- Australia

- /

- Capital Markets

- /

- ASX:AEF

ASX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Australian market is showing resilience, with the ASX 200 futures indicating a slight rise as global markets remain largely unfazed by recent tariff discussions. Amidst this backdrop, investors are keenly observing opportunities that might emerge from smaller or newer companies. Penny stocks, despite their outdated moniker, continue to intrigue those looking for potential growth and value when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.895 | A$89.39M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.03 | A$251.22M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$330.52M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.17 | A$336.11M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$564.83 million.

Operations: The company generates revenue primarily through its Funds Management segment, which accounts for A$100.49 million.

Market Cap: A$564.83M

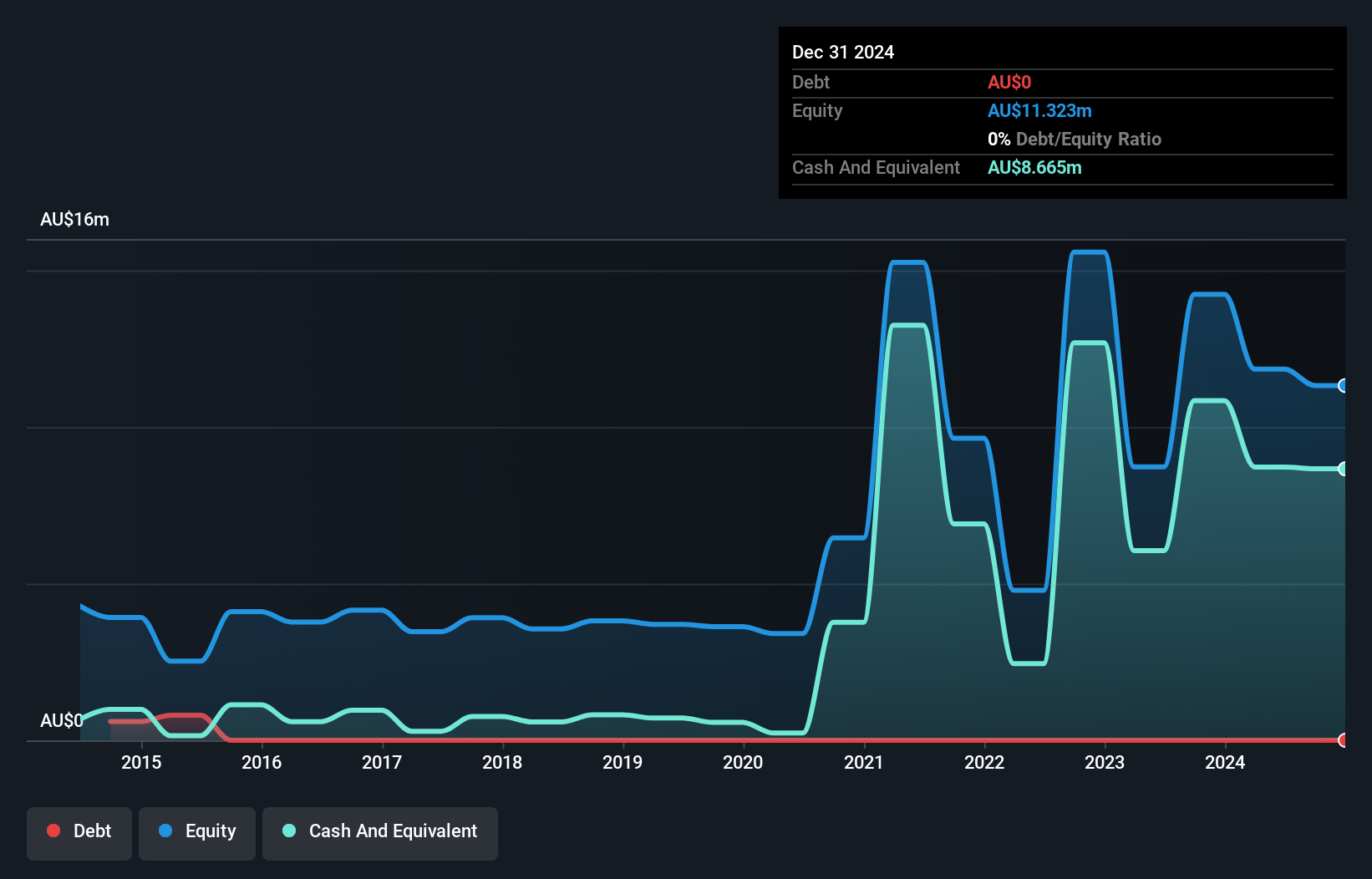

Australian Ethical Investment Ltd, with a market cap of A$564.83 million, shows strong financial health and growth potential. Its Return on Equity is high at 38.3%, and it has achieved significant earnings growth of 75.3% over the past year, surpassing industry averages. The company has maintained profitability despite a one-off loss of A$8.6M impacting recent results and boasts no debt for the past five years. Short-term assets exceed both short-term and long-term liabilities, indicating solid liquidity management. Management's experience further supports its operational stability, while shareholders have not faced meaningful dilution recently.

- Click here to discover the nuances of Australian Ethical Investment with our detailed analytical financial health report.

- Evaluate Australian Ethical Investment's prospects by accessing our earnings growth report.

Caravel Minerals (ASX:CVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caravel Minerals Limited, with a market cap of A$117.06 million, explores for mineral tenements in Western Australia through its subsidiaries.

Operations: Caravel Minerals Limited does not report any specific revenue segments.

