- Australia

- /

- Healthtech

- /

- ASX:AYA

Discover Artrya And 2 Other Top Penny Stocks On The ASX

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it is up 22% over the past year with earnings forecast to grow by 12% annually. In light of these conditions, investors may find value in exploring stocks that combine affordability with growth potential. Penny stocks—often representing smaller or newer companies—can offer such opportunities when they are backed by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Artrya (ASX:AYA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Artrya Limited is a medical technology company focused on developing and commercialising an artificial intelligence platform for detecting, diagnosing, and addressing coronary artery disease in Australia, with a market cap of A$35.42 million.

Operations: Currently, there are no reported revenue segments for Artrya Limited.

Market Cap: A$35.42M

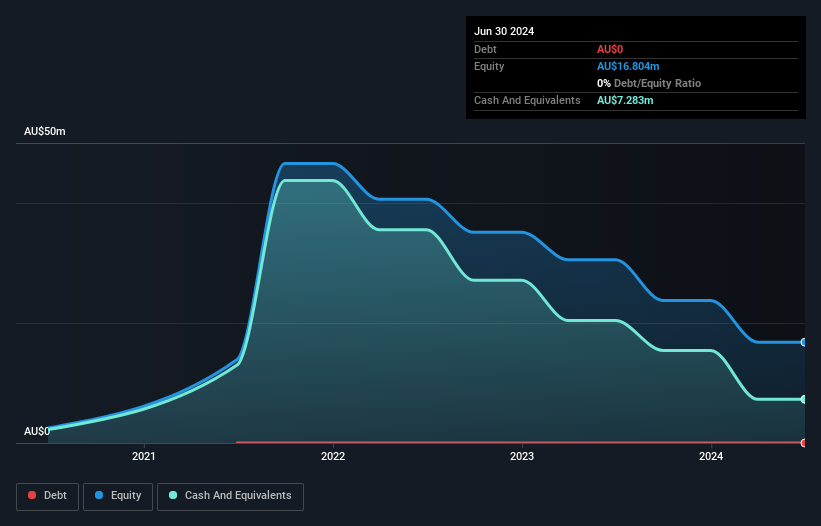

Artrya Limited, with a market cap of A$35.42 million, is currently pre-revenue and unprofitable, having reported a net loss of A$14 million for the year ending June 2024. The company has no debt but faces financial challenges with less than a year of cash runway based on current free cash flow. Its short-term assets exceed both short- and long-term liabilities, providing some balance sheet strength. However, the board's average tenure is relatively low at 2.2 years, indicating inexperience. The stock has shown high volatility recently and earnings have declined significantly over the past five years.

- Navigate through the intricacies of Artrya with our comprehensive balance sheet health report here.

- Gain insights into Artrya's historical outcomes by reviewing our past performance report.

Li-S Energy (ASX:LIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-S Energy Limited focuses on the development and commercialization of lithium sulphur and metal batteries in Australia, with a market cap of A$69.98 million.

Operations: Li-S Energy Limited does not have any reported revenue segments at this time.

