- Australia

- /

- Infrastructure

- /

- ASX:QUB

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market is experiencing a period of relative stability, with the ASX 200 expected to remain nearly flat amid ongoing developments in global markets and domestic economic indicators. Investing in penny stocks, while often seen as niche, can still offer intriguing opportunities for growth, especially when these smaller or newer companies demonstrate strong financial health. In this context, we will explore three penny stocks that combine robust balance sheets with potential for significant returns, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$328.89M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.405 | A$1.6B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$5.00 | A$493.33M | ★★★★☆☆ |

Click here to see the full list of 1,043 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Johns Lyng Group (ASX:JLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Johns Lyng Group Limited offers integrated building services across Australia, New Zealand, and the United States with a market cap of A$1.23 billion.

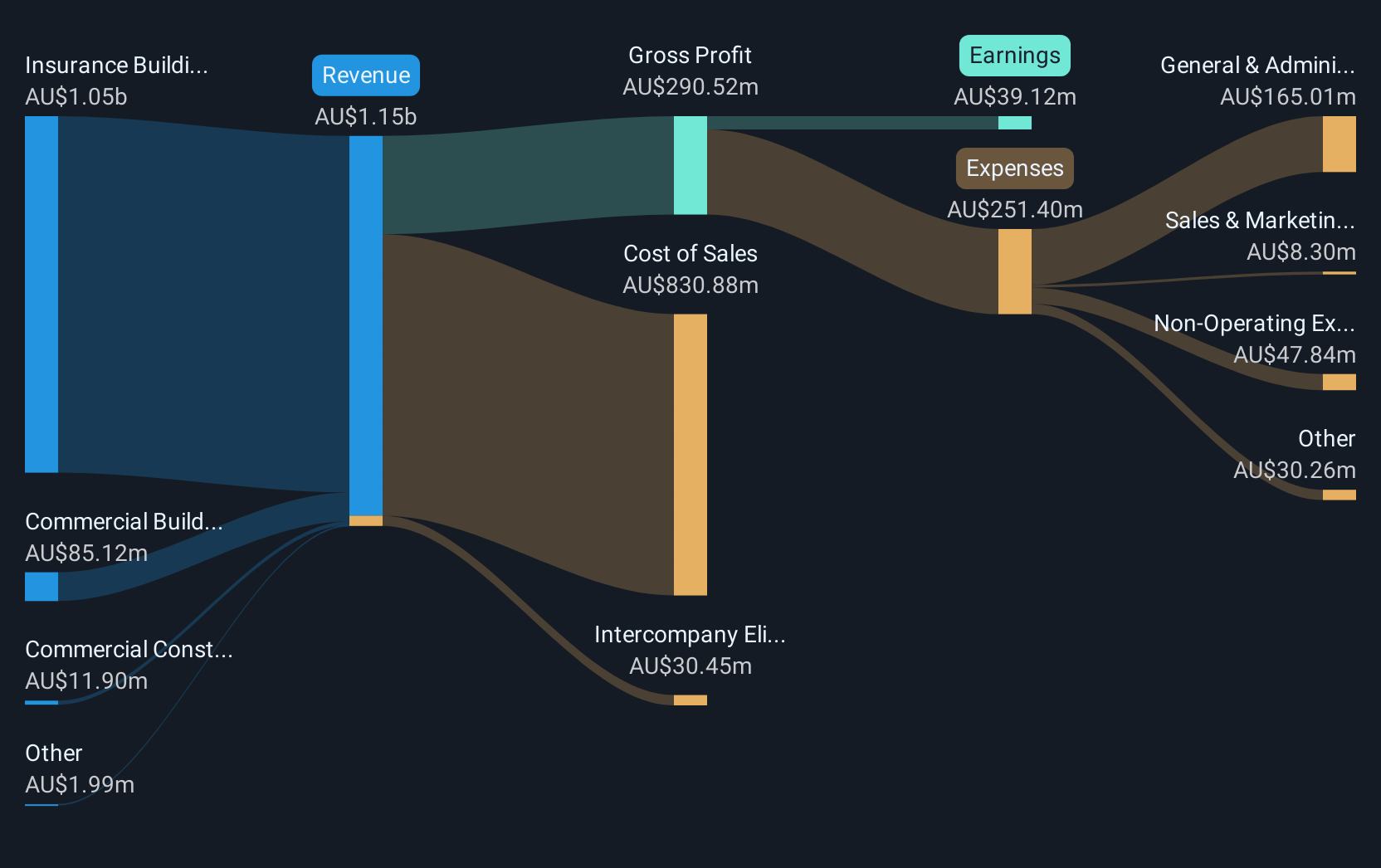

Operations: The company generates revenue from its Insurance Building and Restoration Services segment, which accounts for A$1.08 billion, and its Commercial Building Services segment, contributing A$88.17 million.

Market Cap: A$1.23B

Johns Lyng Group Limited, with a market cap of A$1.23 billion, has demonstrated solid financial management by maintaining more cash than its total debt and covering short-term and long-term liabilities with short-term assets. Despite a significant one-off loss impacting recent results, the company has shown consistent earnings growth over five years at 30% annually. However, recent earnings growth slowed to 2.5%, underperforming the industry average. The board experienced changes with new appointments enhancing expertise in sustainability and corporate affairs. The company provided guidance for fiscal 2025 revenue of A$1.128 billion, reflecting an anticipated increase from previous figures.