Market Cap: A$117.06M

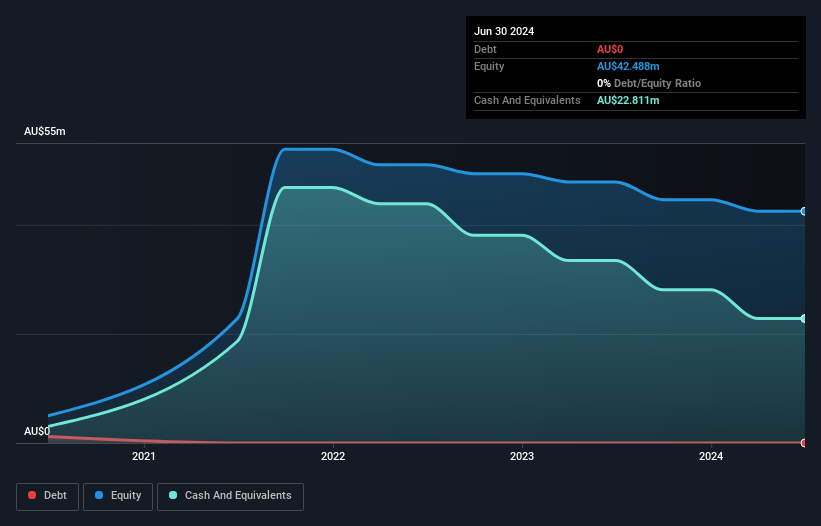

Caravel Minerals Limited, with a market cap of A$117.06 million, is currently pre-revenue and unprofitable, with losses increasing over the past five years. Despite this, it maintains a strong cash position with short-term assets of A$9.3 million exceeding liabilities and no long-term debt. The company has not diluted shareholders meaningfully in the past year and recently raised additional capital to extend its cash runway beyond 10 months. Its experienced board and management team add stability amid ongoing developments like recent shareholder meetings addressing share placements under listing rule 7.1A, indicating strategic efforts to secure funding for future growth initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of Caravel Minerals.

- Gain insights into Caravel Minerals' outlook and expected performance with our report on the company's earnings estimates.

Li-S Energy (ASX:LIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-S Energy Limited is an Australian company focused on the development and commercialization of lithium sulphur and metal batteries, with a market cap of A$89.14 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$89.14M

Li-S Energy Limited, with a market cap of A$89.14 million, is pre-revenue and currently unprofitable. Despite this, the company maintains a robust financial position with short-term assets of A$25 million significantly exceeding liabilities and no debt burden. While earnings have declined over the past five years, Li-S Energy has not diluted shareholders recently and holds sufficient cash runway for over two years if free cash flow continues to decrease at historical rates. The management team is experienced; however, the board's inexperience could pose challenges as they navigate strategic growth opportunities in the battery sector.

- Jump into the full analysis health report here for a deeper understanding of Li-S Energy.

- Explore historical data to track Li-S Energy's performance over time in our past results report.

Where To Now?

- Access the full spectrum of 1,031 ASX Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives