- Australia

- /

- Metals and Mining

- /

- ASX:ESR

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.15% at 8,474 points and sectors like IT leading the charge. For investors eyeing smaller or newer companies, penny stocks—despite their somewhat outdated name—remain an intriguing area of potential value. These stocks can offer growth opportunities when backed by strong financial health, and this article will explore a few that stand out for their financial strength and long-term promise.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$337.98M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$97.63M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.62 | A$789.03M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.97 | A$112.47M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.33 | A$110.99M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.97 | A$477.54M | ★★★★☆☆ |

Click here to see the full list of 1,045 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Brisbane Broncos (ASX:BBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brisbane Broncos Limited manages and operates the Brisbane Broncos Rugby League Football Team in Australia, with a market cap of A$89.22 million.

Operations: The company's revenue is derived entirely from its Sports Management and Entertainment segment, totaling A$58.67 million.

Market Cap: A$89.22M

Brisbane Broncos Limited, with a market cap of A$89.22 million, demonstrates strong financial health by operating debt-free and maintaining sufficient short-term assets (A$31.1M) to cover liabilities. Recent earnings growth of 39.3% surpasses the industry average, indicating robust performance in its Sports Management and Entertainment segment, contributing A$58.67 million in revenue. The management team and board are experienced with an average tenure exceeding four years, supporting stability in operations amidst M&A discussions with Queensland Rugby Union Ltd., which could influence future strategic directions if formalized.

- Take a closer look at Brisbane Broncos' potential here in our financial health report.

- Gain insights into Brisbane Broncos' historical outcomes by reviewing our past performance report.

Estrella Resources (ASX:ESR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Estrella Resources Limited, with a market cap of A$32.72 million, is involved in the exploration of mineral resources in Western Australia and Timor-Leste through its subsidiaries.

Operations: Estrella Resources Limited does not have reported revenue segments.