Market Cap: A$69.98M

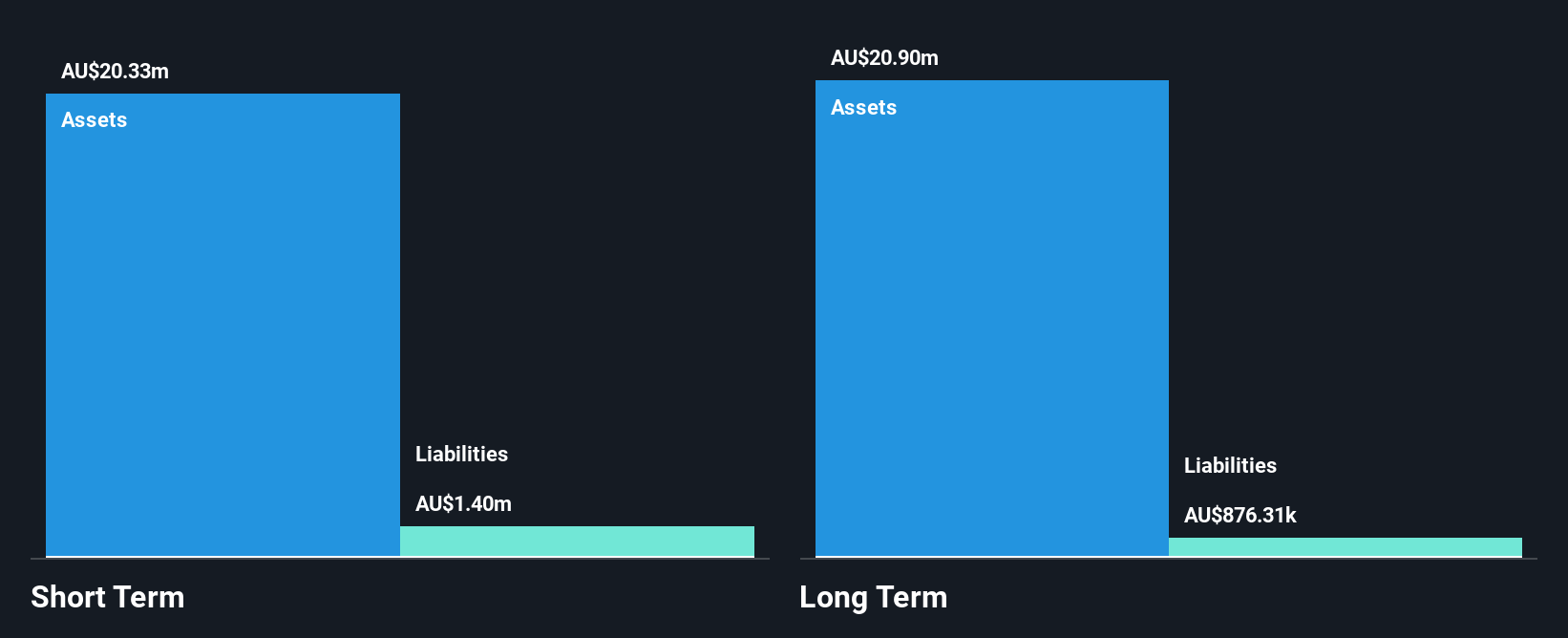

Li-S Energy Limited, with a market cap of A$69.98 million, remains pre-revenue and unprofitable, reporting a net loss of A$4.62 million for the year ending June 2024. Despite this, the company is debt-free and has sufficient cash runway for over a year based on current free cash flow projections. Its short-term assets significantly exceed both short- and long-term liabilities, indicating strong balance sheet health. Recent developments include the launch of a new battery production facility in Geelong supported by an A$1.7 million government grant, enhancing its potential growth prospects amidst board changes with Mr. Robin Levison's retirement.

- Unlock comprehensive insights into our analysis of Li-S Energy stock in this financial health report.

- Examine Li-S Energy's past performance report to understand how it has performed in prior years.

Pengana Capital Group (ASX:PCG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pengana Capital Group (ASX:PCG) is a publicly owned investment manager with a market capitalization of A$77.21 million.

Operations: The company generates revenue of A$40.48 million through its development, offering, and management of investment funds.