- Click here to discover the nuances of Johns Lyng Group with our detailed analytical financial health report.

- Gain insights into Johns Lyng Group's future direction by reviewing our growth report.

Nickel Industries (ASX:NIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron, cobalt, and nickel matte, with a market cap of A$3.99 billion.

Operations: The company's revenue is primarily derived from its RKEF projects in Indonesia and Singapore, totaling $1.66 billion, and nickel ore mining operations in Indonesia, contributing $48.97 million.

Market Cap: A$3.99B

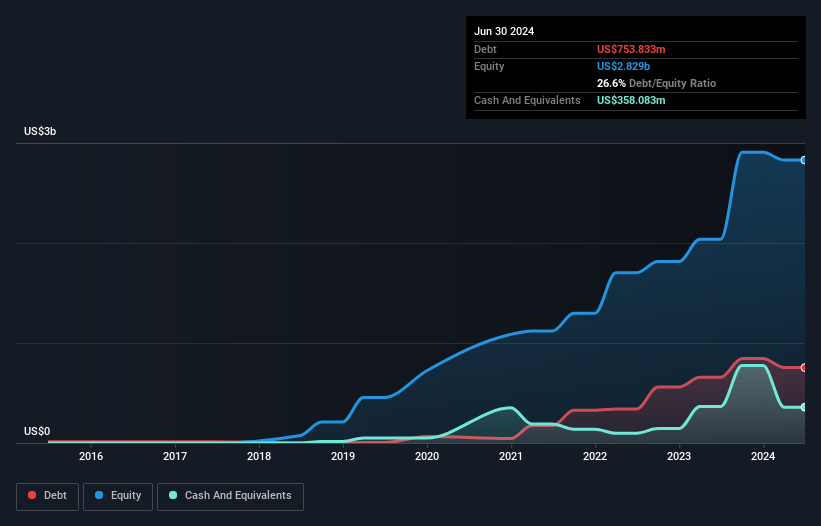

Nickel Industries Limited, with a market cap of A$3.99 billion, is actively expanding its operations through the recent acquisition of a 51% stake in the Siduarsi Project in Indonesia. This strategic move enhances its nickel production capabilities and aligns with its growth strategy. The company reported revenues of US$843.28 million for the first half of 2024, though net income fell to US$5.14 million from US$27.13 million a year prior, indicating profitability challenges despite revenue strength. Its debt is well-covered by operating cash flow, but dividends remain poorly covered by earnings, suggesting potential sustainability concerns for investors focused on income stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Nickel Industries.

- Review our growth performance report to gain insights into Nickel Industries' future.

Qube Holdings (ASX:QUB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qube Holdings Limited, with a market cap of A$6.87 billion, offers logistics solutions for import and export supply chains in Australia, New Zealand, and Southeast Asia.

Operations: The company's revenue is primarily derived from its Operating Division, which generated A$3.51 billion.