Market Cap: A$32.72M

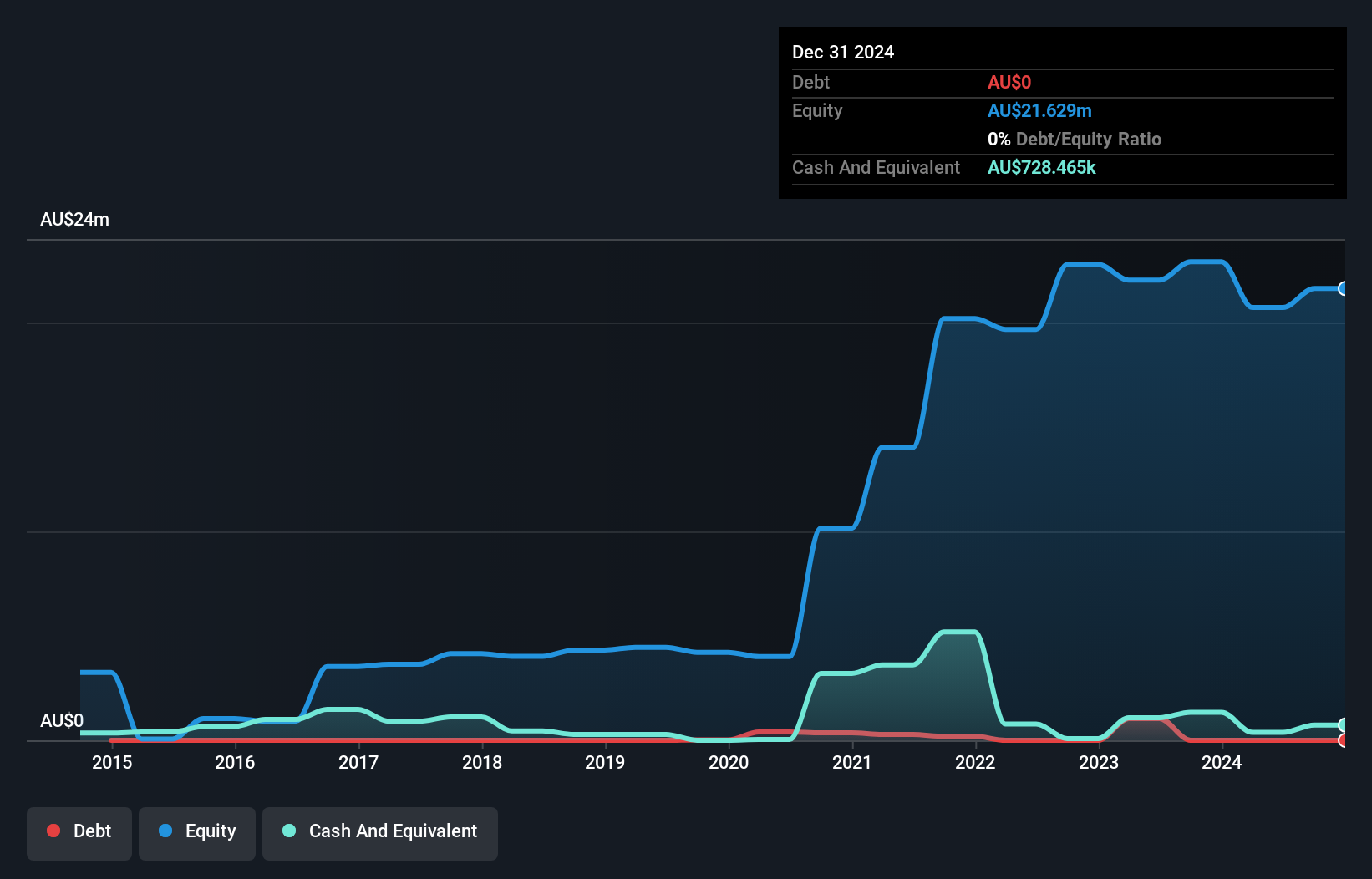

Estrella Resources Limited, with a market cap of A$32.72 million, is pre-revenue and currently unprofitable, reporting a net loss of A$2.99 million for the year ending June 2024. Despite having no long-term liabilities and being debt-free, the company faces liquidity challenges with only a two-month cash runway based on recent free cash flow estimates. Shareholders have experienced dilution over the past year due to new share issuances in a follow-on equity offering that raised A$1.25 million. The company's volatility remains high compared to most Australian stocks, and its auditors have expressed doubts about its ability to continue as a going concern.

- Navigate through the intricacies of Estrella Resources with our comprehensive balance sheet health report here.

- Assess Estrella Resources' previous results with our detailed historical performance reports.

LaserBond (ASX:LBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LaserBond Limited is a surface engineering company in Australia that focuses on improving the performance and longevity of machinery components, with a market cap of A$69.75 million.

Operations: The company generates revenue through three main segments: Products (A$16.55 million), Services (A$23.39 million), and Technology (A$2.05 million).

Market Cap: A$69.75M

LaserBond Limited, with a market cap of A$69.75 million, operates across Products, Services, and Technology segments. Despite recent negative earnings growth (-26%), the company is debt-free and maintains stable weekly volatility at 5%. Its short-term assets (A$22.2M) comfortably cover both short-term (A$8.8M) and long-term liabilities (A$13.4M). However, profit margins have declined from 12.3% to 8.4%, and shareholders faced dilution with a 6.3% increase in shares outstanding last year. Although trading below estimated fair value by 8.6%, the company's return on equity remains low at 9.2%.

- Click here and access our complete financial health analysis report to understand the dynamics of LaserBond.

- Examine LaserBond's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Reveal the 1,045 hidden gems among our ASX Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Estrella Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Estrella Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ESR

Estrella Resources

Engages in the exploration of mineral resources in Western Australia and Timor-Leste.

Flawless balance sheet moderate.

Market Insights

Community Narratives