Market Cap: A$77.21M

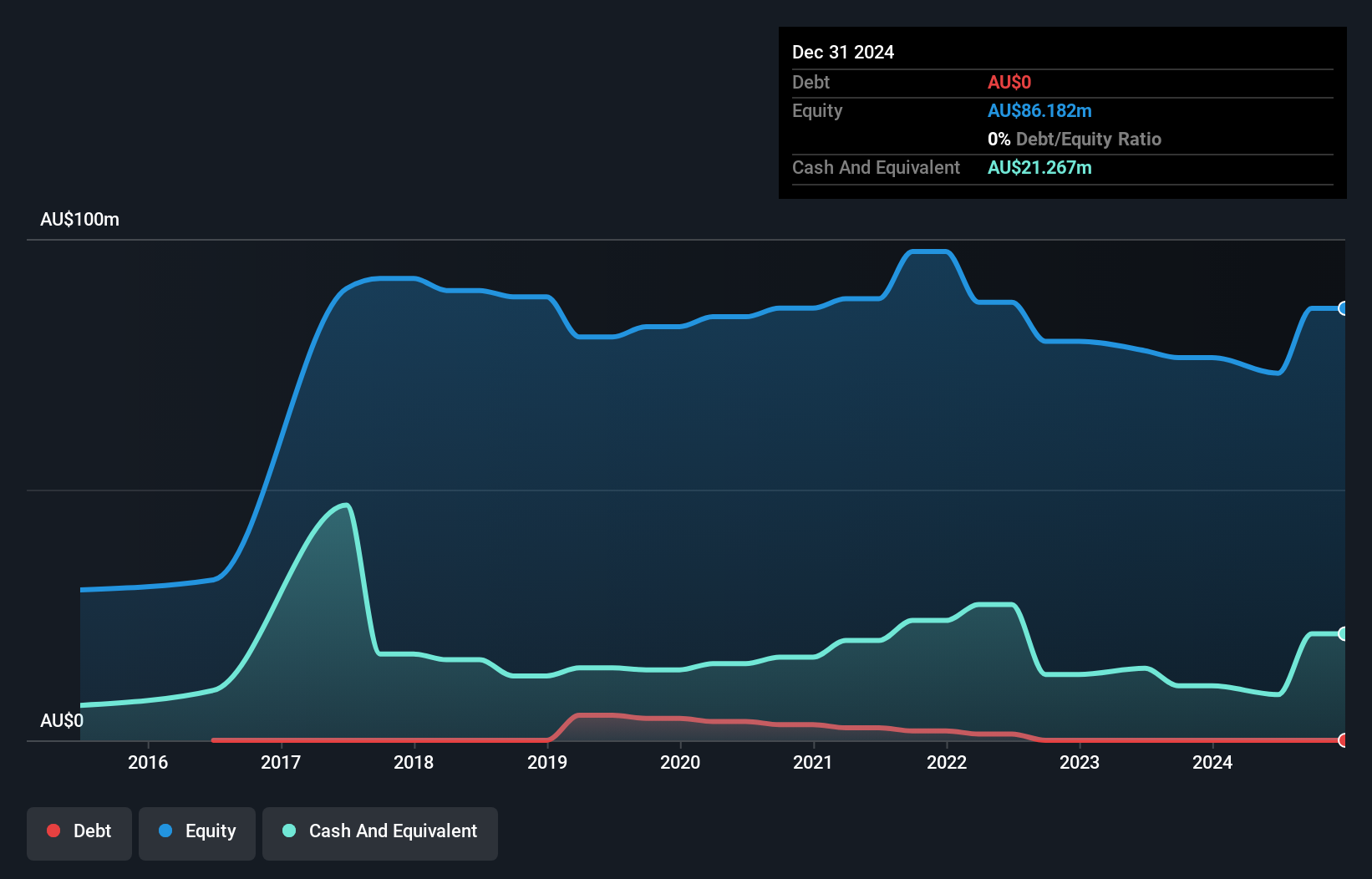

Pengana Capital Group, with a market cap of A$77.21 million, reported revenue growth to A$42.61 million for the year ending June 2024 but remains unprofitable with a net loss of A$4.35 million. Despite its financial challenges, Pengana has no debt and maintains strong liquidity, as short-term assets exceed both short- and long-term liabilities. The company recently extended its buyback plan and declared a fully franked final dividend of 2 cents per share, though dividends are not well covered by earnings or cash flows. Management is experienced with an average tenure of 7.8 years, offering stability amidst strategic developments discussed in recent shareholder calls.

- Dive into the specifics of Pengana Capital Group here with our thorough balance sheet health report.

- Explore Pengana Capital Group's analyst forecasts in our growth report.

Next Steps

- Discover the full array of 1,027 ASX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AYA

Artrya

A medical technology company, engages in the development and commercialisation of artificial intelligence platform that detects, diagnoses, and address coronary artery disease in Australia.

Flawless balance sheet moderate.

Market Insights

Community Narratives