Market Cap: A$6.87B

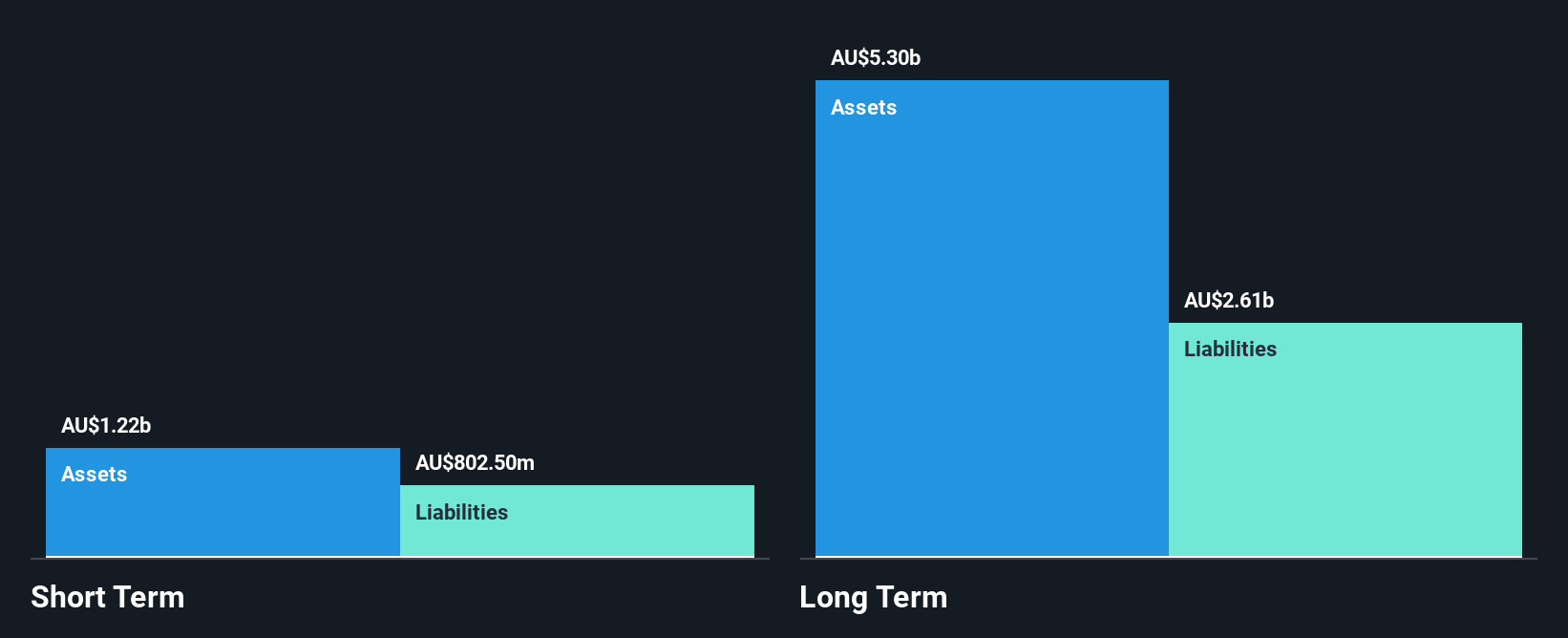

Qube Holdings Limited, with a market cap of A$6.87 billion, has demonstrated strong financial performance with earnings growth of 29.1% over the past year, surpassing the infrastructure industry average. The company's revenue reached A$3.51 billion, driven by its Operating Division. Despite having short-term assets that do not cover long-term liabilities (A$2.2 billion), Qube's debt is well-managed through operating cash flow and interest payments are adequately covered by EBIT. Recent changes include the retirement of Deputy Chairman Sam Kaplan from the Board, while strategic guidance will continue in other capacities within Qube's operations.

- Take a closer look at Qube Holdings' potential here in our financial health report.

- Examine Qube Holdings' earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Discover the full array of 1,043 ASX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Qube Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qube Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QUB

Qube Holdings

Provides logistics solutions for import and export supply chain in Australia, New Zealand, and Southeast Asia.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives