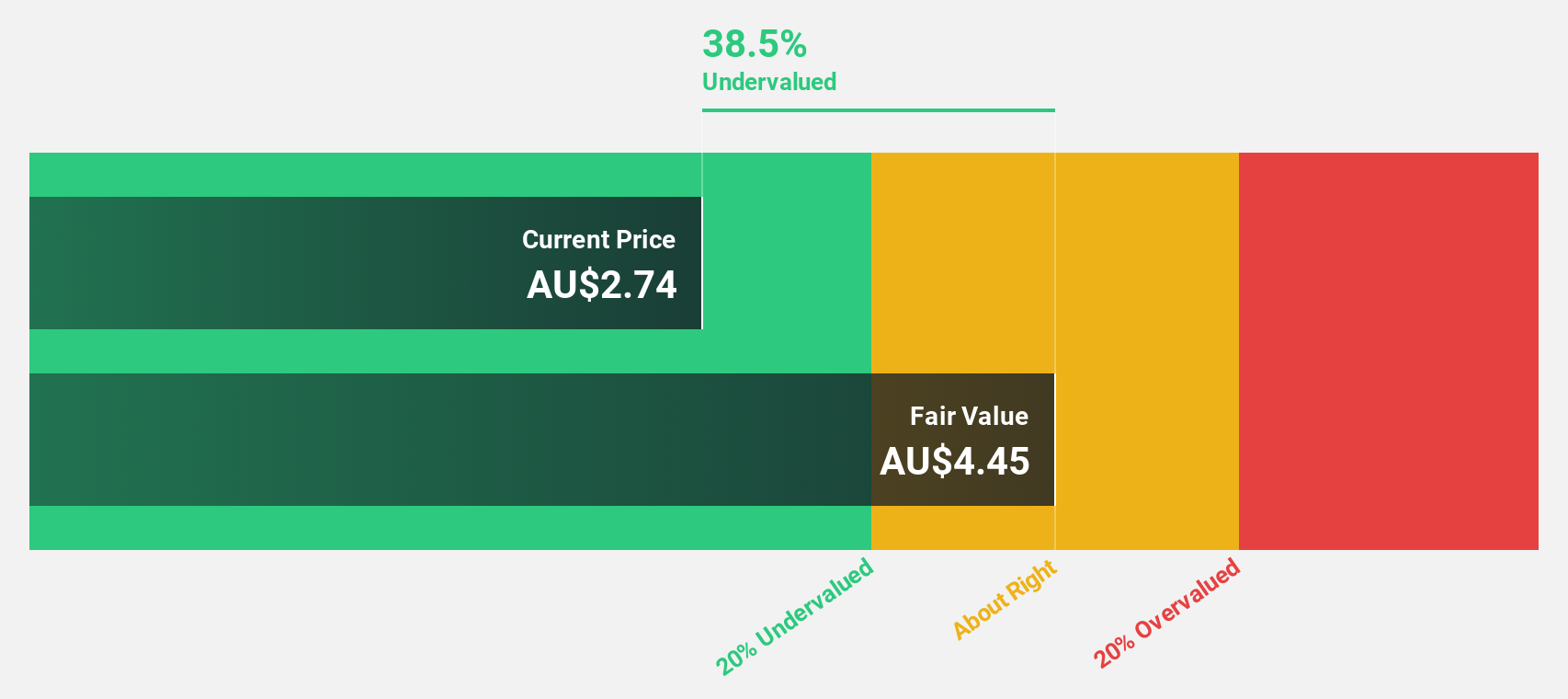

Estimated Discount To Fair Value: 41.4%

SRG Global is trading at A$2.61, undervalued by 41.4% relative to its estimated fair value of A$4.45 based on discounted cash flow analysis. Forecasted revenue growth of 10.9% annually surpasses the Australian market average, while expected earnings growth of 20.3% per year further highlights its potential for profitability enhancement despite a modest return on equity forecast of 19%. The company actively seeks strategic acquisitions to bolster growth and maximize shareholder value, supported by recent M&A discussions and dividend announcements.

- Our earnings growth report unveils the potential for significant increases in SRG Global's future results.

- Unlock comprehensive insights into our analysis of SRG Global stock in this financial health report.

Key Takeaways

- Reveal the 34 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MGH

MAAS Group Holdings

Together with subsidiaries, engages in the provision of construction materials to the civil infrastructure, renewable energy, building and construction, and mining sectors.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success