Peter De Leo became the CEO of Lycopodium Limited (ASX:LYL) in 2015, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Lycopodium.

Check out our latest analysis for Lycopodium

Comparing Lycopodium Limited's CEO Compensation With the industry

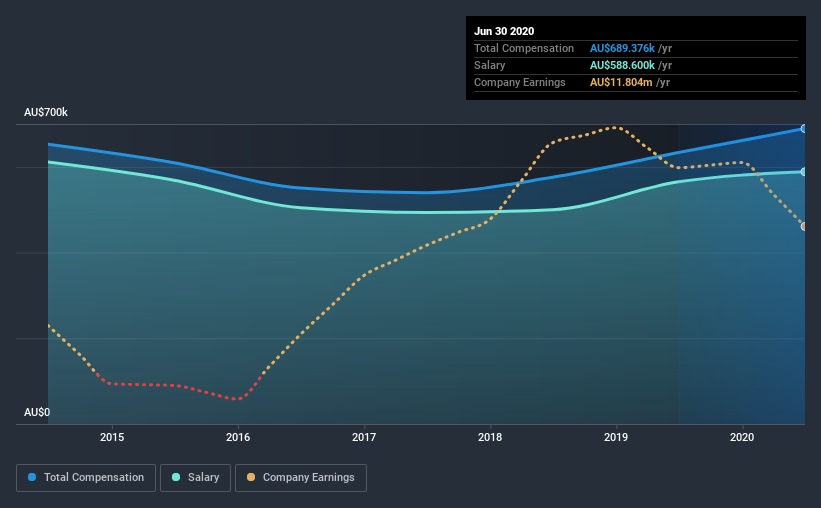

Our data indicates that Lycopodium Limited has a market capitalization of AU$199m, and total annual CEO compensation was reported as AU$689k for the year to June 2020. That's a notable increase of 8.9% on last year. Notably, the salary which is AU$588.6k, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between AU$129m and AU$518m, we discovered that the median CEO total compensation of that group was AU$616k. This suggests that Lycopodium remunerates its CEO largely in line with the industry average. What's more, Peter De Leo holds AU$5.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$589k | AU$565k | 85% |

| Other | AU$101k | AU$68k | 15% |

| Total Compensation | AU$689k | AU$633k | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. Lycopodium pays out 85% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Lycopodium Limited's Growth

Lycopodium Limited has seen its earnings per share (EPS) increase by 4.7% a year over the past three years. It achieved revenue growth of 38% over the last year.

We like the look of the strong year-on-year improvement in revenue. With that in mind, the modestly improving EPS seems positive. So while we'd stop short of saying growth is absolutely outstanding, there are definitely some clear positives! Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Lycopodium Limited Been A Good Investment?

With a total shareholder return of 24% over three years, Lycopodium Limited shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As we noted earlier, Lycopodium pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, EPS and shareholder returns have been stable over the last three years, but have not grown substantially. We'd say that Peter is remunerated reasonably, but shareholders might be looking for better returns before they agree Peter deserves a raise.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Lycopodium that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Lycopodium, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:LYL

Lycopodium

Provides engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026